During February, economic and inflation data came in slightly above expectations, which helped cool the market down. Central banks reiterated the message that the market should expect monetary policy to maintain its course until we see significant signs that inflation is abating.

European equities outperformed other major regional indices, driven by decreasing energy costs and increasing export expectations to China. US equities were sold off, with investor focus remaining mainly on the Fed rate policy. At sector level, performances were mixed. European energy, telecoms and financials outperformed during the period.

European equities outperformed other major regional indices, driven by decreasing energy costs and increasing export expectations to China. US equities were sold off, with investor focus remaining mainly on the Fed rate policy. At sector level, performances were mixed. European energy, telecoms and financials outperformed during the period.

Sovereign yields adjusted to the revised economic expectations, rising significantly over longer term maturities. While European corporate spreads remained relatively muted during February, US corporates reversed the downward trend and rose over the period. As we write this note, the demise of Silicon Valley Bank has triggered a crisis within the banking sector that has had a significant impact on sovereign and corporate yields.

The HFRX Global Hedge Fund EUR returned -0.67% over the month.

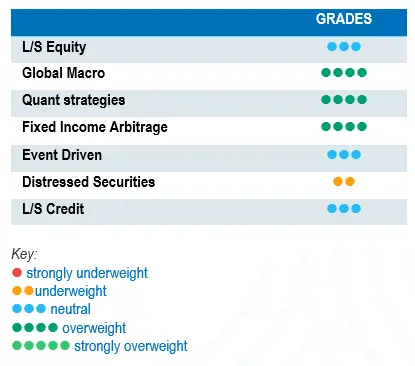

Long-Short Equity

February was a challenging month for Long-Short Equity strategies. On average, global strategies captured 65% of the downside of global equities. While average performances for US- and Asia-focused managers captured respectively around 50% and 60% of the downside of their respective indices, European managers did not manage to capitalise on the positive beta tailwind for the region, posting low single-digit negative returns. Alpha generation for the strategy was particularly affected by strong short covering activity during the first half of the month. Overall, from a positioning perspective, managers kept their net exposures close to 2022 lows. European-focused managers were particularly active, selling defensive sectors and covering shorts in European cyclicals. The heavy lifting of short books’ positive contribution during last year’s equity risk repricing is probably behind us. However, the environment remains favourable for Long-Short equity strategies. Factors such as the rising cost of debt, the possible slowing of economic activity and active risk pricing by investors will benefit equity portfolio constructions from a long-short perspective by picking the winners and losers in the current market environment.

Global Macro

Global Macro managers’ results were mixed, and on average generated flat returns during the month, with performance drivers mainly linked to their view on the inflation trajectory. Relative value strategies tended to add to performance, while the contribution of directional trades was very manager-specific. Fund risk exposures tend to be moderate for risk management reasons, but also because managers need to deploy less risk capital to reach their performance objectives. During 2023, the scope of financial asset price moves is expected to be lower than during the last year, with perhaps a better environment for strategies with a relative value approach. Nonetheless, the ongoing banking sector crisis is a strong reminder for every investor: sound portfolio diversification is still one of the safest ways to invest and accumulate capital over the cycles.

Quant strategies

Quantitative strategies, on average, outperformed other alternative strategies in February, with solid positive mid-single-digit returns. Multi-strategy quantitative managers use a diversified collection of models which tend to be more consistent over time but, compared to trend followers, tend to have lower diversifying characteristics to traditional assets over shorter periods when markets correct. During the month, trend followers’ losses in equities and commodities were largely offset by gains in positions in bonds and currencies.

Fixed Income Arbitrage

After a goldilocks year for fixed income arbitrage strategies, the volatility of the interest rate market moved slightly, mainly in the US. The latest inflation figures surprised the consensus by their resilience versus expectations. As 2023 begins, the main focus will be on this new trend. However, it is far from obvious that inflation worries are behind us and many uncertainties remain (Ukraine-Russia war, pace of the economic slowdown, energy price trend, etc.). Against this backdrop, Relative Value traders should continue to benefit from a healthy environment, while directional funds will face a far greater challenge in making directional bets compared to 2022.

Risk arbitrage – Event-driven

Performances were relatively muted for event-driven strategies, with managers averaging flat to slightly negative returns during the month. Merger arbitrage tended to outperform special situation strategies, due to lower sensitivity to beta. The merger arbitrage opportunity set is currently animated by opposing driving forces generating some level of volatility in merger spreads. The rising cost of debt, the dynamic stance adopted by US regulators in challenging the large deals announced and the level of economic uncertainty are factors helping to widen spreads and keep them wide. At the same time, the strategy currently offers an attractive deal spread above historic averages, which should attract more interest from arbitrageurs, helping to narrow the spread. The current nervousness on equity and credit markets necessitates more caution when investing in Event-driven strategies, due to a higher probability of deal breaks. Conversely, merger arbitrage provides an interesting tool that is structurally short duration, where deal spreads are positively correlated to increases in interest rates.

Distressed

Bankruptcy headlines have captured the implosion of hedge fund strategies and financial intermediaries active in digital assets. The dramatic fall in the value of crypto currencies has put the spotlight on a specific number of crypto investors and crypto lenders. Fortunately, this concerns only a very niche segment of the hedge fund universe. Currently, default rates of sovereign and corporate issuers remain relatively low. Credit spreads have substantially retraced since their highs in October 2022, driven by expectations of a less severe economic downturn. We are only at the beginning of the economic slowdown, and most corporations were able to refinance their debt obligations at better rates following the COVID crisis.

Long short credit

Long short credit managers have done well compared to traditional credit funds. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Some of the managers think that the situation does not look particularly upbeat, but they need to focus to pick the right issues, with particular attention paid to corporate leverage levels and covenants. As markets are expecting rates to continue to rise and economic growth to decelerate, the best managers remain diversified, investing in quality longs and focusing on industries with higher pricing power.