One and a half years after the US Federal Reserve bank began its tightening course, the US economy continues to deliver robust growth, while the labour market is gradually cooling. We continue to expect the landing to occur during Q4 this year, followed by sluggish growth in 2024. Outside the US, activity continues to surprise to the downside, with disappointing news flow out of China and contracting services and manufacturing sectors in Europe. Clearly, the risk to the outlook for global growth is tilted to the downside. The desynchronisation of monetary and fiscal cycles may bring investment opportunities in Emerging markets in both equity and debt assets.

Persistence matters as much as level

In the US, the growth/inflation mix is slowing down as higher rates and tighter bank credit conditions are starting to have a delayed effect. The economic "landing" has begun, although the US should avoid a recession in our central scenario.

Meanwhile, growth in Europe and in China is weaker than expected and is set to remain sluggish in 2024. Global growth risk therefore seems tilted to the downside. As monetary policies work with lags and restriction will spread through developed economies, inflation is likely to decelerate again from Q4.

The ECB is expected to stop hiking soon, but to keep its policy rate high for an extended period. We concur with ECB board member Fabio Panetta, who argued that “monetary policy may operate not just by increasing rates but also by keeping the prevailing level of policy rates for longer. In other words, persistence matters as much as level.”

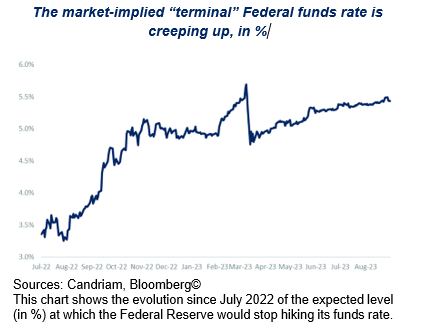

Markets were initially disappointed by higher Fed and ECB terminal rates, but activity deceleration is seen as an obstacle to further hikes. This supports our scenario of range-bound markets in the foreseeable future: capped by economic deceleration in developed countries but also floored by the likely end of Central banks’ tightening cycle.

The market-implied “terminal” Federal funds rate, or the expected level at which the Federal Reserve would stop hiking its funds rate, is gradually rising since the shock to the US regional banking system last spring.

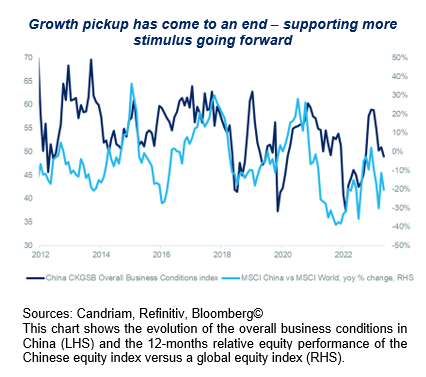

Chinese growth disappoints, prompting further stimulus

Chinese consumer confidence remains depressed and has never really rebounded since the introduction of the zero-Covid strategy and hard lockdowns in early-2022. This leads households to increasingly prefer saving rather than investing or consuming, clearly explaining why activity continues to lose momentum in China.

Increasingly concerned about growth, authorities in Beijing are attempting to bolster the faltering property sector and have recently scaled up measures to support the economy, making 5% real GDP growth in 2023 still achievable, followed by 4% in 2024.

Among others, measures announced to support household income include:

- increasing personal income tax deductions for childcare, parental care and children’s education spending: effective from January 2023, the tax reduction for taking care of children under three and for children’s education will both be doubled from 1,000 to 2,000 yuan ($274) per month,

- raising the deduction to offset the costs of taking care of elderly parents will rise 50% to 3,000 yuan per month.

A balanced asset allocation

Within our regional equity allocation, we have a negative stance on EMU while keeping our positive stance on Emerging markets. We remain more cautious on developed-country equities, positioning ourselves for an economic deceleration by favouring defensive sectors.

In this context, we prefer government bonds and high-quality credit as sources of carry and have chosen to remain exposed to emerging countries (debt and equities) to benefit from the desynchronisation of their monetary and fiscal cycles.

On the fixed income allocation more specifically, we are positive on US and EU duration, positive on IG credit and more cautious on HY bonds. Emerging bonds continue to offer the most attractive carry, provided that the USD does not strengthen.

Overall, we see limited room for rising bond yields, as central banks remain committed to price stability, and the growth/inflation dynamic should ease.

Our regional and style equity allocation is based on the cornerstones of negative EMU, while maintaining our positive stance on Emerging markets.

EMU equities have benefited from a normalisation of uncertainty, although negative economic surprises, rates higher for longer and weaker demand from China are a headwind supporting our cautious stance.

Despite a disappointing economic news flow from China, Emerging markets remain an attractive region with stronger growth prospects than developed markets for 2024, via fiscal and monetary support; LatAm central banks have started to cut rates more aggressively than expected. The region should benefit from an appealing valuation and easier financial conditions.

The US risk/reward is not particularly attractive. Markets are pricing a Goldilocks environment, i.e. slowing growth to avoid too much Fed tightening and ongoing disinflation. This has been our scenario for quite some time, but it has now become consensual. Hence, we are beginning to suspect that further upside risk may be in store, although we think this unlikely and prefer a neutral positioning at this stage.

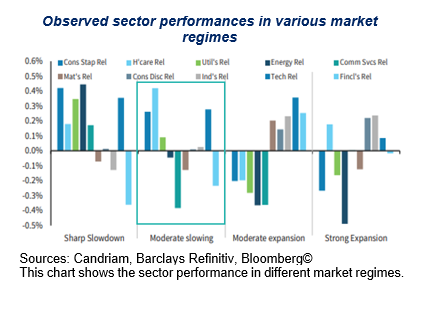

At this stage of the cycle, we prefer defensive over cyclical equities, which are already priced for a recovery. Empirical evidence points to outperformance of defensive sectors in an environment of a moderate economic slowdown.