In our opinion, it is time to add cyclicity to the portfolio to benefit from an improving environment. While disinflation trends are continuing in Europe, economic surprises in the region are positive, leading to better sentiment and flows. We note that investor interest is returning somewhat and, with the risk premium attractive overall, laggards could perform better in a context of economic improvement and catch-up. We therefore turn neutral on EMU equities as it is a cyclical play, adding Small and Mid-caps to the portfolio. In addition, beyond the dataflow, we were reassured by the recent central bank meetings and think that the expected upcoming rate cuts are an additional supportive element which should act as support while capping long-term bond yields, underpinning our positive view on duration. We reduced our exposure on European Corporate Investment Grade credit from overweight to neutral and continue to harvest carry via Emerging Market debt.

A near-term consolidation

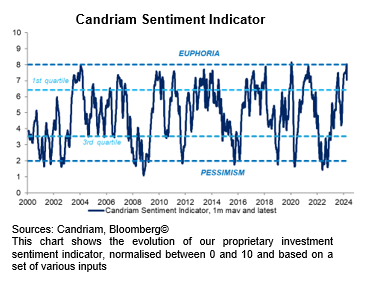

Our composite sentiment indicator, based on a comprehensive set of market factors, technical data and investor surveys, hit the “euphoria” level mid-March, triggering a contrarian sell signal on US equities. After the strong performances registered in the last two quarters, we are likely to see a phase of consolidation at the start of Q2.

In addition to empirical evidence related to this indicator, technical analysis also points to a consolidation phase of mid-single digit amplitude. In our view, it is now time to start adding cyclicity to the portfolio to benefit from an improving fundamental environment: disinflation trends remain broadly intact – notably in the Euro area – allowing central banks to ease monetary policy restriction while economic data has been reported better than expected.

6 June: Independence Day for the ECB

Beyond a potential consolidation in the short-term, our more constructive view on European equities, where we see room for flows to pick up and equity performance to broaden out, is based on a simple fundamental rationale: ECB rate cuts and improving activity.

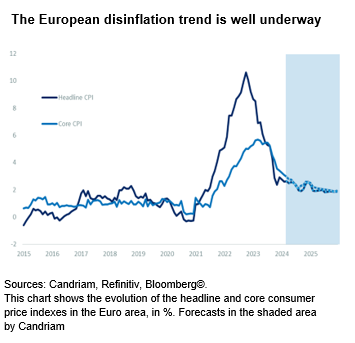

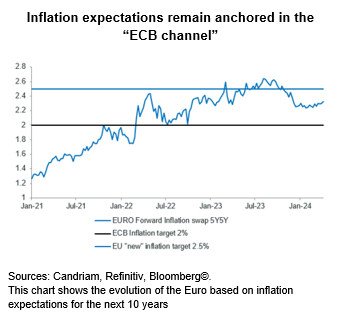

We agree with the ECB’s analysis of Eurozone inflation which has continued to decline. Both headline and core CPI around 2.5% yoy should be sufficient for the ECB to cut in June. Clearly, President Christine Lagarde, who stated that the ECB is “not Fed dependent”, validated our expectation of several rate cuts this year, starting in June.

To what extent could inflation disappointments in the US and a less dovish Fed affect the ECB’s own monetary policy outlook? In the absence of major surprises or shocks, the ECB confirmed in April that it is on track to cut in June regardless of what the Fed does – a declaration of independence from the Federal Reserve, sort of.

This divergence from the Fed is made possible as US and European inflation data are heading in opposite direction. Of note, it is the first time in the 25-year history of the ECB that the reference rate might not be cut due to faltering activity but improving dis-inflation.

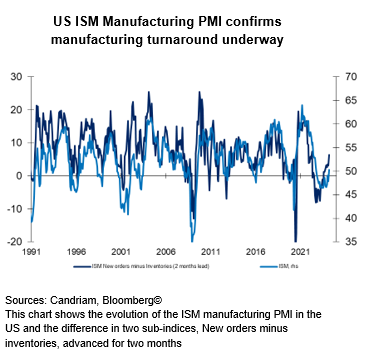

Manufacturing turnaround underway

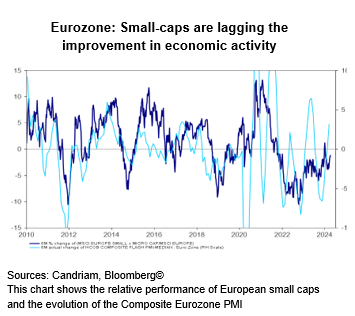

The second trigger for adding more cyclicity to the portfolio is improving activity at a global level. As of March, growth data is surprising positively in all major regions (US, Europe and China). As activity continues to recover, ownership should broaden out further, benefitting Cyclical-Value laggards and Small and Mid-Caps.

European small caps, in particular, have not followed the recent bounce in economic data and are among the most lagging cyclical assets. We are confident that manufacturing PMIs in the region have bottomed out this winter and further green shoots will be visible in upcoming reports.

Overall, we are slightly overweight on equities and are adding cyclicals to our portfolio, given better economic data than expected and the removal of monetary restriction. We express this cyclicality by turning neutral on EMU – notably through Small caps. We continue to target thematics to benefit from specific dislocations and long-term winners.

We remain positive on European duration

The ECB confirmed that the growth / inflation mix reveals nothing to derail the expected rate cut in June. We were therefore reassured by the central bank meetings and think that the upcoming rate cuts are an additional element which should cap long term bond yields.

As a consequence, we keep a positive stance on European duration and aim for the carry in a context of cooling inflation. In particular, we remain exposed to emerging countries’ debt to benefit from the attractive carry.

Further in the fixed income allocation, we maintain a neutral stance on US government bonds. As 10-year yields have risen from 3.8% to 4.5%, we are likely not far from an attractive entry point again.

In terms of portfolio construction, we counterbalance the improvement from neutral to slightly overweight on the equity side, by reducing exposure on European Corporate Credit IG from overweight to neutral. This way we booked some handsome profits on this long-standing conviction in a context of tight credit spreads and somewhat increased volatility on yields.

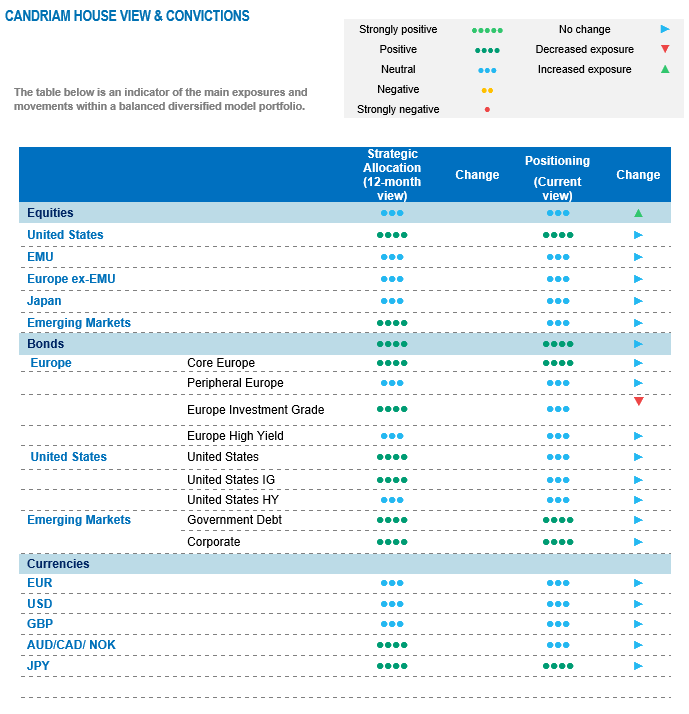

Add cyclicality to our allocation, leading to a slight OW on Equities

Equities: We have a slightly overweight stance. The economic scenario of a soft landing seems to be priced for Equities, although recent upward growth surprises and upcoming rate cuts might further support markets.

Bonds: Medium-term expected returns on bonds are attractive, although the current adjustment to monetary easing market expectations may hit short-term performance.

Currencies: Geopolitical tensions could push the yen higher.

We turn neutral on EMU as it is a cyclical play

It is time to add some beta and cyclicity to the portfolio to benefit from a broadening of the goldilocks environment (lower-than-expected inflation, higher-than-expected growth).

In Europe in particular, economic surprises are now positive, leading to improving sentiment and flows.

We are therefore upgrading Eurozone equities from negative to neutral and adding some small caps and banks to the portfolio

Consequently, the overall Equities grade improves from neutral to slightly overweight.

Downgrading Healthcare to neutral

We made a portfolio adjustment by downgrading the Healthcare sector to neutral. This decision is based on a top-down view, considering the strength of the US economy and its potential headwind for defensive sectors such as Healthcare.

Despite this tactical shift, our long-term view on Healthcare remains positive. Drug approvals are at record highs, M&A activity is strong and valuations appear attractive. However, the current economic strength may limit the sector's near-term outperformance. Once we see clearer signs of an economic downturn, we’ll have an excellent buying opportunity.

Taking profit on Euro IG, keeping Emerging Market debt

We were reassured by recent central bank meetings and think that the upcoming central bank rate cuts are an additional element which should act as a support while capping long-term bond yields.

It is the first time in the 25-year history of the ECB that the reference rate might not be cut due to faltering activity but improving dis-inflation.

EMU Core: Upcoming cuts and easing inflation should be a support for the asset class.

EMU Non-Core: Neutral view in light of high issuance in early 2024 and the shrinking of the ECB balance sheet.

Euro IG: We have reduced our exposure from overweight to neutral, allowing us to book some handsome profits on this long-standing conviction in a context of tight credit spreads and somewhat increased volatility on yields.

Euro HY: High yield spreads are tight, while tightening credit conditions act as a headwind. Rating drift is stabilising although defaults are on the rise.

US Gov: US yields fell from 5.0% in mid-October to 3.8% at the end of 2023, and back to 4.5%. We are likely not far from an attractive entry point again.

US IG: Short-term returns could be impacted by a consolidation following sharp spread-tightening and longer-term attractive carry.

US HY: Some caution on US HY as the tightening of spreads means that the buffer for rising defaults has decreased.

EM Government Debt: Continued disinflation and emerging central banks’ easing firepower are supportive.

EM Corporate: Highest regional real yield level offering carry. Spreads and Yields are above historical average. Dovish emerging central banks should be supportive.

Long JPY as a hedge

EUR: The EUR currently is supported by the bottoming-out in activity, but faces a more rapid monetary easing than in the US.

USD: Markets are adjusting Fed rate cut expectations backwards, which represents a support for the greenback.

JPY: We have a long position on the Japanese Yen as a hedge in a potential risk-off environment.