The month of June was relatively noisy for markets, especially in Europe where geopolitical risk remains one of investors’ primary areas for concern. In the US, the latest macroeconomic data continues to indicate that the Fed might succeed in piloting the economy to a soft landing. However, a disconnect between the real economy and the stock market seems to be building up. While consumer confidence indicators and corporate earnings are turning soft, expectations of higher equity prices remain close to all-time highs. Due to enthusiasm for AI, investors might not see the wood for the trees.

Technology-heavy indices continued to outperform during the month, led by solid earnings and growth expectations for the AI ecosystem. Chinese and European equity indices took a breather on economic and political concerns. US small and mid-cap equity indices also gave back some performance during the period, as softer economic data and slowing consumer spending have a bigger impact on the lower quality and economically sensitive areas of the market.

Sovereign yields in Europe and the US were volatile but continued their downward trend. Interesting to note the European corporate IG and HY spreads widening but also the decoupling of French OATs and German Bund issues following the first round of the French elections. Levels have come down from their peaks, but uncertainty remains.

The HFRX Global Hedge Fund EUR returned +0.19% over the month.

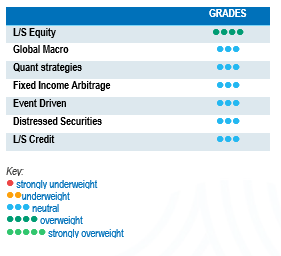

Long-Short Equity

Global Long-Short Equity averaged slightly positive returns during the month. The second quarter was more challenging than Q1, as strategies managed to capture a smaller percentage of the market’s performance. Nonetheless, since the start of the year, Long-Short Equity funds have done well, averaging positive high single-digit returns. At a regional level, Asian Long-Short Equity generated the highest absolute returns, outperforming the reference index. European strategies slightly underperformed US-focused funds but outperformed on a relative basis to their reference index. According to Morgan Stanley Prime Brokerage, the market broadening seems to have taken hold as hedge funds are buying Banks, Energy and Payments and selling AI beneficiaries like Semiconductors. In the current environment of higher rates, a well-balanced Long-Short Equity selection is an excellent tool to benefit from the opportunities offered by inter- and intra-sector dispersion. These strategies have more tools than traditional long-only strategies to help navigate market volatility.

Global Macro

Global Macro strategy performances were dispersed during the month, with indices for systematic and discretionary macro printing negative low single-digit returns. On average, managers were light risk, waiting for additional data to reposition their portfolio and deploy risk. Some consider the equity market to be too stretched and likely to pivot once the benefits of expected rate cuts are outweighed by the slowdown in economic activity. Year-to-date performances are dispersed; therefore, strategy selection is a key factor. We expect the current and foreseeable environment to offer interesting investment opportunities for Global Macro.

Quant strategies

It was a tale of two halves for Quantitative strategies during the month. Multi-Strategy Quantitative strategies did well during the period, driving significant returns from equity statistical arbitrage models, which benefited from increasing equity market dispersion. Commodity arbitrage models also added to performance. On the other hand, Trend-Following models detracted from performance, due to negative contributions from short positions in fixed income. The magnitude of performances varied from negative mid-single-digit returns to low double-digit figures, depending on the level of leverage applied and the time horizon of the model. As Trend models had one of the strongest first quarters on record in terms of performance, despite shedding a significant portion of their gains over the last two months, they remain well in positive territory since the start of the year. Multi-Strategy Quantitative funds have, on average, been consistent performers over the last five years, providing strong diversification benefits.

Fixed Income Arbitrage

Since the start of the year, central banks have become more reliant on data than ever before, with every minor economic indicator having the potential to influence interest rate decisions or alter the shape of yield curves. Consequently, market volatility has significantly decreased compared to 2023, and bond prices have been range-bound. However, unexpectedly strong inflation figures caused markets to abruptly shift from a "wait and see" approach to the realisation that "perhaps we misunderstood inflation," resulting in global spikes in interest rates. As a result, many directional fixed-income investors were caught off guard by the sudden surge, while relative value traders took advantage of this volatility spike. Ultimately, as these data spikes seemed to be outlier data points outside the trend, the ECB decided to pull the trigger first and the expected Federal Reserve rate cuts have now been brought forward again, creating some market noise around rate equilibrium points.

Risk arbitrage – Event-driven

On average, Event-driven managers were positive during the month, with positive contributions from both hard and soft catalyst strategies. The volume of new merger deals has seen a pickup in the US and in Europe, which is a positive sign for the strategy. The dynamic of improving corporate governance for Japanese stockholders has offered interesting deals to invest in. However, these opportunities remain accessible mainly via Asia-dedicated Event-driven strategies. An environment of higher for longer rates and significant maturity walls approaching in 2026 will be an important source of opportunities for special situations strategies.

Distressed

Over the last 18 months, expectations for distressed opportunities have evolved significantly. Coming into the end of 2022, the red-hot inflation levels and rapid rate hike cycle were indicators of a distressed cycle bonanza not seen since the Great Financial Crisis. These expectations dwindled during 2023 as the economy and job market remained resilient. The opportunity set during the year was opportunistic in nature, taking advantage of specific events such as the banking crisis in the US during the first quarter of 2023 or of idiosyncratic situations. Currently, default levels have started to increase although expectations remain contained considering most corporations refinanced their outstanding debt opportunistically at lower rates during the period 2020-2021 and that consumers’ financial health remains relatively strong. While the strategy specialists remain largely on the sidelines focusing on idiosyncratic opportunities, they remain cautious about investing in high yield issuers and have identified cracks in specific areas such as the loan market. Some market participants have taken on large debt loads through loans, which are usually floating rate issues, without anticipating such a meteoric rise in short-term rates.

Long short credit

Base interest rates remain wide, offering decent yields to investors in credit. However, corporate spreads are close to all-time lows. One may wonder if investors are being appropriately remunerated for the risk taken. Managers have concentrated their portfolio in their highest fundamental convictions, increased the level of hedges and lowered strategy directionality. On the other side, such a rich market is generating numerous opportunities for alpha shorts. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamentals research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance, with the increase of idiosyncratic risks and geopolitical uncertainty. It is a fact that yields have widened, again giving fixed income a seat at the asset allocation table. However, as recent events have demonstrated, risk diversification is particularly important and should be an integral part of the investment allocation process.