Japanese stocks outperformed global equities following the resignation of Yoshihide Suga as Prime Minister of Japan and President of the governing Liberal Democratic Party (LDP). The resignation was seen as a consequence of low approval ratings in the run up to the important elections for the Lower House of the country’s parliament, National Diet.

Japanese equities outperformed amid positive early outcomes from the COVID-19 vaccination programme, which may allow to end the health-related state of emergency in the country’s 19 prefectures. That said, the main trigger for the positive mood of market participants was the possibility of a strong government with reforming and accommodative policies to continue and deepen Abe’s reforms.

How new is the “new broom”?

Fumio Kishida, who at the end of September became the new President of the governing LDP and, by default, the Prime Minister, previously served as Minister for Foreign Affairs and Minister of Defence in the government of Shinzo Abe. In order to win his party leadership contest, Kishida had to secure the support of the outgoing Prime Minister Suga, whose views contradicted some of Kishida’s platform. That did not prove very popular with the voters. At the start of his term, his approval rating was only 49%1 when, for a comparison Abe started with 66% and Yoshihide Suga, who served as Prime Minister for only about a year between 2000 and 2001, started with 62%.

The Lower House elections, which took place last weekend, delivered a positive surprise to the LDP, showing that voters didn’t want in the end to penalise the governing party too much, keeping the ruling coalition in power. A new fiscal package will be presented by the government in November. We do not think we will see a game changer for Japan’s growth in 2022, but the package is expected to contain some measures to boost consumption, thus incidentally helping to smooth LDP’s path to victory in the Upper House elections next summer. In the meantime, the Bank of Japan is expected to maintain its accommodative stance, confirming its status as one of the last dovish Central Banks in the developed markets.

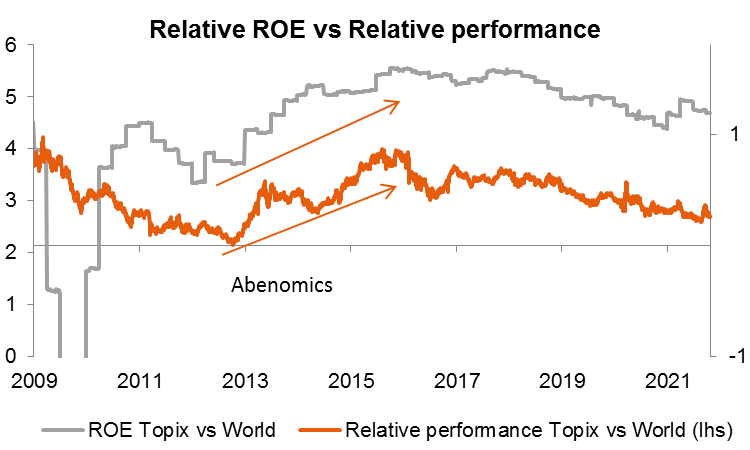

However, all of this has already been discounted by investors, who perhaps still hope for an emergence of a new momentum, such as the one witnessed amid the implementation of “Abenomics”. During this period, Prime Minister Abe was popular and that let him implement ambitious reforms aimed at stimulating corporate profitability (ROE) by improving corporate governance (issues such as independent directors and limiting cross holdings, where one publically listed corporation holds a stock in another publically listed corporation. Moreover, significant quantitative and fiscal easing policies allowed the previously overvalued Yen to depreciate by more than 60% in 3 years, which had the desired effect of boosting Japan’s export revenues, in turn creating a positive momentum for the Japanese equity market. Foreign investor capital flowed in boosting the performance of Japanese equities.

No fireworks are expected

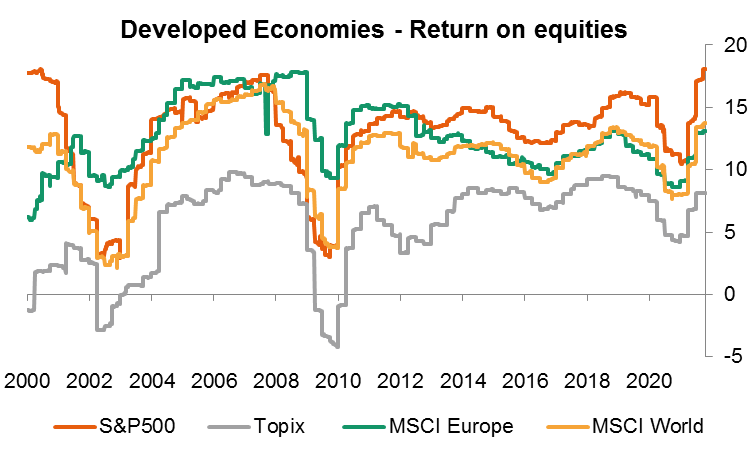

We do not expect a repetition of the same story and an enormous jump in foreign investment. Since 2018, the Return on Equity (ROE) has declined for Japan, now averaging below other key developed markets. In addition, and despite strong monetary easing, the Japanese yen (JPY) does not seem to have the same potential for depreciation as it did at the beginning of Abe’s government..

We maintain our positive stance on Japan for the time being, since it is a play on the global cycle, as well as the expected outperformance of “value” style and a rise in real interest rates.. We also continue to carefully monitor the impact of rapidly rising energy prices as this could negatively impact Japan’s economic recovery. This is because the country lacks significant domestic reserves of all types of fossil fuels except coal, and mostly imports its crude oil, natural gas and other energy resources.

1 Source : NHK, Japantimes.co.jp