After a two-month period of improving risk appetite, the market started to head downwards in mid-August, influenced by the outcome of the Jackson Hole meeting. Jerome Powell’s hawkish tone obviously had a strong impact on the markets, but it was not the only strong driver. The deterioration of energy supply in Europe as we are quickly approaching winter is a cause for concern for industrial output, but also consumers, who will be facing record energy bills.

After a two-month period of improving risk appetite, the market started to head downwards in mid-August, influenced by the outcome of the Jackson Hole meeting. Jerome Powell’s hawkish tone obviously had a strong impact on the markets, but it was not the only strong driver. The deterioration of energy supply in Europe as we are quickly approaching winter is a cause for concern for industrial output, but also consumers, who will be facing record energy bills.

Most equity indices were down for the month, posting negative mid-to-high single-digit returns. European equities underperformed other regional indices because the energy crisis is particularly acute, and it is feared that the ECB will be forced to hike interest rates aggressively despite an already complicated economic situation. At sector level, energy, utilities and staples outperformed technology, industrials and consumer discretionary.

Fixed income sovereign yields and corporate credit spreads reversed a two-month easing period, taking yields and credit spreads close to last June’s year highs and adjusting to central banks’ determination to fight inflation.

Oil and industrial metals futures declined over the month, continuing the summer trend, contributing positively to moderate inflation reads.

The HFRX Global Hedge Fund EUR returned +0.81% over the month.

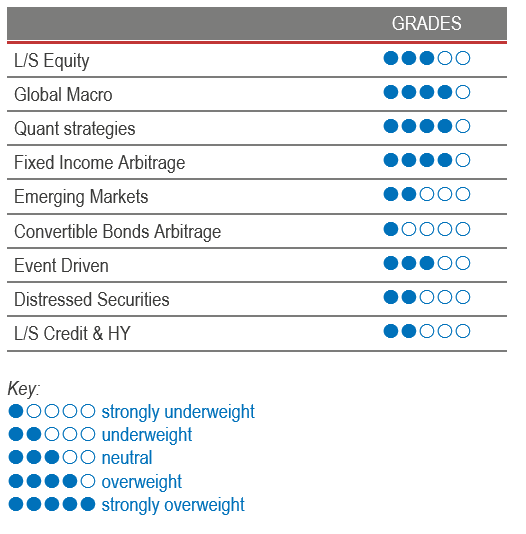

Long-Short Equity

The performance of Long-Short Equity strategies was mixed over the month, but indices tracking the universe were slightly positive for the period. This was a positive outcome, taking into account that equity markets sold off from mid-August. Managers protected capital with a relatively defensive positioning, benefiting from shorts they added to their books. In terms of risk appetite, Long-Short Equity strategies’ gross and net exposures are still at the low level of their average ranges. In general, managers remain cautious and are waiting for further clarity in the macro environment and more data points before raising risk exposure. Alpha generation has been tough over the year, but well diversified allocations to the Long-Short Equity universe have generated better results. As mentioned previously, we do not expect funds to add significant levels of risk for the moment, but rather selectively invest in longs, and refresh and reinforce their short books. Over the short term, we expect good Long-Short Equity strategies to protect capital for their investors by maintaining gross and net exposures close to their lower ranges. Challenges keep on pilling up for corporations, and the world post-Covid, post-war and post-QE will probably be very different from the one we lived in following the Great Financial Crisis. Picking the right stocks will be important, but being able to do so from a long-short perspective can bring a solid edge to long-only equity solutions.

Global Macro

Overall, Global Macro managers performed well over the month. The best performing strategies were mostly managers that did not buy into the early summer market rally and positioned themselves for a market sentiment deterioration by building short equity and rates positions and selective currency and commodity trades. Considering the strength of market moves, directional and fundamental discretionary strategies have tended to outperform managers with a relative value approach. The opportunity set for Global Macro strategies has improved, and is expected to remain positive for the foreseeable future. The Fed is taking liquidity out of the system, and is determined to battle inflation even if this leads to more challenging economic conditions. Asset risk premiums are moving across the board, and Macro managers are capitalising on these market moves. We continue to favour discretionary opportunistic managers who can draw on their analytical skills and experience to generate profits from selective opportunities worldwide.

Quant strategies

On average, Quantitative managers delivered positive returns over the month. Trend-following strategies did well, gaining in currencies, short-term rates and precious metals. Mid- to long-term models tended to outperform short-term models, as short-term models have been more sensitive to choppy markets since May. Multi-Strategy Quantitative strategies continued to do well. Since the start of the year, Quantitative strategies have been strong diversifiers and are among the best performers within the Hedge Fund universe.

Fixed Income Arbitrage

Despite its hawkish rhetoric on the back of pervasive inflation, the Fed is still far behind the curve. As such, the US central bank reaffirmed its willingness to tackle US inflation, pushing back the 10Y yield above the 3% mark, triggering a new equity sell-off late August. Volatility remains high due to wide trading ranges, creating a more challenging environment for directional macro managers. However, fixed income RV managers continue to benefit from healthy opportunities, while long volatility directional managers benefitted from their positive convexity.

Emerging Markets

Emerging Markets strategies suffered on the back of two major idiosyncratic events, a war in Eastern Europe and China’s zero Covid policy, but also from a general risk-off sentiment. In contrast, the strength of commodity prices has provided strong support to opportunities in Latin America and other export-driven nations. Performances vary across managers depending on the area of focus. Few hedge funds cover emerging markets. They tend to be specialists in narrower geographical regions. This strategy offers selective investment opportunities, but we remain overall cautious for the moment as decreasing growth expectations and rising interest rates in developed markets are warning indicators for the region.

Risk arbitrage – Event-driven

Event-Driven strategies were positive for the month, benefiting from idiosyncratic deal completions and deal spreads tightening for Merger Arbitrage strategies. Deal volumes for 2022 are lower than levels experienced last year. This could be seen as a normal reaction from corporate board rooms in a period of greater uncertainty and rising financing costs. Nonetheless, there is still meat on the bone, and strategic acquisitions in sectors such as healthcare, gaming and technology continue to be announced. Current deal spreads are wide, generating a potential low double-digit return opportunity far above this type of strategy’s long-term average return. However, there is no free lunch. There are higher risks of regulatory intervention, companies trying to walk away from a deal or the possibility that acquisition offers are shut down by shareholder vote. Current nervousness in equity and credit markets necessitates more caution when investing in Event-Driven strategies due to a higher probability of deal breaks. On the other hand, merger arbitrage provides an interesting tool that is structurally short duration, where deal spreads are positively correlated to increases in interest rates.

Distressed

Bankruptcy headlines have captured the implosion of hedge fund strategies and financial intermediaries active in digital assets. The dramatic fall in value of crypto currencies has put the spotlight on a specific number of crypto investors and crypto lenders. Fortunately, this concerns only a very niche segment of the hedge fund universe. Currently, default rates of sovereign and corporate issuers remain relatively low, but the rapid widening of credit spreads and the deterioration of economic fundamentals will lead to a rise in companies running into trouble. Leading managers are still waiting for further dislocations to happen before going on the offensive.

Long short credit & High yield

Long short credit managers have done well compared to traditional credit funds. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Some of the managers think that the situation does not look sanguine, but attention is required to pick the right issues, with particular attention paid to corporate leverage levels and covenants. As markets are expecting rates to continue to rise and economic growth to decelerate, the best managers remain diversified, investing in quality longs and focusing on industries with higher pricing power.