European equities: Defensive bias maintained

Energy & IT outperformed

European equity markets have been broadly flat over the past few weeks. Although performance dispersion wasn’t high, small caps continued to underperform large caps.

Cyclical sectors underperformed the broader market, with consumer discretionary and industrials as the main underperformers.

More defensive sectors such as healthcare and consumer staples slightly outperformed the broader market, which was mainly supported by the continued strength of information technology and energy. This sector benefited from the rise in oil prices, which are approaching USD 90 /barrel (Brent). Our recent tactical decision to bring the energy underweight back to neutral thereby paid off.

Earnings expectations & valuations

European equity markets still look attractive, considering the expected earnings growth of almost 4% for the coming 12 months. At 12.2x 12-month forward price/earnings, European equities still seem to have upside potential.

Expected earnings growth of 6.6% for 2024 might nevertheless be a little too optimistic given the current macroeconomic environment. According to consensus expectations, growth should mainly come from healthcare, financials and industrials. Healthcare has decent earnings visibility as a defensive growth sector, but weaker economic growth might have an impact on both financials and industrials and even other cyclical sectors. The market might just be a tad too optimistic on the earnings momentum of those cyclical sectors.

Comfortable with defensive bias

Considering the economic slowdown, we remained cautious on more cyclical sectors, expressed by our neutral grade on consumer discretionary and industrials. In the meantime, we maintain our overweight in defensive sectors such as consumer staples and healthcare. The latter is now benefiting from a rebound of the US dollar against the euro and the end of destocking. A relative catch-up remains our base scenario.

We are comfortable with our more defensive bias and made no strong strategic changes. We nevertheless decided to take some partial profit on our European banks overweight. We are convinced that the best period of the cycle for banks is now behind us and are considering the risk of governments looking for additional income through bank taxes. We have therefore brought European banks back down to neutral from +1. The neutral positioning on financials (banks, diversified financials, insurance) is maintained.

US equities: Resilience remains the keyword

Despite higher yields and volatility, US equities were resilient on the back of better-than-expected economic data and investors already anticipating a more dovish Federal Reserve next year. US equity market performance has been broadly flattish since early August.

Large cap growth leads US market

US equity market performance has been quite highly dispersed over the past few weeks. Large cap companies continued to outperform small caps, while investors’ focus remained on growth stocks, anticipating the US central bank cut to interest rates in 2024. Cyclical and interest-rate sensitive sectors outperformed against this backdrop. Information technology in particular continued to take the lead, while materials and industrials also outperformed the broader market.

The best performing sector over the past few weeks has nevertheless been the energy sector. The sector benefited from rising oil prices, with the price per barrel for Brent crude oil gradually approaching USD 90. Growth risks in China were offset by decent oil demand and the impact of production cuts. After the recent Saudi cut, OPEC+ crude production is now at its lowest level since August 2021.

Defensive sectors continued to underperform the broader market. Consumer staples and utilities have been the biggest underperformers over the past few weeks.

Too optimistic earnings expectations?

Contrary to Europe, earnings expectations have been revised upwards over the past month in the US. Consensus expectations now count on earnings growth of almost 9.5% in the coming 12 months and even almost 12% next year. That might be a tad too optimistic considering that the economy is slowing down anyway.

Valuations aren’t overly expensive. Still, the US equity market is trading above its long-term average at around 19x price/earnings for the next 12 months.

Slight defensive bias makes sense

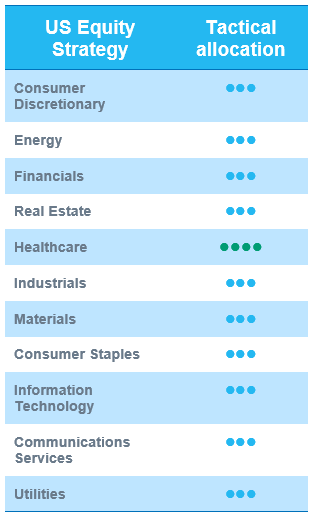

Considering a slowdown in the economy, probably excessively optimistic earnings expectations and above-average valuations, a defensive allocation remains justified. In addition, the end of the year before the US presidential elections is generally somewhat more erratic. That doesn’t mean US equities will be negative in the coming months, but simply limits their potential towards year-end, especially taking into account the nice year-to-date run they have had so far. In this context, healthcare remains our sole sector conviction, with a +1 grade.

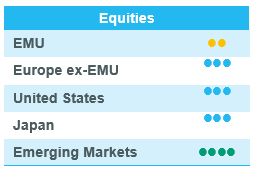

Emerging equities: More pronounced decline than developed markets

Global equities faced significant pressure throughout August, with emerging markets experiencing a more pronounced decline (-6.4% in USD) than developed markets (-2.6%). This decline was driven by a strengthening USD and growing concerns about China's real estate market, which had a negative impact on emerging market returns.

The month kicked off with a noteworthy event, as Fitch downgraded the United States’ sovereign rating overnight from AAA to AA+ due to mounting concerns regarding the country's fiscal health. Concurrently, the US economy showed signs of cooling down. In his speech at the Jackson Hole symposium, Federal Reserve Chairman Jerome Powell expressed a cautious outlook. Other Federal Reserve officials also adopted a less hawkish stance, suggesting the possibility of keeping interest rates steady in the near term.

In China, market sentiment remained unfavourable. The Chinese economy is grappling with several domestic challenges, particularly in real estate, shadow banking and healthcare. Country Garden, one of the country’s largest property developers, was on the verge of default, but eventually paid its debt on schedule. However, this raised concerns about systemic risks in the Chinese property market, as other companies face similar liquidity issues. Regarding economic indicators, China’s CPI turned marginally negative, with the PMI below 50 and exports decreasing. Investment banks again reduced China’s GDP growth forecast. Beginning in mid-August, the Chinese government started to implement multiple policies, including support for real estate and the stock market. The measures were more meaningful than Beijing’s initial moves in previous months, but difficult problems remained. China's equities still ended the month with a significant loss of 9%, dragging down the overall emerging market index.

In other markets, Taiwan was impacted by the China spillover and was subject to profit taking. South Korea fell, as sluggish exports undermined growth prospects. India also fell but less than other markets, as GDP growth estimates looked optimistic and food inflation concerns eased. Latin America declined the most despite the start of an easing cycle. In Brazil, President Lula won an important victory in Congress, allowing him to loosen limits on public expenditure.

Geopolitically, emerging markets played an active role on the global stage. The BRICS summit held in August aimed to expand its membership by inviting six new countries, including Saudi Arabia, Iran and Egypt. US Secretary of Commerce Gina Raimondo engaged in challenging conversations during her visit to China, which coincided with speculation about breakthroughs in Chinese chip technology.

Crude oil prices slightly increased in August (+1.5% in USD), as Saudi Arabia planned to extend the voluntary production cut until year-end. Gold fell by 1.3% and silver by 2.0%. US treasury yields rose to 4.10%.

Outlook and drivers

Despite facing some near-term challenges, we maintain a positive outlook on the long-term prospects for emerging equities. Several emerging markets continue to benefit from significant underlying thematic tailwinds, notably, increasing demand for artificial intelligence (AI) and the potential stabilisation of demand for electronic devices, which represent promising opportunities for selected companies in Taiwan and South Korea. When considering the value chain perspective, numerous Asian companies play crucial roles in driving growth in the AI sector and are expected to reap long-term rewards from this transition. Furthermore, South Korea stands to benefit from the demand related to the United States' Inflation Reduction Act (IRA) and the European Union's commitment to clean technology.

In Latin America, we are seeing a gradual embrace of the easing cycle, with central banks reducing interest rates. We hold an optimistic view regarding potential beneficiaries in the region, particularly within domestic consumption-oriented companies and long duration equities.

In China, valuations remain depressed regardless of the ongoing headwinds on macro weakness and geopolitical concerns. Potential risks in Chinese real estate resurfaced with Country Garden, a major property developer in potential default, which spread to the entire financial system via shadow banking. After some unimpressive measures in previous months, Beijing began to roll out multiple stimulating policies at a rapid and frequent pace, such as meaningful efforts to support property market financing and invigorate stock market dynamics. Chinese companies, including those in property, saw a rebound at the month-end, yet China’s full-year growth prospects are still dragged down by tepid economic situations. We remain cautious about China’s delaying recovery, which needs to be justified by improving sentiment on the market, in investment and among consumers.

The portfolio's current positioning remains well-balanced, with exposure across various diversified clusters and investment themes. Regionally and on a sector level, our strategy maintains a balanced approach in comparison to the MSCI EM© benchmark. This balanced stance has been deliberate, and is aimed at reducing active risk exposure, considering the persistent uncertainties surrounding global economic growth and geopolitics.

Positioning update

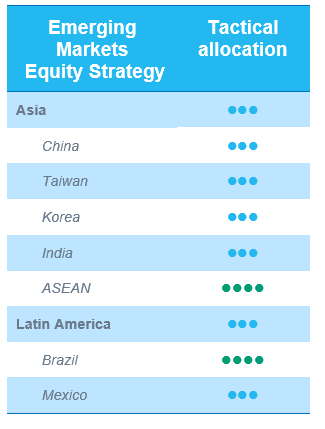

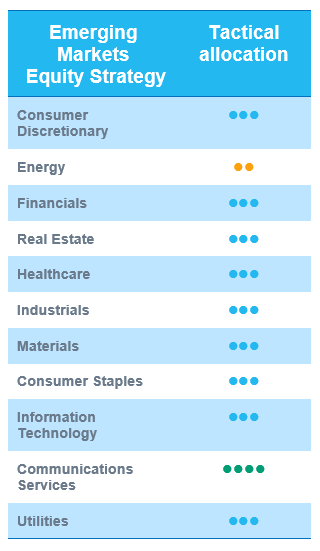

We make no changes to our regional EM ratings. In sectors, we have downgraded consumer staples to neutral.

Regional views:

China Neutral: The latest data from China revealed consumer weakness: decreasing exports/imports, falling CPI figures. In addition to this, China saw net downard revisions in all sectors post 2Q results. Liquidity pressure in the property sector was alleviated by new supportive measures. The main issues, including confidence and property pricing, persist. Geopolitical risk and uncertainities are back on the table and could continue to add to headwinds.

Sector and Industry views:

Consumer staples downgraded to Neutral: Inflation is coming down in emerging countries with the embrace of the start of an easing cycle. Food inflation is no longer a tailwind, and revisions are weakening.