September was another very challenging month for investors. The market is subject to considerable uncertainty, with no clear evidence of the next step. Some market participants are considering trying to call it the bottom for equities, but hesitant to put their toe in the water, because, as the Fed remains determined to bend inflation whatever it takes, the economic scenario could become much darker.

September was another very challenging month for investors. The market is subject to considerable uncertainty, with no clear evidence of the next step. Some market participants are considering trying to call it the bottom for equities, but hesitant to put their toe in the water, because, as the Fed remains determined to bend inflation whatever it takes, the economic scenario could become much darker.

Equity index returns were down by the mid- to low double-digits over the month. Technology-heavy indices in Asia such as Taiwan, Kospi or the Hang Seng index lagged other geographical regions. At sector level, defensive sectors such as consumer staples and healthcare outperformed other sectors.

Sovereign yields and credit spreads continued to widen significantly during the month, taking US 10-year Treasuries close to 4%, a level not seen since 2008. UK gilts were particularly affected by the sell-off, leading the Bank of England to intervene to help stabilise the market and avoid a loop of investors selling bonds to raise cash.

The HFRX Global Hedge Fund EUR returned -1.23% over the month.

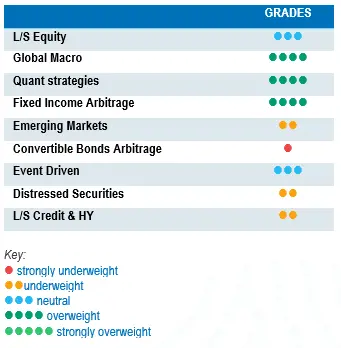

Long-Short Equity

On average, absolute returns were negative over the month for Long-Short Equity strategies. Strategies were running low gross exposures and were well hedged. Managers were able to have a good downside capture ratio and posted only a small percentage of equity indices’ negative returns. Market-neutral strategies benefitted from their short books, posting on average positive returns for the month. In terms of risk appetite, Long-Short Equity strategies’ gross and net exposures are still at the low end of their average ranges. Overall, managers remain cautious and are waiting for further clarity in the macro environment and more data points before raising their risk exposure. Alpha generation has been tough over the year, but well diversified allocations to the Long-Short Equity universe have generated better results. As mentioned previously, we do not expect funds to add significant levels of risk for the moment, but rather selectively invest in longs and refresh their short books. Challenges continue to pile up for corporations, and the world post-Covid, post-war and post-QE will probably be very different from the one we lived in following the Great Financial Crisis.

Global Macro

Global Macro strategies were strong performers in September, benefiting from strong price movements in equities, rates and currencies. On average, systematic strategies outperformed discretionary macro managers during the period. Returns generated by discretionary managers were more dispersed and closer to lower single digits. From a tactical viewpoint, discretionary managers were running lower risk levels, fearing trendless volatile markets over the short term or short squeezes in oversold areas of the market. The opportunity set for Global Macro strategies has improved, and it is expected to remain better for the foreseeable future. The Fed is taking liquidity out of the system and is determined to battle inflation even if this leads to more challenging economic conditions. Asset risk premiums are moving across the board, and macro managers are capitalising on these market moves. We continue to favour discretionary opportunistic managers who can draw on their analytical skills and experience to generate profits from selective opportunities worldwide.

Quant strategies

September was one of the best months of the year in terms of performance for Quantitative strategies. High inflation data readings surprised the market, and expectations of additional tightening by central banks resulted in severe sell-offs in equities and bonds. The main performance drivers were short positions in equities and bond futures, long dollar and short British pound. Trend-following models tended to outperform multi-strategy quantitative models. Since the start of the year, Quantitative strategies have been strong diversifiers and are among the best performers within the Hedge Fund universe.

Fixed Income Arbitrage

Despite its hawkish rhetoric on the back of pervasive inflation, the Fed is still far behind the curve. As such, the US central bank had to reaffirm its willingness to tackle US inflation, triggering a new equity sell-off. Even if the direction of short-term rates across the globe is clear, the long end dynamic is far from being obvious. If volatility remains high due to wide trading ranges, creating a more challenging environment for directional macro managers (who have reduced their risk and becoming more tactical as we speak), fixed income RV managers still benefit from healthy opportunities both in Europe (France, Germany) and the US.

Emerging Markets

It was a challenging month for Emerging Market assets. The strong dollar and expectations of further monetary tightening by the Fed do not usually correlate well with a positive sentiment for the region. The strength of commodity prices has provided strong support to opportunities in Latin America and other export-driven nations. Performances vary across managers depending on their area of focus. Few hedge funds cover emerging markets. They tend to be specialists in narrower geographical regions. This strategy offers selective investment opportunities, but we remain overall cautious for the moment, as decreasing growth expectations and rising interest rates in developed markets are warning indicators for the region.

Risk arbitrage – Event-driven

Merger Arbitrage strategies returns were flat to slightly negative for the month, holding up well in a strong sell-off market. The Department of Justice’s failure to block the acquisition of Change Healthcare by United Health sent a positive signal to the market. Conversely, the stress in markets caused other deal spreads to widen a little. Nonetheless, Merger Arbitrage strategies are relatively well insulated from rising rates, since deal spread risk premiums tend to incorporate higher risk-free rates than sovereign issues to compensate arbitrageurs for holding these equities until the deal closes. Deal volumes for 2022 are lower than levels experienced last year. This could be seen as a normal reaction from corporate board rooms in a period of greater uncertainty and rising financing costs. Nonetheless, there is still meat on the bone, and strategic acquisitions in sectors such as healthcare, gaming and technology continue to be announced. Current deal spreads are wide, generating a potential low double-digit return opportunity far above this type of strategy’s long-term average return. However, there is no free lunch. There are higher risks of regulatory intervention, companies trying to walk away from a deal or the possibility that acquisition offers are shut down by shareholder vote. The current nervousness on equity and credit markets necessitates more caution when investing in Event-Driven strategies, due to a higher probability of deal breaks. On the other hand, Merger Arbitrage provides an interesting tool that is structurally short duration, where deal spreads are positively correlated to increases in interest rates.

Distressed

Bankruptcy headlines have captured the implosion of hedge fund strategies and financial intermediaries active in digital assets. The dramatic fall in value of crypto currencies has put the spotlight on a specific number of crypto investors and crypto lenders. Fortunately, this concerns only a very niche segment of the hedge fund universe. Currently, default rates of sovereign and corporate issuers remain relatively low, but the rapid widening of credit spreads and the deterioration of economic fundamentals will lead to a rise in companies running into trouble. Leading managers are still waiting for further dislocations to happen before going on the offensive.

Long short credit & High yield

Long short credit managers have done well compared to traditional credit funds. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Some of the managers think that the situation does not look sanguine, but attention is required to pick the right issues, with particular attention paid to corporate leverage levels and covenants. As markets are expecting rates to continue to rise and economic growth to decelerate, the best managers remain diversified, investing in quality longs and focusing on industries with higher pricing power.