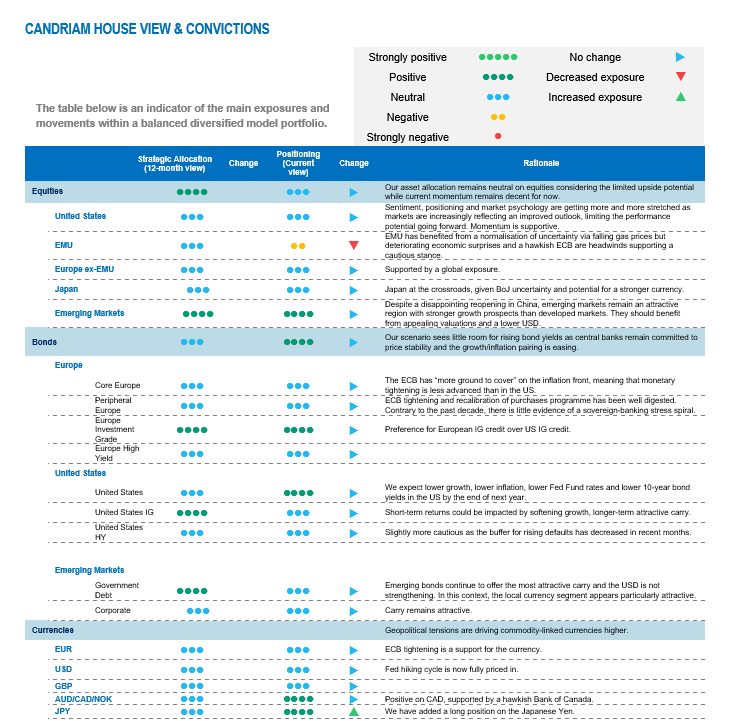

Financial markets have been resilient in H1 2023, reflecting a better growth/inflation mix than expected by consensus at the start of the year. During H2, however, we expect a less supportive market environment, as the gradual economic slowdown continues and central banks maintain a hawkish tilt, even though this monetary tightening cycle is already unprecedented in recent history. We note that the markets appear to be having second thoughts about the Fed’s job, which is likely not finished yet: consequently, our positioning on equities has become somewhat more defensive, and we are reducing our exposure to EMU equities as pricing has become too complacent in our view. We are buyers of investment grade credit and emerging market debt, since the carry is attractive in a soft-landing scenario.

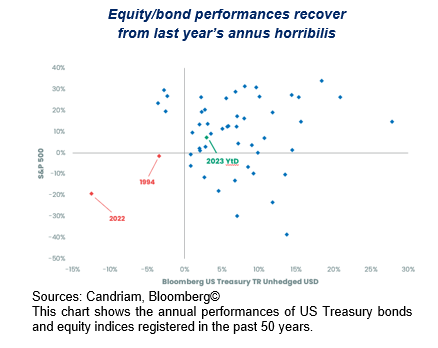

2023 unlikely to replicate last year’s disappointing market performance

As expected at the end of last year, equity/bond performances have recovered from last year’s annus horribilis: both US equity and sovereign bond markets have returned positive performances towards the end of H1. We always knew that the starting point was exceptional, as 2022 was only the second occurrence of such an outcome.

Maintain a defensive equity bias in our portfolio

In our multi-asset allocation, we maintain a neutral stance on equities overall, considering both upside and downside risks for the upcoming months.

Among the fundamental factors we are looking at, we note that economic growth remains sluggish. Prospects for EU manufacturers hit a new post-pandemic low, while both services and manufacturing activity in the US disappointed in May. Also, there is increasing evidence that China didn’t deliver the recovery the world was betting on.

Rather unsupportive valuations, combined with already positive EPS expectations despite the ongoing financial tightening, appear to be capping further upside from current levels – a constructive economic scenario seems already priced in for equities.

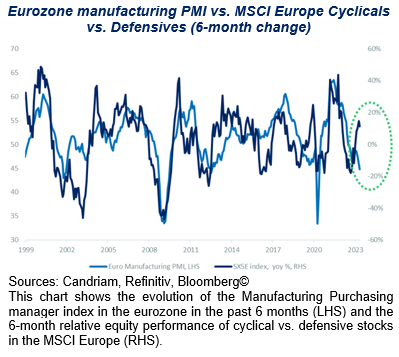

Eurozone equities are increasingly vulnerable: the area ranks among the best performing regions in EUR terms since the start of the year as it has benefitted from a normalisation of uncertainty and falling energy prices, but deteriorating economic surprises into deeply negative territory and a hawkish ECB are significant headwinds supporting our cautious stance.

More specifically, we note that the internals of European equities have recently disconnected from the economic environment. While the eurozone manufacturing PMI has fallen below 45 points, driven, among other things, by a fall in new orders, European cyclicals vs defensives are implicitly pricing in a steep recovery.

Either activity recovers sharply over the summer months or equities will have to price in a more sober outlook. As the ECB tells us that it has “more ground to cover” as inflation remains uncomfortably high, we expect EMU equities to underperform in the foreseeable future.

Within our regional equity allocation, we maintain a preference for Emerging markets. We expect emerging markets to outperform based on fundamental aspects. Valuations remain relatively more attractive, and the region has an improving growth differential prospect vs. developed markets.

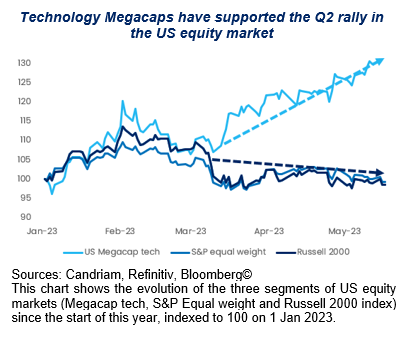

In the US, note the increasing market concentration among a handful of tech leaders.

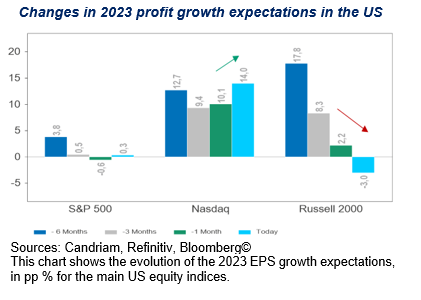

Given the current polarisation beneath the surface of the US stock market, we have an overall neutral stance on US equities. Fundamentally speaking, this concentration on a few stocks can be explained by superior – and rising! – profit growth expectations for technology–related stocks:

- EPS growth expectations for the current year have remained fairly stable, and close to zero, for the large cap S&P500 index;

- over the same period, earnings growth expectations have consistently registered double-digit growth for the tech–heavy Nasdaq index;

- and finally, analyst expectations for the small cap Russell 2000 index are being revised downwards.

Harvesting carry

Our fixed income allocation remained unchanged this month. We kept an overall slightly overweight duration in our portfolios. Our scenario sees little room for rising bond yields, as central banks remain committed to price stability, and we expect the growth/inflation pairing to ease further during the second half of 2023.

As inflation is decelerating as broadly expected, we are getting closer to the end of the rate hiking cycle. We expect that central banks will monitor carefully whether household inflation expectations become entrenched before declaring they have accomplished their price stability mission.

In our fixed income allocation, we are neutral on EMU duration, positive on US duration, positive on IG credit, but still cautious on global HY bonds (with a preference for Europe over US). We are buyers of emerging market bonds, which continue to offer the most attractive carry, and the USD is not expected to strengthen. We note that spreads remain above historical average levels given the tightening of the bank credit channel.