Following weeks of rising tensions between Russia and Ukraine, Russia’s President Vladimir Putin has recognised the independence of two Moscow-backed regions in the Donbas region in eastern Ukraine. The Russian parliament has authorised the use of the country’s armed forces abroad and Putin ordered troops to cross the Ukrainian border into the Russian-backed separatist-controlled regions of Luhansk and Donetsk.

A diplomatic solution would ultimately be preferable and less costly for all parties, but the resolution of the conflict still promises to be fraught with difficulties. We expect markets to remain volatile for as long as there is a risk of further military action in Ukraine. Military escalation is likely to trigger a further market selloff, accompanied by a spike in volatility. However, a realistic prospect of a diplomatic resolution would allow the markets to recover and shift their focus back to central banks’ efforts to rein in inflation without provoking a hard landing.

A diplomatic solution…

The most recent move, which effectively has put an end to the Minsk agreement of 2014, represents a clear escalation of tensions and complicates the path to a diplomatic solution. Even though, arguably, sending troops to the Donbas region for “peacekeeping” operations does not represent an invasion per se, it represents a clear confrontation with Kyiv. It is designed to increase the pressure on the West to agree to the Kremlin’s demands, such as limitations around both the possible future NATO membership for Ukraine and the number of troops and weapons deployed on NATO’s eastern flank.

While Russia has chosen a military path for now, we believe that, at the end of the day, diplomacy will prevail over war. In this scenario, Ukraine will have to, de facto, recognise the loss of the Donetsk and Luhansk “Republics” and accept an agreement under which Russia obtains most of the security guarantees it asked for. In this scenario, activity in the Eurozone area continues to recover towards pre-pandemic levels (projected GDP growth 4.2% in 2022).

...or a further military escalation

However, a more difficult course of the conflict cannot be excluded. As the tensions between Ukraine and Russia escalate further, heavy sanctions against Russia are put in place, its trade with Europe will be significantly impacted. Even though this tense situation could linger for some time, we believe that eventually only two outcomes are possible. The conflict could either (1) be resolved through negotiations and agreements, and get back on track for our “diplomatic” scenario outlined earlier, or (2) escalates into a full invasion of Ukraine by the Russian army. This last scenario would see energy prices jump and remain elevated for a long period time. A sudden drop in consumers’ purchasing power is likely to be accompanied by a fall in consumer and business confidence, with households cutting their spending and businesses postponing their investment projects. Against this market backdrop, we see GDP growth in 2022 sharply slowing down from 4.2% to 1.3% in the Eurozone, with inflation remaining elevated at around 5.5%. In this scenario, the European Central Bank (ECB) is more likely to demonstrate patience.

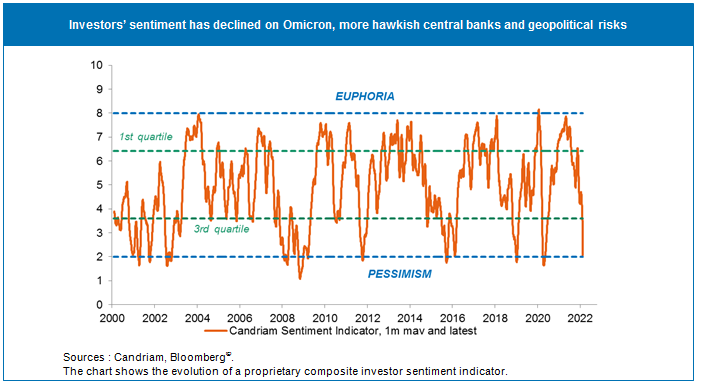

Investors’ sentiment has declined markedly

The conflict on the Ukrainian border has been the latest uncertainty to weigh on investors’ sentiment after the Omicron variant and the central bank hawkish pivot earlier this winter.

Our proprietary measure of investors’ sentiment, a composite indicator based on seven different inputs, has fallen to levels not seen since March 2020, when the Covd-19 pandemic started. Clearly, from a contrarian point of view, a lot of bad news is already priced in.

A diplomatic solution would shift the focus back on central banks’ ability to rein in inflation without provoking a hard landing

If the events unfold in line with our main “diplomatic” scenario, which is unlikely to take shape before Spring, we will closely watch the evolution of energy prices as a decline would alleviate pressure on inflation data.

Monetary policy would regain the lead, starting with the next FOMC meeting in the US on 15-16 March. The meeting’s decisions will determine economic forecasts, the median dot plot trajectory until end-2024 and potential announcements around the reduction of the Fed’s balance sheet.

Accordingly, US bond markets may see real and nominal yields keep on rising towards 2.25%. European yields would be expected to slightly increase, with credit spreads stabilising following the ECB’s decision on 10 March regarding its Asset Purchase Programme (APP) and Targeted longer-term refinancing operations (TLTROs).

For equities, we estimate that the risk premium currently encapsulated in market prices could lead to a rebound by 5%-10% and a decline in volatility. As a result, derivative protections, currently in place, could be decreased. In terms of sectors and market factors, our preference would go to value investments and cyclical stocks. “Growth” style sectors are likely to remain under some pressure as the rotation will depend on the increase in real rates.

In commodities, energy prices are likely to decline somewhat as tensions abate. Conversely, the price of gold, which currently enjoys the characteristics of a good portfolio hedge in an uncertain environment, may decrease. Finally, industrial commodities are likely to remain strong as capex expands further.

A Russian military invasion of Ukraine would lead to significant tensions and alter the market outlook over the medium term

Sanctions implemented by Western countries are likely to add to the turmoil. A sharp selloff and a spike in volatility would warrant an underweight exposure to European equities as the market faces a combination of shocks around the energy prices, household sentiment and business confidence.

As a result, a renewed spike in inflation, a fall in household consumption and a decline in business investment (capex) would further complicate central banks’ objectives as they wait for the dust to settle.

In fixed income, US 10-year yields should decline as an attractive safe haven asset, touching as low as 1.30%/1.50% again before recovering up again at some later stage. As a result, the yield curve would flatten more. In sync with global bond markets, European yields are likely to fall in this scenario and could revisit negative territory again.

A sharp equity selloff becomes a distinct possibility as a knee-jerk reaction to a jump in energy prices and a shock to market confidence. Shortages of gas could force closure of some sectors, leading to declines in activity and an inflation acceleration. Defensive sectors and “GARP” stocks (Growth at a reasonable price1) could outperform in this event.

In this market environment, commodities are likely to represent a good portfolio hedge. The gold price could see a strong rally, while energy prices should also rise initially. Industrial metal prices could stabilise as capex spending might be adversely affected.

Currency markets could see a rise in the US Dollar and the Japanese Yen could become more attractive and be seen as “safe haven” currencies.

Over the past weeks, our strategy adjustments over the shorter investment horizon include a more neutral positioning on equities. From here on, we believe that after everything, diplomacy will prevail over war and, therefore, that a scenario of above-potential economic growth still remains the most likely. However, a more difficult scenario cannot be excluded. In this context of high uncertainty, we are buyers of volatility, we maintain derivative positions to mitigate the impact of market volatility on our equity portfolios as further military action remains a risk. We also note that, should a future diplomatic solution succeed, a market rebound may result in gains of around 5% to 10%. We acknowledge that the situation could reverse at any time. Along with developments in Ukraine and Russia, the next fundamental market drivers will be central bank decisions and the evolution of upcoming growth perspectives.

1 GARP stocks are growth-orientated with relatively low price/earnings (P/E) multiples.