Markets held up well during March, supported by robust economic indicators coming from the US, manufacturing and services PMIs improving in China and an increasingly dovish stance from the ECB. Inflation prints came out stickier, pushing out expectations for the first rate cut towards the end of the year.

Markets held up well during March, supported by robust economic indicators coming from the US, manufacturing and services PMIs improving in China and an increasingly dovish stance from the ECB. Inflation prints came out stickier, pushing out expectations for the first rate cut towards the end of the year.

Equities did well during the month. European assets outperformed US stocks, partially driven by cheaper valuations and dovish comments from the ECB, but also an outperformance of value and cyclicals, which are heavier in European indices. Energy, financials, materials and utilities outperformed during the month, catching up a portion of the lag they have accumulated against technology and growth-tilted stocks since the start of the year.

Sovereign yields in the US and Europe were volatile during the period, but ended the month close to the same level as at the end of February. US corporate spreads reversed course and trended upwards, after touching a trough mid-March. As the market is now expecting rate cuts to come later this year, this may have a negative effect on the weakest section of the corporate spectrum.

The HFRX Global Hedge Fund EUR returned +1.14% over the month.

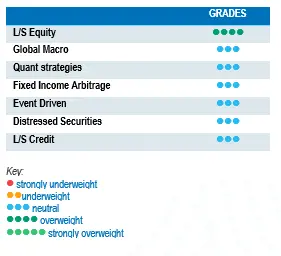

Long-Short Equity

March was another strong month in terms of performance across the overall spectrum of Long-Short Equity styles. According to Morgan Stanley Prime Brokerage, average performances were positive for funds focused on the Americas, Europe and Asia, with strategies capturing around 50% of the upside of their respective traditional long regional index. Performances were driven by positive alpha on both long and short stock picks. The first quarter of 2024 was one of the best quarters in terms of alpha generation over the last 15 years. As performance contribution was good from both long and short positions, performance dispersion across strategy styles was low. In the current environment of higher rates, a well-balanced Long-Short Equity selection is an excellent tool to capitalise on the opportunities offered by inter- and intra-sector dispersion. These strategies have more tools than traditional long-only strategies to help navigate market volatility, should the consensus scenario of moderate growth for 2024 hit a bump in the road.

Global Macro

Performances for Global Macro funds were good during the month across the spectrum. Most asset classes were positive contributors to performance, but long positions in equities and commodities made some of the biggest contributions. Long carry positions on corporate and emerging market credit also continue to be a positive performance driver. Some fundamental discretionary managers have tactically taken down portfolio risk following inflation prints that came out warmer than expected. We expect the current and foreseeable environment to offer interesting investment opportunities for Global Macro.

Quant strategies

Quantitative strategies performed well during the month. Trend Followers were a significant positive outlier, benefiting from strong market movements across a vast variety of asset classes, closing the quarter with one of the strategy’s best quarterly returns. Positions in equities, currencies and commodities were the main drivers of performance. Multi-Strategy Quantitative programmes generally contributed positively to performance during the month.

Fixed Income Arbitrage

Since the beginning of the year, central banks have become more data-dependent than ever, and each small piece of economic data could potentially trigger interest rate moves or change yield curve shapes. However, as we speak, volatility has dropped significantly compared to 2023, and the bond price dynamic is range-bound. The market seems positioned in a “wait-and-see stance”, supporting a carry strategy but not directional or relative value strategies, while offering a supportive environment to implement positively convex positions to take advantage of the next moves.

Risk arbitrage – Event-driven

Event-Driven strategies were generally positive during the month, progressively recovering from a period of challenging performance generation for the strategy. Both Merger Arbitrage and Special Situation books contributed positively to performance. Merger announcements have been relatively muted for the last two years, which is understandable in the context of market volatility and higher borrowing costs. Nonetheless, the number of new deals has ticked upwards since the start of the year. Some major banks have expressed positive expectations towards an increase in corporate activity and progressive normalisation of the number of deals announced. According to strategy specialists, the number of deals announced is more correlated to the level of visibility corporate management has on the state and direction of the economy than to the level of the cost of debt itself. As inflation slowly trickles down and interest rates are getting closer to peak, we might be at the beginning of a nice cycle for the strategy.

Distressed

During the last 18 months, expectations for distressed opportunities have evolved significantly. Coming into the end of 2022, the red-hot inflation levels and rapid rate hike cycle were indicators of a distressed cycle bonanza not seen since the Great Financial Crisis. These expectations dwindled during 2023, as the economy and job market remained resilient. The opportunity set during the year was opportunistic in nature, taking advantage of specific events such as the banking crisis in the US during the first quarter of 2023 or from idiosyncratic situations. Currently, default levels have started to increase, although expectations remain contained considering most corporations opportunistically refinanced their outstanding debt at lower rates during the 2020-2021 period and that consumers’ financial health remains relatively strong. While the strategy specialists remain largely on the sidelines focusing on idiosyncratic opportunities, they remain cautious about investing in high-yield issuers and have identified cracks in specific areas such as the loan market. Some market participants have taken large debt loads through loans, which are usually floating rate issues, without anticipating such a meteoric rise in short-term rates.

Long short credit

Interest rates remain wide and offer interesting opportunities on an absolute and relative basis. Strategy specialists currently have portfolios with a long bias, because economic fundamentals remain resilient, central banks may be getting closer to pivot and yields across credit markets offer equity-like returns with a higher degree of safety. Shorts are mainly used to hedge specific issuers or sectors and target certain areas of the market displaying some kind of fragility. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, again giving fixed income a seat at the asset allocation table. However, as recent events have demonstrated, risk diversification is particularly important and should be an integral part of the investment allocation process.