With young populations, technological innovation and a focus on sustainability, emerging markets excluding China may offer a lower-risk alternative and better diversification for those investors seeking growth.

Emerging markets (EM) have long been heralded as an El Dorado, a high-growth area promising lucrative returns for investors willing to take the risk of venturing there. In recent years, however, enthusiasm has waned as returns have fallen short of those in developed markets, raising doubts about their viability.

Yet, EMs have long been associated with rapid growth, fuelled by young populations, expanding consumer markets and globalisation. China's phenomenal growth story epitomised this success, attracting significant investment and reshaping global trade patterns. Now, as China's dominance has grown, its growth may be entering a mature phase, prompting investors to seek greater control over their exposure and turn to other emerging markets for further growth prospects.

Indeed, the relative decline of China is highlighting the rise of other emerging nations such as India, along with countries from South East Asia and parts of Latin America, which are poised to play a more central role in global economic expansion. The contribution of emerging markets excluding China to global GDP growth is expected to rise significantly from 40% to 50% over the next decade[1], making it the only region where the contribution is expected to increase. Growing investor interest and capital inflows in recent years is also improving the liquidity of these markets, adding to the appeal of this equity asset class.

Unleashing the Power of Diversity

Their rise rests on several pillars: a young population, an emerging middle class, growing domestic consumption, a thriving technology sector and an appetite for innovation. In addition, high levels of foreign direct investment (FDI) are helping to develop their various industries and position them as key players in global supply chains. What's more, their flexibility and that of their small businesses increases their adaptability and resilience in the face of changing market dynamics.

Despite the perception of uniformity, emerging markets encompass a diverse range of economies. India's thriving consumer sector contrasts with Taiwan’s technology manufacturing base, while Indonesia's natural resources set it apart from service-oriented economies such as Thailand and the Philippines. This diversification acts as a hedge against global market fluctuations and reduces dependence on any single growth driver.

Structural trends in EM outside China are also worth noting. India's robust growth, driven by recent policy reforms, positions it as a key contributor to global GDP growth. Its mix of domestic consumption and export-led growth makes it attractive to thematic investors, offering opportunities in areas such as investment cycle revival, manufacturing, energy transition and digital services.

In addition to their dynamic demographic growth, emerging markets outside of China are at the forefront of innovation, with their burgeoning technology hardware sector poised to shape the global technology ecosystem. The drive towards self-sufficiency in semiconductors further enhances these prospects, with countries such as Taiwan and South Korea playing key roles.

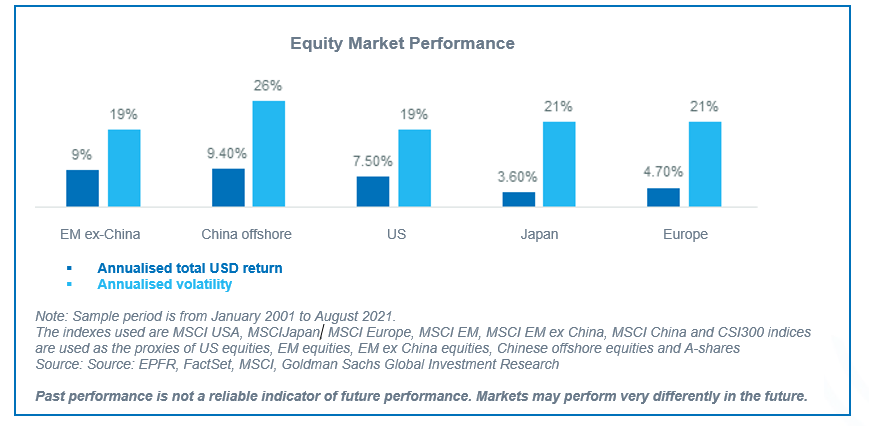

The risk of sanctions, tariffs and geopolitical tensions (such as those experienced by Russia and Russian companies) is also low for most EM ex-China equities. Taken together, this makes EM ex-China equities less volatile over the long term, as the study below shows, and an obvious alternative for investors with a low risk appetite.

Embracing Sustainability for Prosperity

Sustainability is a growing focus for both companies and investors in emerging markets. While there are fewer ESG leaders in EM than in developed markets, this presents an opportunity to identify future champions early.

Through an active bottom-up approach and rigorous ESG screening, Candriam's ESG EM Ex-China strategy aims to capitalise on this opportunity by targeting high-growth companies with sustainable potential. In line with Candriam's commitment, this strategy emphasises key growth countries in EM, such as India, as well as transformative technologies. Our long-standing focus on ESG seeks to ensure a concentrated portfolio of undervalued companies positioned for long-term success.

We are already seeing signs of improved corporate governance in key EM markets such as South Korea. The Korean government's recently launched "Value Up" programme, which focuses on improving corporate governance standards is already unlocking value for shareholders, particularly from "laggards" in terms of sustainability and corporate governance.

In addition, ESG assets in emerging markets are growing rapidly, with ESG-sensitive companies outperforming, according to a BCG report[2] published in March 2023. While most funds are still invested in developed market companies, emerging market ESG assets under management have grown significantly in recent years, with an approximate 80% increase between 2018 and 2021. The report also highlights that ESG-sensitive emerging market companies have shown strong performance relative to other emerging market equities. For example, the MSCI Emerging Markets ESG Leaders Index outperformed the MSCI Emerging Markets Index by 54% in 2021.

Candriam's ESG EM Ex-China strategy targets high-growth companies in emerging markets, particularly India, that are positioned to benefit from transformative technologies. This diversified approach seeks to mitigate risk while capitalising on long-term growth trends. In addition, the growing focus on ESG issues provides an opportunity to invest in emerging market companies that have adopted ESG practices. By tapping into these markets, investors can gain access to sustainability-oriented companies with strong growth potential.

Risks

All our investment strategies involves risks. The risk of loss of the principal is borne by the investor. Other main risks associated with our ESG Emerging Markest ex-China strategy are: equity risk, Foreign exchange risk, Emerging markets risk, ESG investment risk.

The risks listed are not exhaustive, and further details on risks are available in regulatory documents (Prospectus and KID).

DISCLAIMER

This is a marketing communication. This document is provided for information purposes only and does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Candriam consistently recommends investors to consult via our website www.candriam.com the key information document, prospectus, and all other relevant information prior to investing in one of our funds, including the net asset value (“NAV) of the funds. This information is available either in English or in local languages for each country where the fund’s marketing is approved.

Warning: Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance does not predict future returns. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.

Information on sustainability-related aspects: the information on sustainability-related aspects contained in this communication are available on Candriam webpage https://www.candriam.com/en/professional/sfdr/.

[1] Source: 1. IMF, World Economic Outlook Database, Apr 2023 2. Wei, Xu, Xu. MSCI, Foundations of Dedicated China Allocations: Part 2 – MSCI

[2] The Sustainability Imperative in Emerging Markets | BCG