Markets remain nervous, as investors perceive the Fed as being behind the curve in taking control over inflation. Rising prices are biting into consumer sentiment and savings, leading to decreasing growth expectations. The Fed is committed to trying to engineer a soft landing for the economy and staying on track with its rate hike schedule. Its decisions will be mainly effective in controlling demand inflation, since there is not much it can do to rein in supply-side inflation, which is aggravated by the war and COVID-related supply chain disruption. The US monetary authorities must nonetheless draw a line in the sand to prevent a total market meltdown.

Markets remain nervous, as investors perceive the Fed as being behind the curve in taking control over inflation. Rising prices are biting into consumer sentiment and savings, leading to decreasing growth expectations. The Fed is committed to trying to engineer a soft landing for the economy and staying on track with its rate hike schedule. Its decisions will be mainly effective in controlling demand inflation, since there is not much it can do to rein in supply-side inflation, which is aggravated by the war and COVID-related supply chain disruption. The US monetary authorities must nonetheless draw a line in the sand to prevent a total market meltdown.

It was a month of two halves for equity markets. Investors started the month aggressively selling off several bellwether companies reporting bad earnings and guidance, but rebounded towards the end of the month. Chinese equities finished the month slightly up, driven by expectations of looser COVID restrictions and less scrutiny of tech companies. In the US, long duration equities in technology and biotechnology continued to suffer. At sector level, energy and utilities outperformed the market, while consumer-facing stocks were hit by negative guidance in consumer spending.

Rates in developed market sovereign yields continued to adjust upwards on the front end of the curve. The bigger moves were seen on European rates.

Futures on coal, natural gas and oil continued to move, reflecting the current tight supply conditions.

The HFRX Global Hedge Fund EUR returned -1.20% over the month.

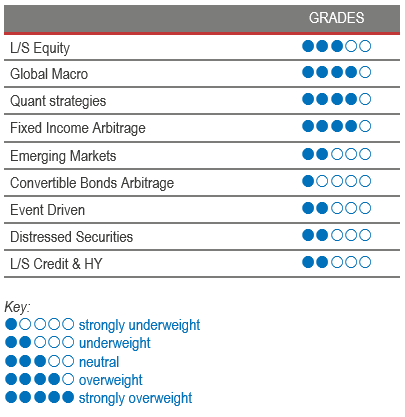

Long-Short Equity

Long-Short Equity funds have been reducing risk since the start of the year. Hence, they had a low downside capture ratio during the equity sell-off in the first half of the month. Upside capture ratios were also relatively muted during the late market rally. Overall, the strategies ended the month with falls in the low single digits. Market neutral and value bias strategies outperformed their peers, returning on average modest but positive returns. Managers focusing on consumer, technology and biotech tended to lag their peers. On average, since the start of the year, returns generated on short books have not been able to offset the negative alpha on long investments. This has particularly been the case for high octane strategies with concentrated investments in growth sectors. Headlines are concentrated on the poor results of big star fund managers. This picture is a narrow image of the dispersion within the universe in 2022. Well-diversified allocations to the Long-Short Equity universe have generated good results, generating positive alpha and also positive returns. As mentioned previously, we do not expect funds to add significant levels of risk for the moment, but rather to selectively invest in longs, and refreshing and reinforcing their short books. Over the short term, we expect good Long-Short Equity strategies to protect capital for their investors by maintaining gross and net exposures close to their lower ranges. The war is exacerbating some of the challenges companies around the world are facing. Picking the right stocks will be important, but being able to do so from a long-short perspective can bring a solid edge to long-only equity solutions.

Global Macro

May was a tricky month for Global Macro strategies. Some of the trends in rates and equities started to lose steam heading into several months of rising rates and correcting equities. The rise of medium- and long-term maturity yields took a breather or even fell on the far end of the US yield curve. Equity indices were volatile over the period. Tactical positioning from the managers was important over this month, leading to some level of dispersion in performances. Positions in equities and rates were mainly performance detractors, while long positions in commodities continued to add value to performance. On average, Global Macro indices were slightly negative for the month, but remain among the best performers and asset allocation diversifiers for the year. In past comments, we said that Global Macro would have a better environment to deploy capital as central banks were starting to reduce liquidity injections and plan for rate hikes. This infamous war has just jumpstarted some of the market volatility that we were anticipating due to less fiscal and monetary support. Asset risk premiums are moving across the board, and macro managers are capitalising on these market moves. We continue to favour discretionary opportunistic managers who can draw on their analytical skills and experience to generate profits from selective opportunities worldwide.

Quant strategies

Quantitative strategies were on average slightly down for the month. Their models were partly affected by the market volatility variance. The US market’s implied volatility during the period seesawed between 25 and 35. Trend models tended to be negative contributors to performance. Overall, Quant strategies have performed very well since the start of the year, helping to mitigate investors’ losses on traditional asset allocations. Blue chip Multi-Model Quant strategies are also doing very well, generating high double-digit returns since the start of the year. For the last three years, these strategies have been great diversifiers to traditional assets, which are posting some of the worst year-to-date returns in the last 20 years.

Fixed Income Arbitrage

Despite its hawkish rhetoric on the back of pervasive inflation, the Fed is still far behind the curve, hoping that the depth of the equity sell-off will help to curb inflationary pressure. While the 10Y yield went through the 3% mark, the equity sell-off intensified, triggering some flight to quality, pushing yields down from 3.15% to 2.75%. As we speak, the momentum for higher interest rates is losing steam, and volatility remains high due to wide trading ranges, creating a more challenging environment for directional macro managers. However, fixed income RV managers continue to benefit from healthy opportunities, while directional managers reduced their risk at the end of May.

Emerging markets

Emerging Markets strategies suffered as a result of two major idiosyncratic events, a war in Eastern Europe and China’s zero-Covid policy, but also from a general risk-off sentiment. Conversely, the strength of commodity prices has provided strong support to opportunities in Latin America and other export-driven nations. Performances are dispersed across managers depending on the area of focus. Few hedge funds cover emerging markets. They tend to be specialists in narrower geographical regions. This strategy offers selective investment opportunities, but we remain overall cautious for the moment, as decreasing growth expectations and rising interest rates in developed markets are warning indicators for the region.

Risk arbitrage – Event-driven

Indices for Event Driven strategies were negative in the low single digits for May. Contrary to what usually happens, Merger Arbitrage strategies on average underperformed Special Situations strategies, which have a higher beta correlation. Merger Arbitrage suffered as a result of the widening of deal spreads that are pricing in a higher level of uncertainty in economic fundamentals, but also lower probabilities of deals closing. Widening spreads are also being fed by capital being forced to leave in merger arbitrage pods. Certain merger arbitrage managers are being forced to cut risk when they reach certain drawdown or volatility thresholds. According to the managers we speak to and track, the opportunity set remains very interesting, with wider spreads potentially generating a double-digit annualised return. The pipeline of deals coming to the market remains adequate for capital deployment, and also importantly, financing is still available for corporations to act on boardroom decisions. An interesting element to point out is that the share of financing being provided by non-banking institutions is growing substantially. With investors currently looking for diversification, merger arbitrage provides an interesting tool that is structurally short-duration, where deal spreads are positively correlated to increases in interest rates.

Distressed

Credit spreads are widening slightly, but the environment is relatively calm for distressed strategies for the moment. Apart from specific cases, spreads in bonds, loans and structured products remain relatively tight. While the opportunity set remains relatively modest, economic uncertainties can no longer be easily overlooked, as current inflation levels will limit central banks’ possible measures to once again save the market. Our contacts in the industry point out that they are expecting a slight increase in delinquencies in corporate and consumer loans as inflation contributes to deteriorating economic fundamentals and drains consumer savings. Leading managers are still waiting for further dislocations to occur before going on the offense.

Long short credit & High yield

Long short credit managers have done well compared to traditional credit funds. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Some managers think that the situation does not look sanguine, but attention is required to pick the right issues, with particular attention paid to corporate leverage levels and covenants. As markets are expecting rates to continue to rise and economic growth to decelerate, the best managers remain diversified, investing in quality longs and focusing on industries with higher pricing power.