After focusing on the elections in France and the UK, investors’ attention is rapidly shifting towards the United States. The first presidential debate has increased the likelihood of a second Donald Trump presidency, implying a potential risk of higher inflation in 2025.

Beyond politics, we are focusing on policy, namely monetary and fiscal policy. In that respect, the lower-than-expected CPI report in the US for the second month in a row increased market expectations for a Federal Reserve rate cut in September. Several authorities already started to cut interest rates during H1, notably the European Central Bank (ECB), and should continue to do so.

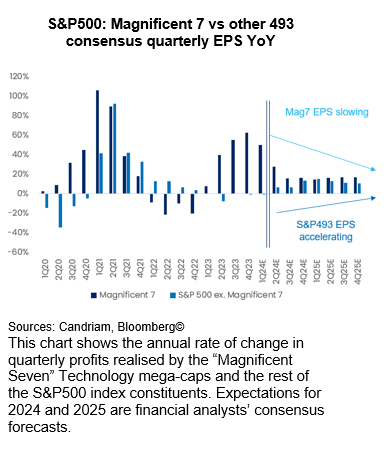

While we caution against the latest political developments on both sides of the Atlantic, upcoming policy actions favour a constructive view on developed equity markets. Also, at the start of the earnings season, Q2 earnings growth estimates have remained relatively robust, suffering less downward revisions than usual: consensus expectations for S&P 500 profit growth stands close to 9% YoY – it will be important to note this overall resilience, which should also reflect a broadening out towards a larger stock universe.

On the fixed income side, we prefer holding safe sovereign bonds, which represent a good hedge and also deliver attractive carry as global disinflation trends become increasingly apparent. Looking forward, we caution against political decisions leading to higher tariffs and a tighter labour market in the US, which would ultimately again result in rising inflation.

The UK appears to be the unlikely winner of the European summer elections

The UK appears to be the unlikely winner from the developments in France as the new government has a clear mandate and ability to act. Cabinet nominations have been fast and several ministers hit the ground running, outlining their policy priorities over the first few days.

Notably, on the first business day in office, new Chancellor of the Exchequer Rachel Reeves made her inaugural speech, in which she laid out a plan to “get Britain building again” through planning reform, among other things. On the same day, Energy Security and Net Zero Secretary Ed Miliband announced that Labour has overturned the ban on onshore wind projects. The day after, the government confirmed that a new National Wealth Fund has been set up, with a remit to invest in key infrastructure projects.

Clearly, the Labour pledge to remain fiscally constrained, the recent disinflation trend (CPI hit 2.0% in May), and the rising probability of a Bank of England rate cut in August cannot go unnoticed.

France: from risks to uncertainty

The speed of change in the UK contrasts with political developments in continental Europe, where the European Parliament is convening before the summer break and voting on the composition of the new European Commission. Risks of a significant rollback of earlier decisions can likely be ruled out, but uncertainty over several milestones on the path to reach climate neutrality by 2050 have popped up (e.g. revising the 2035 combustion-engine vehicle ban).

Also, in France, the result of the second round of the snap election called by President Emmanuel Macron was rather inconclusive: the surprise left-wing alliance win and a hung parliament imply political uncertainty. This represents an unprecedented situation for France’s V Republic, as a coalition must be formed to achieve political stability in a context of limited fiscal space for a supply boost. However, we acknowledge that the tail risks of an absolute majority of the far-right or the far-left have been avoided and that anti-EU forces have no majority in the newly-elected Assemblée Nationale.

US: from uncertainty to risks

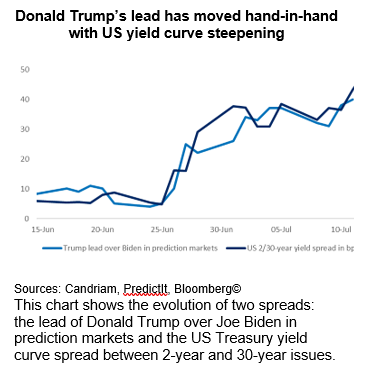

In the US, the first televised presidential debate appears to have been decisive in favour of Donald Trump. While we perceive a decline in political extreme risks in Europe and less uncertainties regarding the outcome of the US elections in November, market risks remain regarding future policies in America.

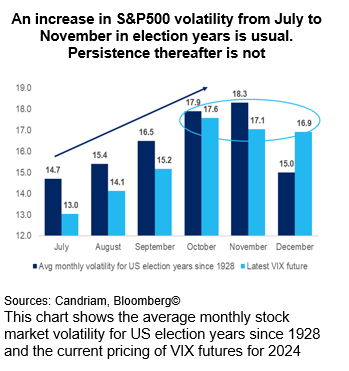

Following the first presidential debate, uncertainty on the election winner has declined sharply. However, markets have likely to wait several months to get more clarity on policy implementation: if an elected Donald Trump does (almost) all that he promised, inflation would rise due to higher tariffs and a tighter labour market. To remain credible, the Federal Reserve would likely have no choice but to tighten monetary policy despite faltering activity. The risks of such a tail scenario is reflected by unusually persistence of high volatility in November and December VIX contracts, while market volatility historically declines sharply post-election.

Constructive view on developed equity markets

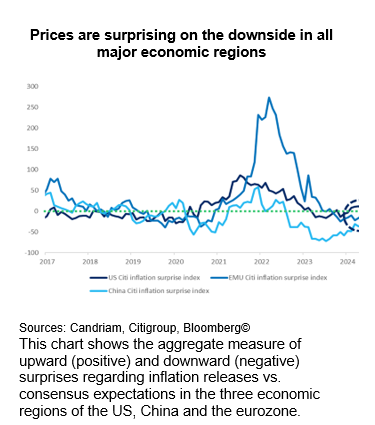

Beyond political uncertainties, we focus on policy actions as important market drivers. In assessing the growth/inflation mix, we note that global disinflation trends have been confirmed by the most recent data, notably in the US. At the current juncture, our scenario that interest rates have peaked and the Federal Reserve would start its monetary policy easing cycle in September is gaining traction.

We note that cooling inflation – and core inflation – represents a synchronised global development. Supportive (i.e. lower) inflation news is also laying the groundwork for Europe’s central banks (e.g. ECB, BoE, SNB, Riksbank) to lower rates in Q3. As several emerging market central banks have already been cutting rates since 2023, the long-awaited global easing cycle is on the verge of beginning. A potential change in the White House and the reprioritising of US economic policies could weigh on the speed and magnitude of this easing.

Our equity investment implication is straightforward, as we are currently slightly overweight equities via US, Europe ex-EMU and Japan. We have the following regional equity investment convictions:

- Regarding the US, beyond robust earnings, the favourable repricing of monetary expectations represents a support for Tech stocks. Broad market leadership within IT and the industry’s relative insensitivity to the upcoming US presidential elections also justify our view. As we enter the Q2 earnings season, strong EPS growth should continue to be supportive, while a narrowing growth differential should be a catalyst for the market to broaden out beyond mega-caps.

- In addition to political stability, valuations remain attractive on UK markets, with a potential for multiples expansion, while the Bank of England should start cutting rates this summer. Notably, UK small and mid-caps should benefit from improving consumer confidence.

- In Japan, exiting the multi-decade long deflation as well as corporate governance reforms bearing fruit should more than counterbalance a less dovish Bank of Japan.

- We are neutral on eurozone equity, as the bloc faces a rise in political uncertainty and a higher risk premium appears justified. However, we believe that a European small cap bias gives us the benefit of lower inflation and lower central bank rates in anticipation of a consumer awakening.

- Finally, we will maintain our neutral stance on emerging market equity until consumer confidence gains traction. It is of note that economic activity in China remains fragile and price evolution remains deflationary as consumer confidence remains at very low levels: the latest trade balance data has confirmed that domestic demand remains in the doldrums.

Fixed income: long duration, but aware of asymmetrical balance of risk in the US

We currently see an asymmetrical balance of risk on US duration as the upcoming central bank rate cuts are increasingly factored in by bond yields, while a potential risk of higher inflation in 2025 is not. The imminent start of a Fed policy easing cycle and the potential for higher inflation due to higher tariffs and a tighter labour market can best be captured by a yield curve steepening: the inversion of the Treasury curve has suddenly started to normalise in the aftermath of the presidential debate: yield curve steepeners are a popular trade to express faith in Donald Trump’s victory.

In the face of an easing monetary policy and a rise in political uncertainty, safe bonds represent an attractive investment while we see little room for credit spreads to tighten further. Our fixed income convictions can be summarised as follows:

- With the expectations that US Treasury yields would retreat with the hawkish repricing of monetary policy from the Federal Reserve largely behind us, we seized an entry point last spring on the asset class which we have now exited. We are currently neutral on US duration.

- We keep our neutral stance on credit and hold a relatively small exposure to emerging market sovereign bonds amid very narrow spreads.