In a market animated by contradictory economic data points, NVIDIA’s excellent Q1 earnings were enough to light the fire under an already hot technology sector. The famous quote by Jensen Huang naturally came to mind: “every $1 trillion business starts in a $0 billion market”. The disrupting power of AI has enhanced the appeal of many technology stocks due to the productivity enhancements they might generate. Data is indicating a slowdown in economic activity, but as Justin Lahart from the WSJ points out: “Predicting an economic downturn isn’t crazy, but being confident about it right now might be”.

The returns of US equities were relatively muted but hid a big dispersion in performance between the different sectors. The technology sector massively outperformed cyclical sectors. Tech-heavy Taiwanese equities also did well. Japanese equities were among the best performers for the month and the year, helped by renewed investor interest in improved corporate governance standards.

Yields on US treasuries increased by 30 to 40 bps over the month, adjusting to strong job market data. Moves on the yields of European issues over the curve were relatively muted.

The HFRX Global Hedge Fund EUR returned -0.67% over the month.

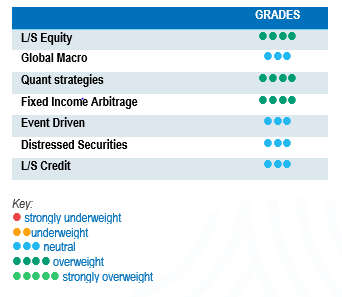

Long-Short Equity

It was a good month for Long-Short Equity strategies, but performances were very dispersed compared to other strategies. Average performances varied significantly depending on the strategy style, sector of focus and dominant region invested in. US-focused managers on average outperformed their peers investing in Europe and Asia, benefiting from movements on the technology sector and a positive performance spread between long and short positions. According to Morgan Stanley Prime Brokerage, hedge funds were net buyers of US equities over the month and net sellers of European and Asian equities. In terms of style, Long-Short Equity strategies with a fundamental growth tilt outperformed, benefitting the most from the strong movements in technology-related investments. Although alpha generation from short books has improved since the beginning of February, May was a challenging month for some market-neutral strategies due to short squeezes. Since the start of the year, we have witnessed a low-breadth market driven by mainly large cap technology and semis, which is not ideal for the implementation of a diversified long-short equity programme. After periods like these, market trading tends to normalise, offering a broad spectrum of long and short opportunities based on company fundamentals.

Global Macro

Global Macro indices averaged slightly positive returns for the month, but with relatively high dispersion. This could be explained by the current high level of uncertainty and difference in positioning adopted by managers. The distribution of returns realised by the funds was positively tilted, with positive contributions generated by positions in currencies, short positions in commodities and long positions in Brazilian equities and rates. Although returns generated by macro strategies since the start of the year have been below expectations, the current and foreseeable environment is expected to offer interesting investment opportunities. In this highly uncertain environment, strategies with a relative value approach, strong research and strong risk management will tend to outperform.

Quant strategies

Quantitative strategies did well during the month, particularly trend-following models. Gains generated by positions in currencies, equities and short positions in commodities were slightly balanced by positions in fixed income. Since the start of the year, Multi-Strategy Quantitative strategies have been more resilient than CTAs, balancing negative contributions from trend models with positive contributions from non-directional arbitrage models. After ranking as one of the best performing strategies in 2022, CTAs have been lagging since the start of the year, partly due to asset price trend reversals but also due to lower signal-to-noise ratios.

Fixed Income Arbitrage

The main question that all arbitrageurs are considering is what will happen next after experiencing a once-in-a-50-year movement in 2-year US treasuries. The answer appears to be a decrease in the volatility of the US interest rate market at the current level, with market participants waiting for economic data to provide a clearer trend. On the directional side, market participants are opting for a more pronounced yield curve incline in both short-term and long-term rates. However, the existence of additional banking issues could potentially exacerbate the inversion of the yield curve. In this type of environment, relative value traders, who have been extremely resilient over the last few months, should continue to benefit from a healthy environment, while directional funds will probably continue to face a greater challenge in taking directional bets compared to 2022.

Risk arbitrage – Event-driven

May was a very challenging month for the Event-driven space. Merger arbitrage strategies contributed negatively to performance, affected by a series of deal breaks and challenges, which, according to most managers, have previously rarely been seen. Although economic uncertainty and market volatility have been the main factors affecting deal volumes and deal spreads since the start of the year, the impact of regulatory risk was the main cause for the poor performance in May. The CMA and FTC have challenged several important deals by announcing court action or requiring further deal remediation to move merger processes along. The deals most impacting performance were Microsoft’s takeover of Activision Blizzard, Amgen’s acquisition of Horizon Therapeutics and United Healthcare’s bid for EMIS. The deal arbitrage community has, for some time, already had to adapt to more offensive US regulatory scrutiny on larger deals by reducing the size of deals considered to be more at risk or increasing the portion of deal hedging. However, many managers say they are surprised by the level of effort they have seen to block or complicate the successful conclusion of merger deals. The opportunity set remains very interesting in terms of expected returns. The greater emphasis on fundamental analysis required to build a portfolio of merger deals will favour managers and strategies with stronger track records in terms of risk management and drawdown control.

Distressed

The distressed community got an adrenaline shot last month with the collapse of several US financial institutions and Credit Suisse. The surprise failure of Silicon Valley Bank provoked panic, leading to an indiscriminate sell-off of financial stocks, which progressively reversed for most assets. This was a major event due to the size of the failed banks but was contained to a limited number of institutions with a big percentage of uninsured bank deposits. Although the amount of non-performing loans, defaulting issues and bankruptcies remains relatively low, investors are much more alert to the risk of cracks in the market, as economic fundamentals may continue to deteriorate. One area of particular attention is commercial real estate and the percentage that the financing of these assets represents in US regional banks.

Long short credit

Long-short credit strategies seem to be gaining in appeal. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance, as positions in AT1 issues have generated significant volatility and market losses for the investment community. Yields have widened, again giving fixed income a seat at the Asset Allocation table. However, as recent events have demonstrated, risk aversion should also be part of the investor’s decision-making process.

* Quote from Jensen Huang, CEO of NVIDIA.