Looking back over the first half of the year, we can say that the bulls gained the upper hand over the bears. Despite the occurrence of a banking crisis and the many political and economic challenges that lie ahead, market volatility remained muted on the back of a resilient US economy. Although the world economy is still pointing to a slowdown, the resilience of US consumers supports the case for a soft landing or shallow recession scenario.

Overall, equities did well during the month, with most major equity indexes returning positive mid to high single-digit returns. Korean equities and UK small and mid-cap stocks were among the laggers during the period. In the US, consumer discretionary, industrials, materials and technology sectors outperformed more defensive sectors such as utilities, telecom and consumer staples.

Yield curves in the US and Europe steepened slightly during the month, as central bankers remained hawkish in the face of core inflation figures pointing in the right direction but remaining sticky.

The HFRX Global Hedge Fund EUR returned +0.54% over the month

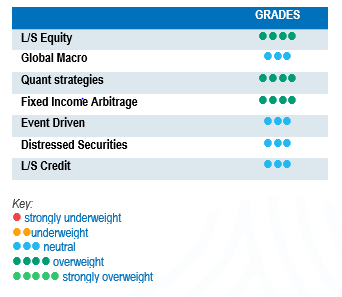

Long-Short Equity

June was on average a positive month for Long-Short Equity strategies. As performance was mainly driven by market exposure, directional strategies tended to outperform those with moderate or low net exposure. Alpha generation was on average negative due to the outperformance of the short book, partly due to active short covering by managers. From a regional perspective, US-focused strategies on average outperformed strategies focusing on Asia and Europe. However, on a relative basis, US funds underperformed by capturing a third of the upside of a broad equity index, while their European and Asian counterparts captured close to half the index’s performance. Since the start of the year, performance of directional strategies and strategies with a variable net exposure have been widespread, with a clear positive skew. On the other hand, market neutral strategies have also been put in dispersed performances, with an even distribution around a flattish mean performance. 2023 has witnessed a low breadth market driven by large cap technology and semis, which is not ideal for the implementation of a diversified long-short equity programme. After periods like these, market trading tends to normalizes, offering a broader spectrum of long and short opportunities based on company fundamentals.

Global Macro

Performances generated by global macro managers during the month of June were dispersed but on average positive. Performances were supported by strong returns on equity and currency positions. Some managers, endorsing the view that inflation would be stickier than expected, maintained shorts on the front end of the curve, which contributed positively to performance. Good performances generated by certain emerging market regions were also a positive driver for Global Macro strategies. Although returns generated by macro strategies since the start of the year were below expectations, the current and foreseeable environment is expected to offer interesting investment opportunities. In this type of highly uncertain environment, strategies with a relative value approach, strong research and strong risk management will tend to outperform.

Quant strategies

Quantitative strategies were on average positive contributors to performance during the month. Trend-following models tended to outperform Multi-Strategy Quantitative strategies, with portfolios benefiting from trends in fixed income, equities and currencies. However, since the start of the year, Multi-Strategy Quantitative strategies have been more resilient than CTAs, balancing negative contributions from trend models with positive contributions from non-directional arbitrage models. After ranking as one of the best performing strategies in 2022, CTAs have been lagging since the start of the year, partly due to asset price trend reversals but also due to lower signal-to-noise ratios.

Fixed Income Arbitrage

The main question that all arbitrageurs are considering is what will happen next after experiencing a once-in-a-50-year movement in 2-year US treasuries, and the jury has yet to come out with a straight answer. To illustrate how shaky the market is, we will take 22 June, when Jerome Powell gave confidence and evidence that they will have to implement further rate hikes; however, on 23 June, European economic data were so weak that 10-year rates across developed countries dropped by 15/20bps. As we speak, rates are now 40 bps higher, as it looks like inflation is here to stay. On the directional side, if market participants are opting for higher rates, they can be stopped out by a violent setback. Relative value traders continue to benefit from a healthy environment, while directional funds will continue facing a more challenging place to take directional bets compared to 2022.

Risk arbitrage – Event-driven

June was a positive month for Event-driven strategies benefitting from the recovery of last month’s dislocation partly caused by a few deal breaks and regulators challenging large deals. During 2023, there has been a lot of noise surrounding Event-driven strategies. Although economic uncertainty and market volatility were the main factors affecting the number of deal volumes and spreads, since the start of the year, regulatory risk impact has been the main cause for poor performance. The CMA and FTC have challenged several important deals by announcing court action or requiring further deal remediation to move merger process along. Among the deals impacting performance, the most notorious were Microsoft’s takeover of Activision Blizzard, Amgen’s acquisition of Horizon Therapeutics and United Healthcare’s bid for EMIS. The deal arbitrage community has, for some time, already had to adapt to more offensive US regulatory scrutiny on larger deals by reducing the size of deals considered to be more at risk or increasing the portion of deal hedging. However, many managers say they are surprised by the level of effort they have seen to block or complicate the successful conclusion of merger deals. The opportunity set remains very interesting in terms of expected returns. The greater emphasis on fundamental analysis required to build a portfolio of merger deals will favour managers and strategies with stronger track records in terms of risk management and drawdown control.

Distressed

The distressed community got an adrenaline shot in March with the collapse of several US financial institutions and Credit Suisse. The surprise failure of Silicon Valley Bank provoked panic, leading to an indiscriminate sell-off of financial stocks, which progressively reversed for most assets. This was a major event due to the size of the failed banks, but was contained to a limited number of institutions exposed to a big percentage of uninsured bank deposits. Although the amount of non-performing loans, defaulting issues and bankruptcies remains relatively low, investors are much more alert to the risk of cracks in the market, as economic fundamentals may continue to deteriorate. One area of particular attention is commercial real estate and the percentage that the financing of these assets represents in US regional banks.

Long short credit

Long-short credit strategies seem to be gaining in appeal. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance, as positions in AT1 issues have generated significant volatility and market losses for the investment community. Yields have widened, again giving fixed income a seat at the Asset Allocation table. However, as recent events have demonstrated, risk aversion should also be part of the investor’s decision-making process.