European equities: improvement on the labour market

In Europe, an unreliable supply of Russian gas, falling investments in thermal energy and maintenance work on nuclear power plants led to a sharp rise in gas and electricity prices across the continent before they fell in December. Higher energy prices are fuelling the rise in inflation in the region.

Inflation is an issue. In December, three of the four major developed market central banks indicated that they have greater concerns about inflation heading into 2022 than about the economic disruption that could be caused by the Omicron variant.

The European Central Bank (ECB) confirmed that the pandemic emergency purchase programme (PEPP) would end in March, reducing monthly purchases via the asset purchase programme until shortly before the first rate rise.

The new wave of COVID-19 has reduced mobility but the effects on fourth-quarter activity should remain muted. Nevertheless, activity in services has been affected, as highlighted by the latest PMI. This will weigh on activity in Q1.

The improvement on the labour market should support consumption, but household consumer confidence has started to reverse as energy prices keep on increasing.

Favourable demand expectations should support moderate growth in business investment.

Supportive EU-wide fiscal policy and the cautious rebalancing of national public deficits should allow GDP growth in the eurozone of 4.2% in 2022, but discussions around the new budget rules are likely to be heated.

The ECB will be patient. Core inflation has clearly accelerated, but up to now it has not been driven by wage increases and it is expected to fall back below 2% by the end of 2022.

Net purchases under PEPP will end in March, but could be restarted if the pandemic delivers another “negative shock”. We expect no lift-off in 2022.

In terms of style performance, over the last 4 weeks, Value stocks outperformed Growth stocks, especially Large Cap names, while Small Caps lagged somewhat, as in the US.

In terms of sector performance, over the last 4 weeks, we can observe that IT stocks suffered the most, with consumer discretionary and industrials also slightly negative. On the other hand, financials and energy performed very well.

Regarding Price to Book vs Return on Equity, we can observe that rather cheap sectors performed the best, such as financials, energy and materials. Conversely, IT, which remains expensive, suffered the most.

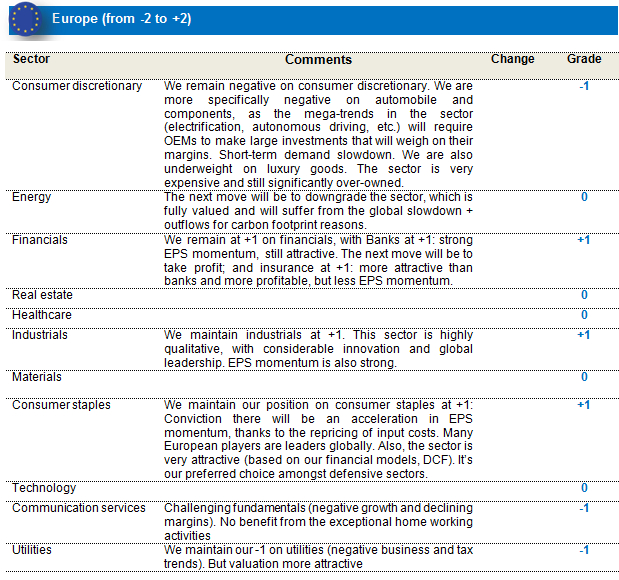

NO CHANGE IN OUR GRADES

- We maintain our position on consumer staples at +1. We are convinced there will be an acceleration in EPS momentum, thanks to the repricing of input costs. Many European players are leaders globally. Also, the sector is very attractive (based on our financial models, DCF). It’s our preferred choice amongst defensive sectors.

- We maintain industrials at +1. This sector is highly qualitative, with considerable innovation and global leadership. EPS momentum is also strong.

- We remain at +1 on financials, with banks at +1: strong EPS momentum, still attractive. The next move will be to take profit; and insurance at +1: more attractive than banks and more profitable, but less EPS momentum.

- We remain negative on consumer discretionary. We are more specifically negative on automobile and components, as the mega-trends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments that will weigh on their margins. Short-term demand slowdown. We are also underweight on luxury goods. The sector is very expensive and still significantly over-owned.

US equities: growth should remain above its long-term trend in 2022

Global equities rallied in the last month of 2021, giving investors a third positive calender year in a row. Strong earnings were an important market driver, together with President Joe Biden signing the bipartisan infrastructure bill.Since the start of the new year, investors have nevertheless started to take some profit, as markets incorporate the start of quantitative tightening in the US and rising rates. Despite increased volatility, we are nevertheless convinced equity markets can perform well in the first half of the year on the back of good earnings.

US economic activity remained firm in the third quarter of 2021, but the latest surveys are tilted downwards in response to the emergence of the Omicron variant. The observed slowdown in the latest ISM surveys appears to be strongest in the services sector, whereas the drop in suppliers’ delivery suggests supply constraints may have started to ease somewhat in the manufacturing sector.

Growth in 2022 should nevertheless continue to receive support from business investments and inventory building on the back of non-financial corporations’ financial surplus and favourable credit conditions. In the meantime, President Biden has signed the USD 1 trillion bipartisan Infrastructure Investment and Job Act. The Build Better Back Act remains nevertheless stuck in Congress.

Inflation, in the meantime, remains high. The unique nature of the crisis has created unusual tensions on the labour market, which has induced wage pressures in low-paid industries. Candriam expects consumer price tensions to ease in 2022. Still, with inflation risks rising, the Federal Reserve is turning more hawkish. The central bank has accelerated its tapering to be in a position to hike earlier if needed and to remain flexible in adjusting the speed of its tightening cycle to the persistence of supply-side tensions.

In this context, we expect growth in 2022 to remain above its long-term trend close to 4% in 2022.

We remain confident that the Omicron variant will not have the same effect as previous ones, and will not materially disrupt our quite positive economic and market outlook for the coming months.

Despite the recent short-term correction, we are looking ahead to the first six months of the year with confidence. We expect a good earnings season, as companies are able to pass through price inflation to their end-clients, and earnings expectations seem too low. Markets expect less than 10% earnings growth this year, which is probably an underestimation, taking into account expected US GDP growth of close to 4%.

Of course, the start of the Federal Reserve’s tightening cycle, and inflation and interest rate pressures will result in more volatility, without derailing our constructive scenario in the first half of 2022. Cyclical and mid-cyclical sectors should continue to perform well during this period. The biggest tail risk for this scenario is an escalation of the tensions between Russia and the US over Ukraine.

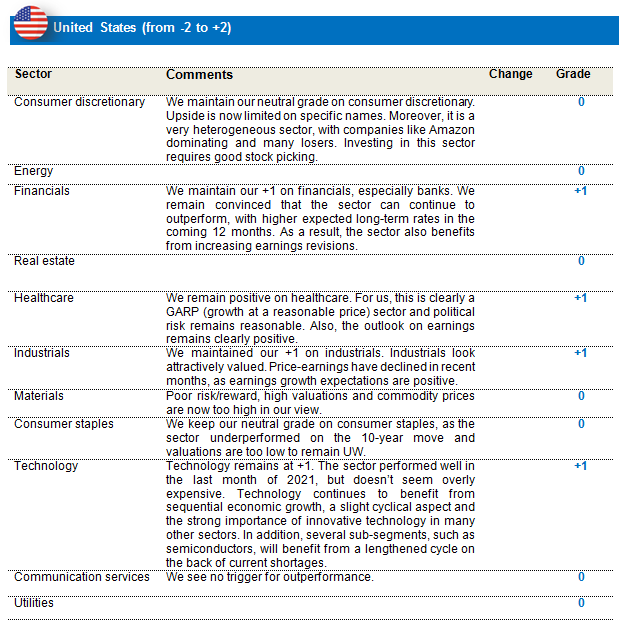

No strategic changes

- We have maintained our +1 on financials, especially banks. We remain convinced that the sector can continue to outperform, with higher expected long-term rates in the coming 12 months. As a result, the sector also benefits from increasing earnings revisions.

- We maintained our +1 on Industrials look attractively valued. Price-earnings have declined in recent months, as earnings growth expectations are positive.

- Technology remains at +1. The sector performed well in the last month of 2021, but doesn’t seem overly expensive. Technology continues to benefit from sequential economic growth, a slight cyclical aspect and the strong importance of innovative technology in many other sectors. In addition, several sub-segments, such as semiconductors, will benefit from a lengthened cycle on the back of current shortages.

- We remain positive on healthcare. For us, this is clearly a GARP (growth at a reasonable price) sector, and political risk remains reasonable. Also, the outlook on earnings remains clearly positive.

- We remain neutral on materials. The risk/reward is poor, valuations are high and commodity prices are now reaching their short-term highs in our view. Most commodity prices are above pre-pandemic levels.

- We maintain our neutral grade on consumer staples, justified by low valuations.

- We remain neutral on consumer discretionary. For us, this is clearly a sector in which stock picking remains vital.

A balanced approach for Emerging Markets

Emerging markets posted slight positive returns in December, even as markets started pricing in prospects of faster Fed tightening and worries about the spread of Omicron. Conversely, global equities led by the US continued to look past these concerns and posted decent returns of +3.9% (USD) for the month. Amongst major EM regions, in China some optimism was built in, with the CEWC (Central Economic Work Conference) signalling selective credit easing, but it was soon lost with concern around the slowdown in consumption and COVID-19 restrictions. In continuation of what was a trend for much of the year, onshore China equities outperformed the broader MSCI China index, which ended -3.2% for the month. South Korea posted one of the better monthly performances in December, gaining 5.0%, as prospects of a recovering trend in memory semiconductors led to foreign inflows. Taiwan posted gains of 4.8% for the month, in line with the broader DM performance. India started the month with concerns around extended valuations in a rising yield environment and profit-taking, but gained ground later in the month, following the global equity recovery. In commodities, Brent crude recovered quickly back to $77.5bbl levels, as concerns around the spread of Omicron faded.

For the year, the EM index ended in negative territory (-4.6%), significantly behind the global equity performance.

No change in regional ratings

Changes to sector ratings:

Upgrade of capital goods to positive: We have upgraded capital goods in industrials on expectations of a cyclical recovery in the sector and a pick-up in the capex cycle, on the back of a potential comeback of fiscal (infrastructure) spending in China and the US.

Downgrade of retailing in consumer discretionary to-1: Within consumer discretionary, we have downgraded retailing, as tech heavyweights may remain under pressure from technical overhangs from events in Chinese Tech – for instance, Tencent’s stake reduction in JD.Com, Sea Ltd. In addition, we have observed weakness in the Chinese consumption trend and ongoing antitrust regulation.

Downgrade of healthcare equipment and services to -1: Downgrade on valuation concerns and a peaking earnings cycle, especially for healthcare equipment companies.

2021 was a difficult year for EM equities, which ended up lagging DM equities by as much as 24%, one of the largest divergences in a long time. In a year characterised by global recovery, the EM landscape was clouded by increased regulatory tightening in China and a shift away from easy global liquidity conditions towards the end of the year. A strengthening USD did not help relative returns for EM equities, while in style, EM value made a comeback after some time. Despite these volatile conditions, the strategy outperformed its benchmark EM index in terms of relative returns, maintaining a balanced portfolio approach focusing on thematic ideas benefitting from secular tailwinds. Moving into 2022, the strategy continues to maintain the same balanced portfolio approach of long-term sustainable thematic plays in the emerging market supported by reasonable valuations. We continue to closely monitor expected earnings growth of our holding companies, as markets move into tighter liquidity conditions; and among other factors, we are keeping under observation the evolution of the regulatory environment in China, global inflation prints and the threat from new COVID-19 variants.