During the 2nd quarter, US GDP contracted by an unprecedented 32.9% QoQ annualized – slightly better than the expected 34.5%. Unsurprisingly, economic data related to the last quarter is bad across the board. Expectations were so bad that data points with small positive surprises helped maintain risk appetite. Central bank support and management of expectations were key to boosting the market. However, taking stimulus plans and political agendas into consideration, it is important to see beyond the short-term stabilization to assess how the world economy is to be shaped in the post-COVID era.

During the 2nd quarter, US GDP contracted by an unprecedented 32.9% QoQ annualized – slightly better than the expected 34.5%. Unsurprisingly, economic data related to the last quarter is bad across the board. Expectations were so bad that data points with small positive surprises helped maintain risk appetite. Central bank support and management of expectations were key to boosting the market. However, taking stimulus plans and political agendas into consideration, it is important to see beyond the short-term stabilization to assess how the world economy is to be shaped in the post-COVID era.

US equities continued to perform well, returning mid-single-digit returns and outperforming European equities, which declined, on average, by low single-digit figures. The European stock return drivers were: poor economic data, bleak corporate earnings, rising COVID-19 infection rates and a surging Euro versus the dollar.

The environment for fixed income remains benign. Roughly 86% of the $60 trillion global bond market tracked by ICE Data services is trading at yields below 2%.

Gold continues to be in strong demand. During July, it increased by 9% and, for the first time, the ounce of gold quoted above $2000.

The HFRX Global Hedge Fund EUR gained +0.99% over the month.

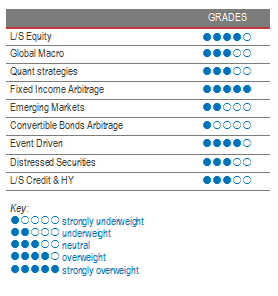

Long Short Equity

The month of July was, on average, good for Long Short Equity strategies. According to brokers, style factor was an important performance-driver, as investors continue to bet on growth and quality factors. Strategies exposed to the technology, consumer and healthcare investment thematics – which are fully benefiting from the current environment – continue to lead the pack. The average alpha generated by managers is positive but below average due to the negative contribution from their short books. Irrational flows into poor-quality companies and sectors generated price pops that have been difficult to manage in a Long Short Equity framework. Also, baskets of thematic equities like “high short interest” or “profitless tech” were among the best performers during the 2nd quarter going into July. Despite these difficulties, Long Short Equity strategies have been printing very impressive performance numbers both on an absolute and on a relative basis. Current average gross and net exposures are at multi-year highs, exemplifying Warren Buffet’s well-known saying: “Be greedy when others are fearful.” Net exposures will probably decrease going forward as investors continue to collect additional data on the state, the economy and corporations, and the market reverts further to fundamentals. LS Equity managers are relatively excited as, with correlations decreasing, they will be able to capture current market dislocations in a wide variety of themes, sectors and geographies.

Global Macro

During July, once again, Discretionary Global Macro managers outperformed, on average, Systematic Global Macro strategies. The main positive performance drivers were trades on long EM rates positions, long gold, long selective equities, and short selective energy equities. Many of these energy companies saw their equity price rally early June by triple-digit returns when they were on the verge of bankruptcy. Systematic strategies, which tend to be more diversified by nature and rely on observable data, are having more difficulties dealing with market noise. In this sentiment-driven environment, we tend to favour discretionary opportunistic fund managers who can draw on their analytical skills and experience to generate profits from selective opportunities worldwide. The stabilisation of the market and increased visibility in macro-economic data should lead to better performances from systematic strategies with expected lower realized volatility levels than the more concentrated discretionary managers.

Quant strategies

2020 has not been an easy environment for Quantitative Strategies. Models had difficulties dealing with the violent and rapid increase in market volatility and asset correlations between the end of February and April. The extreme and prolonged volatility levels reached during March led to a significant deleveraging of quantitative strategies, generating poor performance and leading to further deleveraging. The implementation of the stock-shorting ban on some European countries helped accentuate the deleveraging effect as managers were unable to implement or adjust the optimal portfolios of long and short securities as defined by their model. July was a positive month for Quantitative Strategies, with performance mainly driven by directional models.

Fixed Income Arbitrage

If Fixed Income Relative Value had one of the most spectacular months in its history in March 2020, it did highlight the need to be invested in managers with strong set-ups (secured-term repo lines with high-quality counterparts and longstanding relationships). At the end of March, our managers took advantage of the dislocation within the US basis to post historical positive returns from what has been a once-in-a-decade opportunity. As we came close to the June expiry, basis positions were rolled down on the September expiry, which seems quite attractive, even though not as good as the opportunity presented in March. Like other RV trades, spreads are wider than they were pre-crisis, and we are reiterating our positive stance on the strategy, even if the potential implementation of yield control by the Fed could be a significant game-changer for interest-rate volatility.

Emerging markets

It was a strong month for hedge fund strategies focusing on Emerging Markets strongly benefiting from the risk-on environment. Diversified and Relative Value strategies tended to be outperformed by Discretionary directional managers, who did well with their conviction trades. The main performance-drivers were credit long positions in sovereign issues in Puerto Rico, South Africa and Argentina and receiving rates from Brazilian and Mexican issues. However, the macro outlook remains extremely foggy for Emerging Markets: fundamental managers stress that, in a zero-rate world, Emerging Markets is the only alternative to investing in yielding fixed income. Considering the fragility of fundamentals, managers usually adopt a very selective approach. Trades are mainly implemented by investments in fixed income, credit and currencies, where the pricing of risk, led by fear, is creating massive dislocations and opportunities by ignoring the fundamentals specific to each region. The market is cyclical and, as such, current massive dislocations are the seeds of future investment opportunities at more interesting entry points. We remain cautious about the strategy because, on top of fundamental considerations, EM assets might suffer from outflows of capital-chasing opportunities in DM High Yield, and from a lack of liquidity.

Risk arbitrage – Event-driven

July accounted for $320 billion of newly announced M&A activity, which is quite encouraging for the strategy. However, this might be a false start, but all the more understandable considering the current economic uncertainty. However, some M&A advisors think the activity recovery might be faster than in previous crises. Financial institutions are in better health, financing is accessible and large corporations have high cash levels. It is also estimated that private equity vehicles have $1.5 trillion of dry powder and are willing to be more active in this coming cycle. Event-driven strategies performed well during the month. One of the best-contributing deals to performance was the increased offer from Thermo-Fisher to buy Qiagen (+10%: from €39 to €43). As we write, considering the strong Q2 numbers and Q3 outlook, Qiagen’s shareholders had not reached the minimum 66.67% acceptance threshold. M&A activity is cyclical and, as such, the number of deals should increase again in view of the still-low GDP growth (companies will compete for growth), rising visibility and still widely available financing. Meanwhile, it is important to remain selective in deal selection due to the increased risk of deal failure.

Distressed

According to JP Morgan, 2020 already ranks as the second-highest annual default total on record, with defaults on a notional amount of $100 billion. Cable, Energy, Retail and Telecom are the most impacted industries. Also, as larger-quality companies find it easier to issue debt to compensate for a temporary lack of revenues, some managers estimate that the default rate of lower-quality and smaller companies is around 5x the broad market-default rate. According to Epiq, a legal services group, bankruptcy filings in the US are running at their highest pace since 2013. Moody’s and S&P projected default rates are, respectively, 13.3% and 12.5%. During the last three recessions, irrespective of the duration and level of these, default rates always peaked at around 10%. This time, however, the size of the economic shock is much bigger than anything we have ever met. It is therefore probable that many credit assets will still correct to adjust to the severity of the crisis. This strategy will offer interesting investment opportunities over the coming quarters and years.

Long short credit & High yield

Credit spreads for Investment Grade and High Yield markets reached extreme levels unseen since the crisis of 2008. The market was also highly affected by the lack of liquidity, prompting the ECB and the Fed to step up their IG debt-purchasing programmes. The Fed also decided to include High Yield in its buying programmes to smooth the high amount of Investment Grade fallen angels downgraded to High Yield. Rating agencies forecasted that the amount of fallen-angel debt could reach $700 billion in the US, probably too much to be absorbed by the HY market smoothly. Investment Grade and short-term High Yield issue spreads reacted very quickly to liquidity injections, especially in the US. According to the managers we track, while this move in higher-quality issues was widely expected, there are still many opportunities not only in High Yield but also in the cross-asset relative value trades (long bond vs short equity) and intra-asset RV trades (long bonds and long protection) generated by the market dislocations. Contrary to 4Q 2018, opportunities offered in credit will take longer to be arbitraged, leaving time for investors to review their allocations.