European equities: Ending the month in the green

European equities: Ending the month in the green

After a slightly hesitant start, European stock markets continued their recovery from the October lows and ended November well into the green.

The Fed and the Bank of England continued their restrictive monetary policy by increasing rates, while the ECB indicated it saw no reason yet to slow the pace of its rate increases. But after better-than-expected inflation figures in the US, investors began to think that a potential Fed pivot (stopping raising interest rates and even lowering them) could be on the cards sometime in 2023. Stock markets reacted positively, to end significantly higher. Much of this move is driven by hope and anticipation, as the current underlying fundamentals remain rather weak and still point towards a meaningful slowdown or even recession.

The October eurozone CPI (consumer price index) rose to a new high. Food prices and energy costs were the main drivers. Europe continues to feel the effects of the energy crisis and the delayed price pass-through to end customers.

The risk of running out of gas this winter has further reduced for Europe in recent weeks, thanks to relatively mild temperatures and reduced demand. At the end of the month, storage was at 93% capacity.

Styles & Sectors

Since the last committee, over the past 4 weeks, Small Caps - despite a positive absolute performance - underperformed compared to Large Caps. While we expect Small & Mid Cap names to underperform in the short term as market participants are gradually pricing recession risk, we believe a major buying opportunity will soon occur once PMIs trough and inflation figures start peaking.

If we look at sectors level, since the last committee, top performers were IT, Utilities and Consumer Discretionary. On the other hand, worst performers, with a negative absolute performance, were Energy and Communication Services.

Earnings

Despite the recent rebound, Europe remains an attractive region in terms of valuation, being at the bottom of its historical range when looking at the 12 months forward Price/Earnings ratio.

Regarding earnings revisions, positive and negative revisions almost compensate each other in Europe, with a rather neutral short-term trend. It's a pretty quiet period in terms of earnings revisions, we may have a sharper view again in January.

Despite a strong contribution of Energy in terms of EPS growth for 2022 (estimates) within the MSCI Europe©, this sector should be the main detractor when looking at the estimated contribution for 2023, together with Materials. On the other hand, Financials should be the top contributor.

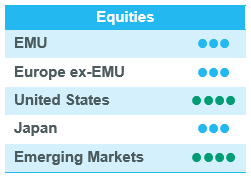

Grades

- After the strong (relative) performance, valuation is much less attractive on certain insurance names (eg: reinsurance at target price).

- Price inflation is also impacting claims creating imbalances in some markets (non-life) as premium may sometimes lag.

- After a strong increase, interest rates may start peaking ► relatively less attractive for insurance.

Otherwise, we remain comfortable with our strong overweight on Consumer Staples, within which we are investing in companies with a strong pricing power and solid EPS momentum.

Whatever the sector in which we are overweight or underweight, the watchword remains, more than ever in an economic slowdown environment, the selectivity: strong discipline while picking stock.

US equities: Slightly lower inflation boosts equity markets

After a difficult start to the month, due fears for further central bank tightening to combat inflation, global equity markets ended November significantly higher. Investors sentiment was buoyed by the release of US inflation numbers for October. In the light of this improved investment sentiment, the MSCI World© gained almost 7% in November. When looking at MSCI World sectors, the materials sector gained the most over the past month, followed by industrials, and financials. Energy was the biggest underperformer, as oil prices declined.

Performance dispersion within cyclicals

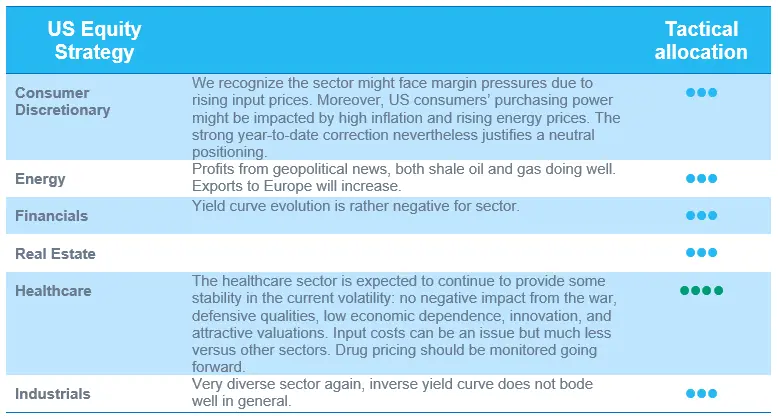

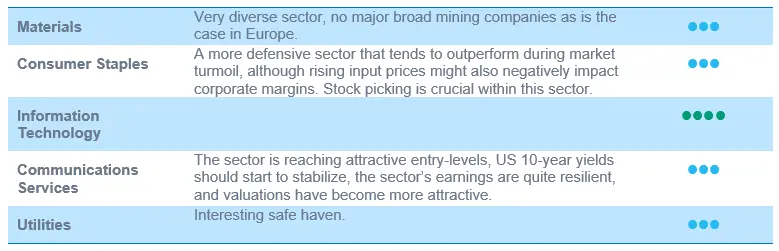

US equity market performance wasn’t driven by a specific style over the past weeks. Growth and value performed broadly in line and defensive stocks performed quite good compared to the broader market.

Within cyclicals there was nevertheless a higher performance dispersion, with especially energy coming into focus. The sector lost significant ground as oil prices declined around 10% over the month. Materials performed quite well, while industrials and consumer discretionary underperformed the broader market.

Finally, when looking at market capitalizations, small caps continued to underperform large caps.

Earnings expectations and valuations

After a quite decent third-quarter earnings season, earnings revisions are no longer negative. Consensus expectations now count on a moderate earnings growth of around 5% in the coming twelve months. This seems to be quite in line with the current state of the economy.

Defensives don’t really contribute to that expected earnings growth. The largest contribution comes from cyclical sectors, such as consumer discretionary and industrials. Also, financials are expected to realize a significant earnings increase, while energy and materials should experience and earnings decline following a strong 2022 on the back of higher commodity prices.

In this context, and following the rebound since early October, the US equity market doesn’t look overly expensive at 18 times expected earnings for the coming twelve months.

Health care remains main conviction

US equity markets have rebounded strongly after the sell-off of September and seasonality is in favour of a continuation of that rebound towards the end of the year. Visibility is nevertheless not very high going into 2023 and further market evolution will depend on the extent of the economic growth slowdown and the Fed pivot, which isn’t there yet. A balanced approach remains important in the context.

As a result, we did not make any strategic changes and kept our +1 on health care. The sector remains our main conviction as it is a rational choice on the back of its defensive characteristics: no negative impact from the war, low economic dependence, supported by demographic trends and ongoing innovation, and attractive valuations. We also kept out +1 on information technology unchanged.

Emerging equities:

Emerging markets posted a strong rebound in November. For the first half of the month, recovery was driven by better than feared inflation figures in the US, driving expectations that subsequent rate hikes would proceed at a slower pace. As a result, US 10-yr treasury yields retraced 44 bps to 3.61%, while the dollar weakened, giving support to EM currencies. In the latter half of the month, Chinese equities continued their strong surge, as geopolitical risks subsided with the Xi-Biden meeting at the G20, followed by announcements of China’s policy support for the property sector and easing Covid restrictions.

MSCI China recorded its best month in a long time, posting gains of 30% in US$ terms. Taiwan and South Korea also posted strong gains, of 22% and 15% respectively, as China reopening expectations lifted equities in its North Asian peers. India gained 5.1% over the month, as oil prices continued to correct easing concerns of inflation. LatAm, one of the better EM markets YTD, declined in November, with Brazil falling by 4.7% over the month, on fiscal policy concerns and uncertainties around the composition of the Lula government. MSCI EM ended the month up 14.6% (in US$ terms).

With the dollar weakening from its peak in October, most EM currencies strengthened. In the commodity complex, expectations of China reopening drove most metals higher, but oil ended the month lower at US$ 86.60/bbl (Brent), following expectations of a global slowdown.

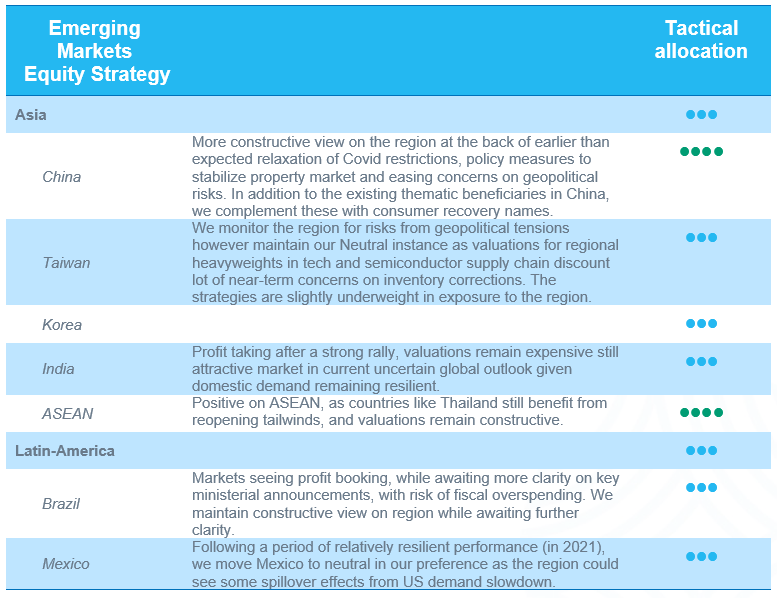

Summary of regional and sectors views:

China: Turning more constructive (+1)

Taiwan: Maintain neutral but monitor closely for geopolitical tensions

Positive on ASEAN, as countries like Thailand still benefit from reopening tailwinds, and valuations remain constructive.

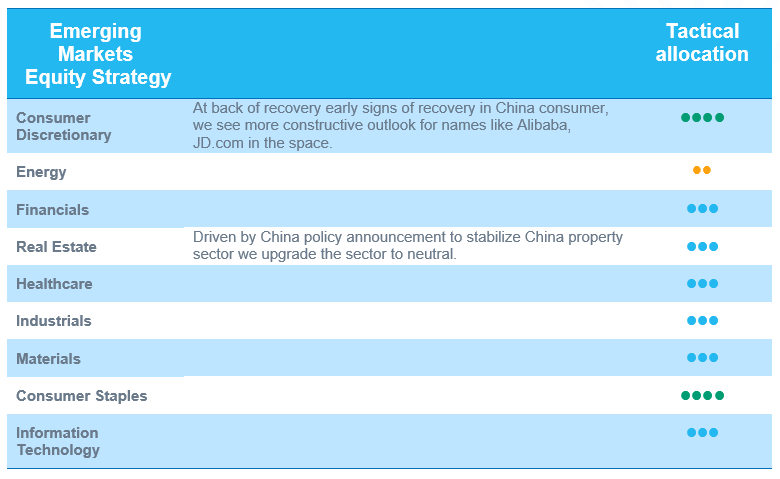

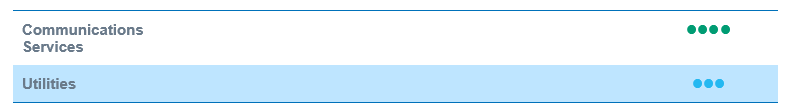

Consumer discretionary: Upgrade to +1

Real Estate: Upgrade to neutral

So far this year has been one of the most volatile for EM equities, without any clear signs of style/regional/sector leadership. November was no different in that sense, as we saw a strong rebound led by Chinese equities. Optimism regarding the Chinese recovery was backed by policy announcements to support the property sector and the gradual relaxation of Covid restrictions. We could still be some time from a full reopening, but we find the announcements directionally positive, and they could lead the way towards normalised risk premiums for Chinese equities. We maintain neutral exposure to China, with preference for China A shares, where we find more thematic and fundamental growth stories. However, given the incrementally positive policy announcements, we have complemented our China positioning with consumer recovery and reopening beneficiaries in China offshore H markets.

More broadly for the EM equities outlook, we remain cautious given the number of persistent uncertainties including a slowdown in global growth, geopolitical risks, the resurgence in inflation and continued US$ strength. In terms of positioning, the strategy maintains a balanced portfolio of sustainable growth stocks that are beneficiaries of the long-term thematic in EM.