It is not unusual for the quiet summer season when investment professionals take a break from their screens to chime with nervous and volatile markets. This year broke with the tradition. Markets were mainly driven by a flow of positive macro news and data points that make it almost believable that Jerome Powell will be able to pull off the impossible trick of bringing down inflation without putting the economy into recession.

A large majority of equity indices returned positive mid to high single digits during the month. Returns were supported by improved macroeconomic data, better than expected earnings figures and a positive dynamic triggered by the AI thematic.

There were almost no surprises on the fixed income front. US front-end yields adjusted to the Fed hike of 25 bps, while longer-term yields were volatile but ended the month at a similar level. US Corporate bond spreads eased during the month, especially those for riskier issues.

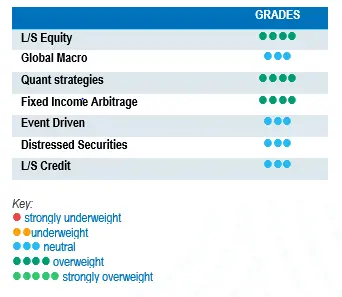

The HFRX Global Hedge Fund EUR returned +0.38% over the month.

Long-Short Equity

On average, Long-Short Equity strategies were positive during the month. Performances were mainly driven by the beta factor, hence directional strategies tended to outperform strategies with low to no net market exposure. Short books weighed negatively on performance, as managers accelerated the level of short covering. This was particularly painful for market neutral strategies. Since the start of the year, the performances of directional strategies and those with variable net exposure have been disparate, with a clear positive skew. On the other hand, market neutral strategies have also been dispersed, with an even distribution around a flattish mean performance. 2023 has witnessed a low breadth market driven by large cap technology and semis, which is not ideal for the implementation of a diversified long-short equity programme. After periods like these, market trading tends to normalise, offering a larger spectrum of long and short opportunities based on company fundamentals.

Global Macro

Global Macro strategies were flat to slightly positive during the month, with returns supported by investments in currencies and equities. Macro strategy returns have been dispersed since the start of year. Bearish managers were not rewarded on their positions as the economy remains resilient, particularly in the US. Most of them have been pragmatic and reduced risk, waiting to fight another day. Although returns generated by macro strategies since the start of the year were below expectations, the current and foreseeable environment is expected to offer interesting investment opportunities. In this type of environment, with high levels of uncertainty, strategies with a relative value approach, strong research and strong risk management will tend to outperform.

Quant strategies

July was a challenging month for trend-following strategies. Equities continued to trend higher but specific assets and markets reversed course, due to strong economic data points or expectations of government intervention. The largest losses were driven by positions in currencies. The Japanese yen reversed significantly after the Bank of Japan announced it will adopt greater flexibility in controlling the yield curve. Short positions in the Chinese renminbi and in Chinese and Hong Kong equities impacted performance negatively, as investors bought these assets, in anticipation of more government measures to stimulate growth. Since the start of the year, Multi-Strategy Quantitative strategies were more resilient than CTAs, balancing negative contributions from trend models with positive contributions from non-directional arbitrage models. After ranking as one of the best performing strategies in 2022, CTAs have been lagging since the start of the year, partially due to asset price trend reversals but also due to lower signal-to-noise ratios.

Fixed Income Arbitrage

Fixed income arbitrage specialists have managed to navigate a tricky year for the strategy, generating decent performances. On the other side, strategies that combine pure price arbitrage with fundamental relative value positions have been more challenged since the start of the year. On the directional side, if market participants opt for higher rates, they can be stopped out by a violent setback. Relative value traders continue to benefit from a healthy environment, while directional funds will continue to face a more challenging place to take directional bets compared to 2022.

Risk arbitrage – Event-driven

During the month of July, Event-driven strategies performed well, driven by positive contributions from Special Situations and Merger Arbitrage books. During 2023, there has been a lot of noise surrounding Event-driven strategies. Although economic uncertainty and market volatility were the main factors affecting the number of deal volumes and spreads, since the start of the year, regulatory risk impact was the main cause for poor performance. The CMA and FTC have challenged several important deals by announcing court action or requiring further deal remediation to move the merger process along. Among the deals impacting performance, the most notorious were Microsoft’s takeover of Activision Blizzard, Amgen’s acquisition of Horizon Therapeutics and United Healthcare’s bid for EMIS. The deal arbitrage community has, for some time, already adapted, dealing with more offensive US regulatory scrutiny of larger deals by reducing the size of deals considered to be more at risk or increasing the portion of deal hedging. However, many managers say they are surprised by the level of effort demonstrated to block or complicate the successful conclusion of merger deals. The opportunity set remains very interesting in terms of expected returns. The greater emphasis on fundamental analysis required to build a portfolio of merger deals will favour managers and strategies with stronger track records in terms of risk management and drawdown control.

Distressed

The distressed community got an adrenaline shot in March with the collapse of several US financial institutions and Credit Suisse. The surprise failure of Silicon Valley Bank provoked panic, leading to an indiscriminate sell-off of financial stocks, which progressively reversed for most assets. This was a major event due to the size of the failed banks, but was contained to a limited number of institutions exposed to a big percentage of uninsured bank deposits. Although the amount of non-performing loans, defaulting issues and bankruptcies remains relatively low, investors are much more alert to the risk of cracks in the market, as economic fundamentals may continue to deteriorate. One area of particular attention is commercial real estate and the percentage that the financing of these assets represents in US regional banks.

Long short credit

Long-short credit strategies seem to be gaining in appeal. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance, as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, again giving fixed income a seat at the Asset Allocation table. However, as recent events have demonstrated, risk diversification is very important and should be an integral part of the investment allocation process.