And if you’re broken, I’ll mend ya,

And I keep you sheltered from the storm[1]

March was a challenging and volatile month, with investment sentiment going through a whole variety of shades in a single month. It started positively with better-than-expected economic data, shifted to a banking crisis triggered by a bank run, to end on a narrow-breadth market rally driven by technology stocks and growth factors due to expectations of economic growth tanking. Jerome Powell and Janet Yellen were at the forefront of trying to stabilise this financial Lego House.

Equity market returns were mixed over the month, with technology and defensive sectors outperforming cyclical sectors, and financial stocks dragged down by the collapse of SVB and Credit Suisse.

This market stress on banks had a very strong impact on sovereign yields, with investors buying quality and safe assets. Medium- to long-term maturity US Treasury yields tightened aggressively between 50 to 75 bps over a single month. European sovereign yields moved in a similar way to US issues.

Energy and industrial metal futures continued their downward trend during the month, while precious metals rebounded strongly as investors were looking for alternatives to store value.

The HFRX Global Hedge Fund EUR returned -1.38% over the month.

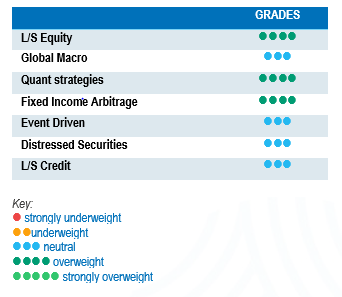

Long-Short Equity

Average performances for Long-Short Equity strategies were relatively muted during March, but displayed relatively high levels of dispersion across the universe. Alpha generation on short books was positive, but the upside capture by long books was limited due to a very narrow market breadth in regions like the US: i.e. most of the index performance was driven by a very small number of stocks. In terms of style, strategies tilted to growth outperformed market-neutral and value-driven funds. Most Long-Short Equity strategies managed to navigate a very challenging and volatile month relatively smoothly. Sector specialist managers in technology benefited from the collapse in sovereign yields and the rotation out of energy and banks into TMT to print good returns for the month. The Silicon Valley Bank failure was a good reminder for investors that weak business models will be challenged by the current higher rate environment and deteriorating economic fundamentals. Long-Short Equity strategies will benefit in this environment by being long on good businesses that will come out stronger and by shorting structurally declining business models or businesses whose valuation does not reflect the current economic environment of lower liquidity, higher rates and deteriorating growth.

Global Macro

March was challenging for global macro strategies and particularly for discretionary managers who tend to manage more concentrated portfolios centred around fundamental analysis and strong investment convictions. Performances for the universe averaged a low single-digit negative return and were relatively dispersed with a negative skew. Some global macro funds considered financial asset valuations to be too stretched to face a recessionary environment. They were positioned for the Fed having to raise rates above expectations to fight persistent inflation. Hence, their portfolios held net short positions in equities and bonds. This was a costly bet in terms of performance in the face of the flight to safety occurring after the banking crisis. In this highly uncertain environment, strategies with a relative value approach, strong research and strong risk management will tend to outperform.

Quant strategies

Rippling waves from the Silicon Valley Bank debacle created a challenging environment for quantitative strategies. The rally on sovereign yields caused by the flight to safety had a negative impact on trend-following models, which were mainly net short on bonds. Multi-strategy quantitative funds were more resilient, balancing negative contributions from trend models with positive contributions from non-directional arbitrage models. After ranking as one of the best performing strategies in 2022, CTAs have been lagging since the start of the year, partially due to asset price trend reversals but also due to lower signal-to-noise ratios.

Fixed Income Arbitrage

After a goldilocks year for fixed income arbitrage strategies, the direction of developed interest rates markets were still pointing north and steady, mainly driven by the resilience of inflation figures and the desire among central banks to tackle the problem. This abruptly changed on 10 March, when the SVB brought back the spectre of a new financial crisis. In less than two days, we witnessed one of the most spectacular reversals in interest rate history. The Eurodollar June contract fell from 6% down to 4.15% in two days, then climbed back to 5% by the end of the month, wiping out all rational market expectations. As we speak, market players are still suffering from a big hangover. Most market participants, positioned for higher interest rates, had to reduce or cut their positioning, posting losses. In this type of environment, Relative Value traders, who were very resilient over the month, should still benefit from a healthy environment, while directional funds will probably continue to face a more challenging context with regard to taking directional bets compared to 2022.

Risk arbitrage – Event-driven

Event-driven average performances were relatively muted for the month. Positive contributions from deals moving in the right direction such as Activision and successfully closed deals, such as the merger between Rogers Communications and Shaw Communications, were negatively offset by a widening in deal spreads owing to recent market instability. A deal in the financial sector, in which Toronto-Dominion Bank is buying First Horizon Corporation, was particularly affected by the sell-off of bank stocks. The merger arbitrage opportunity set is currently animated by opposing driving forces, which are generating a degree of volatility in merger spreads. The rising cost of debt, the dynamic stance adopted by US regulators to challenge the large deals announced and the level of economic uncertainty are all factors helping to widen spreads and to keep them wide. At the same time, the strategy currently offers an attractive deal spread above historic averages, which should attract more interest from arbitrageurs and help to narrow the spread. According to merger arbitrage managers, the lower-than-average number of deals announced since the start of the year is not surprising. Corporate CEOs and board rooms would like greater economic visibility before making a move on a new acquisition.

Distressed

The distressed community got an adrenaline shot during the month with the collapse of several American financial institutions and Credit Suisse. The surprise failure of Silicon Valley Bank provoked panic, leading to an indiscriminate sell-off of financial stocks, which progressively reversed from most of the assets towards the end of the month. This was a major event due to the size of the failed banks, but contained to a limited number of institutions with a big percentage of uninsured bank deposits. Although the amount of non-performing loans, defaulting issues and bankruptcies remains relatively low, investors are much more alert to the risk of cracks in the market, as economic fundamentals may continue to deteriorate. One area of particular attention is commercial real estate and the percentage that the financing of these assets represents in US regional banks.

Long short credit

Long short credit managers have done well compared to traditional credit funds since the start of 2022. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Long-Short credit strategies seem to be gaining in appeal. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance, as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, again giving fixed income a seat at the Asset Allocation table. However, as recent events have demonstrated, risk aversion should also be part of the investor’s decision-making process.

[1] “Lego House” lyrics by Ed Sheeran