Solvency II now has two official objectives :

- Encourage long-term capital investment in the economy by insurance companies, and

- Support the Green Deal.[1]

While these objectives are laudable, there are methodological obstacles. The initial objectives of Solvency II were harmonization, financial stability and policyholder protection. The text had therefore been conceived as a risk-based regulation, based on the valuation of the balance sheet on a mark-to-market[2] basis and on capital requirements calibrated using Value at Risk (VaR)[3] with a confidence level of 99.5%. With this approach, capital investment, including in energy and cleantech, can be less attractive than sovereign bonds and high-quality corporate bonds. Similarly, emerging risks such as climate risk, which develop over long periods, are difficult to calibrate and do not fit well into such a framework.

The current revision of Solvency II attempts to address these points through technical amendments aimed at stabilizing prudential balance sheets, providing targeted capital relief to facilitate certain investments, and strengthening the focus on ESG risks, in particular climate risks. Here, we focus on the topics with the most direct impact on investment management (and do not examine other important aspects, such as proportionality measures, risk margin calculation or transitional measures). Nor will we dwell on the increased importance of liquidity risk in the regulations, as this seems to us to be in line with current practice in France.

What stage has been reached in the review of the Solvency Directive?

The Council of Europe and Parliament have agreed on a joint revised version of Solvency II which includes the changes below. It will probably come into force on 1 January 2026.

Changes in the measurement of liabilities

The most important changes for investment management concern the liability discount curve, known as the risk-free interest rate curve. This curve has two main components: the base curve (i.e. the swap rate curve in relation to the overnight interest rate) plus the volatility adjustment (a fraction of the spread observed on the markets and corrected for the cost of default).

The base curve is extrapolated from year 20. The extrapolation method has been modified to include information on the yield curve beyond the 20-year maturity. This will make long-term commitments more sensitive to market rates and long-term hedges more financially efficient.

The volatility adjustment could include a higher proportion of bond spreads, and the application of the adjustment will depend more on the insurer's actual bond allocation. This would allow greater flexibility in the design of the investment portfolio and a better asset/liability match.

Changes in capital requirements for market risk

The Solvency Capital Requirement (SCR) for interest rate risk should be recalibrated to reflect the risk of falling interest rates, even when they are already low. In the current context of significantly higher rates than over the last 10 years, the impact of this change is low, but insurers could consider a more systematic hedging of interest rate risk.

The long-term equity module, which allows certain holdings to benefit from a lower capital requirement, should be subject to less restrictive conditions. The scope of application has been extended to EEA or OECD equities, and the target holding period is five years, a period that can be assessed at fund level for certain vehicles, including ELTIFs. It should make it easier for insurers to invest in diversified equities.

Other changes could have a much smaller impact.

- The symmetrical adjustment for equity risk, also known as "equity dampener", is currently limited by an interval of +/- 10 %, while it is proposed to extend the interval to +/- 13 %. In the past, the brake was activated during the internet bubble and the Global Financial Crisis. Since then, only the lower limit has been activated, during the Covid-19 financial turbulence.

- Spread risk for securitization exposures could also be more granular, incorporating notions of seniority.

As most of these measures will have a negative impact on insurers' solvency ratios, they will be subject to 5-year transitional periods.

In addition to the above non-exhaustive list, the importance of sustainability in regulation is growing, and specific capital requirements could be determined for sustainability-related risks. The European Insurance and Occupational Pensions Authority (EIOPA) has also been asked to study this topic, to determine which risks are the most important from a prudential point of view, and how capital requirements might be calibrated. EIOPA has opened a consultation on the subject until March 22, 2024.

Sustainability risks

More specifically, EIOPA is analyzing the potential link between prudential market risks in terms of equities, spreads and real estate risks, and transition risks. We will not be examining the other two areas of assessment, namely the potential link between P&C underwriting risks and measures to prevent climate-related risks, and the potential link between social risks and prudential risks, including market and underwriting risks.

The first conclusion is that analysis is not easy : few data points are available, and only from a very recent period. Moreover, sustainability is not the only financial risk factor. However, EIOPA has noted that bonds and equities linked to fossil fuels present a higher risk than those exposed to other activities, which justifies specific prudential treatment. On the other hand, EIOPA was unable to reach a conclusion on the effect of a building's level of energy efficiency on property risk.

In addition to the status quo option, the approaches adopted by EIOPA to incorporate sustainability would consist in increasing the capital requirement on the basis of the NACE code of the issuer of the security :

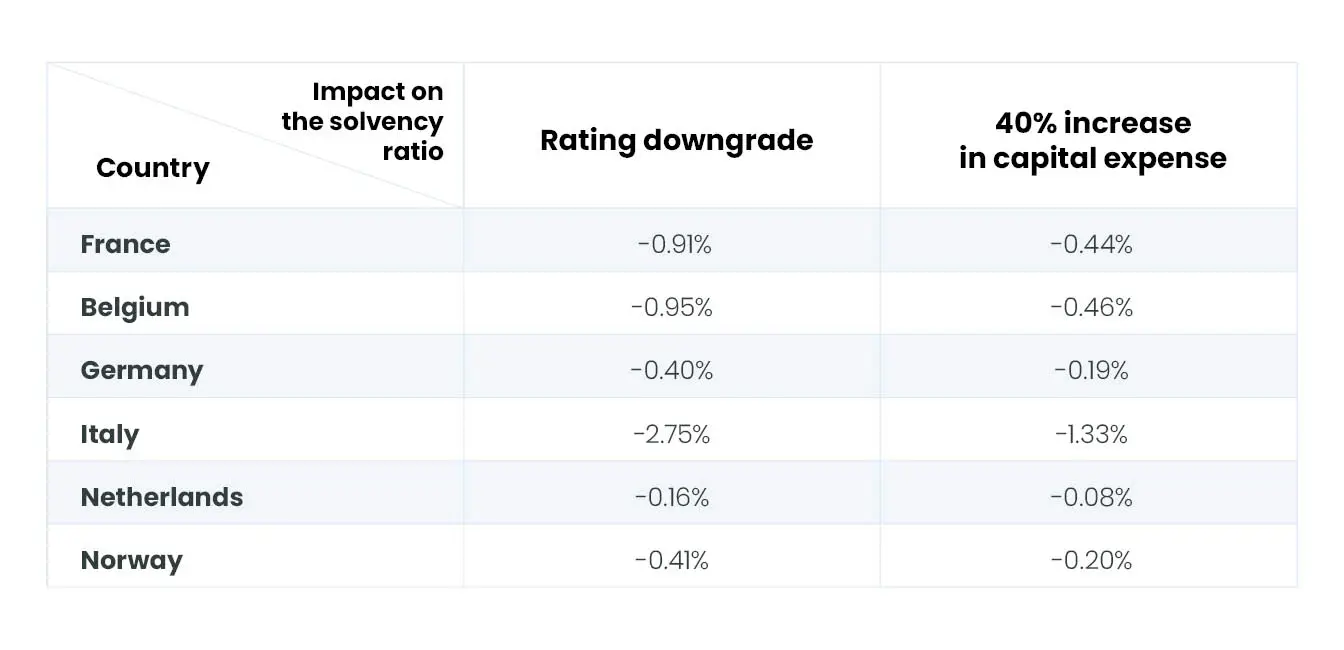

- For equities, either the use of a Type 2 capital charge instead of a Type 1 capital charge (SCR higher by +10 %), or the application of a surcharge of +17 % on the equities concerned. The impact on solvency ratios of a 17% increase for fossil fuel stocks would be as follows :

- For bonds, two methods are also studied :

EIOPA is very transparent in its research, and describes in plain language the main obstacles facing most investors: the lack of data and the difficulty of adopting a single approach for all investments. While the increase in capital charges for companies most exposed to climate change could, in our view, be offset by a reduction in capital requirements for solution providers, such as green bonds, we are convinced that the implementation of these capital charges will not replace the need for in-depth analysis of each issuer's business and transition plans.

This document is provided for information and educational purposes only and may contain Candriam opinions and proprietary information. It does not constitute an offer to buy or sell financial instruments, nor does it constitute investment advice, nor does it confirm any transaction, unless expressly agreed otherwise. Although Candriam carefully selects the data and sources it uses, errors and omissions cannot be ruled out. Candriam cannot be held responsible for any direct or indirect loss resulting from the use of this document. Candriam’s intellectual property rights must be respected at all times. The contents of this document may not be reproduced without prior approval in writing.

[1] The European Green Deal is a set of policy initiatives proposed by the European Commission with the overriding aim of making Europe climate neutral by 2050.

[2] Mark-to-market consists in regularly, or even permanently, valuing a Position on the basis of its observed Market Value at the time of valuation. Thus, all assets must be valued at the amount that can be realized on the market, and all liabilities must be valued at the cash surrender value demanded on the market.

[3] VaR is a concept generally used to measure the market risk of a portfolio of financial instruments. It corresponds to the amount of losses that should only be exceeded with a given probability over a given time horizon.