President Trump regularly highlights that China has more to lose from a trade war than the US. He is clearly overlooking the need for western companies to continue benefitting from Chinese technological ability in certain domains. The Chinese economy is nevertheless showing signs of weakness which are being exacerbated by trade tensions. The Chinese authorities aim to rebalance growth towards a greater focus on services and consumer spending and away from manufacturing investment. Historically, as the examples of South Korea and Japan have demonstrated in the past, overdependence on the manufacturing sector is unsustainable and can lead to a sharp downturn in the economy.

However, their task has been complicated by several factors.

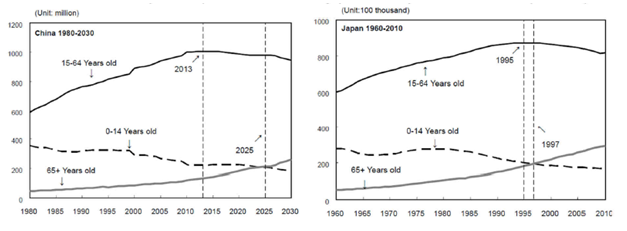

Firstly, the demographic structure does not favour this process, as the weight of the population aged 15 - 64 has been in steady decline since 2013. An interesting comparison can be made between trends in the Japanese and Chinese populations across a time lag of 20 years or so. Recent Japanese economic history therefore illustrates the structural challenges facing the Chinese economy.

Source: Cai, Fang & Lu Yang, “Population change and resulting slowdown in potential GDP growth in China” China &World Economy,2013,Vol.21, Issue 2, p. 1-14

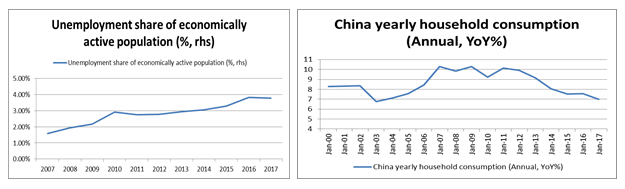

Secondly, the unemployed proportion of the economically active population has been significantly increasing over the past few years (see below).

Sources: National Bureau of Statistics of China, Candriam Asset Allocation

Several factors account for this increase, including job losses in rural areas, a slowing new jobs creation rate in urban areas and a greater number of students joining the active population. Lastly, the rate of wage increases has also slowed significantly. Household consumption has therefore declined over the past few years (see above). Some of these trends could be exacerbated by the trade war, notably the slowdown in job creations in urban areas, which could also be impacted by production lines relocating to Vietnam or Taiwan.

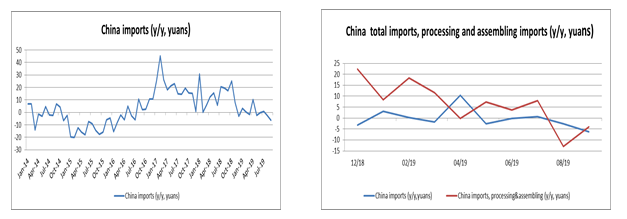

Chinese imports have also declined over the past few years reflecting a slowing domestic trend. The trade war may also amplify this process by displacing production lines. Although imports of products for assembly and processing prior to export have certainly declined, this factor does not fully account for the downturn, highlighting weak domestic demand.

Sources: National Bureau of Statistics of China, Candriam Asset Allocation

However, the Chinese authorities are trying to counter these trends. Fiscal leverage has been deployed, notably in the private sphere. Monetary measures have also been implemented, involving lower reserve requirement ratios and a reform of the monetary system in order to reduce corporate financing costs. These measures have nonetheless been limited by the sharp increase in debt which represented 276% of GDP in 2018 vs 160% in 2008. The government is therefore trying to attract funding from abroad, by relaxing financial market accessibility rules for foreign financial companies. This policy can only succeed if the targeted investors have confidence in the yuan and if their home countries do not erect legal barriers. These 2 constraints are highly difficult to manage for the Chinese authorities. If the economy slows down too sharply, a weaker yuan may be required. Furthermore, threats from the US authorities to regulate financial investments in China could also make it more difficult to issue the debt securities required to finance the economy. This context therefore limits the authorities’ capacity for political intervention, particularly with regard to the events in Hong-Kong.

China is therefore facing a tough challenge: how to accompany the required transition of its economic model (notably for demographic reasons) in a context of a political struggle with the US, while at the same time managing risks of social discontent? Against this backdrop and given the levels recently reached by equities and bonds following the start of the talks in early October, we are neutral on Chinese assets.