Upcoming data on the spreading of epidemic and on recent economic developments indicate that Covid-19 will deal a blow to global growth, but we believe that the shock will be temporary.

What’s new?

As we wrote a couple of days ago, Depth, Duration and Diffusion are key in assessing the economic pain of the coronavirus.

Concerning Depth, China PMIs plunged in February both in the manufacturing and service sectors. This gives a first idea of the spectacular impact of the epidemic on China Q1 GDP. Moreover, high-frequency data reinforce the view that resumption of activity is slow.

Concerning Diffusion, new reported cases outside of China are now more numerous than within China. Most epidemiologists now believe that containing the Covid-19 virus worldwide is becoming a less and less likely outcome.

The economic impact on the US and the Euro area could be significant… but should be temporary

While it is too early to assess the impact on the global economy, it is now becoming obvious that the shock will extend beyond temporary supply chain disruptions and lost tourism receipts from China. On top of this external shock, domestic shocks within both the US and the Euro area have now to be taken into account. Indeed, in many places, part of the domestic workforce is likely to be unable to attend work for a couple of weeks (or months?), and many services activity will be severely affected by a lack of demand.

A note from the staff of the Federal Reserve in October 20091 to assess the impact of H1N1 flu on economic activity provides some help to calibrate the supply side of the 'domestic' shock . At that time it was assumed that “20 percent of the workforce either will get sick or will need to stay home to care for others who are sick; affected employees will miss four days of work; and one half of the output lost from the reduction in hours will be offset by individuals working at home or working longer hours when they return to work, by temporary help, or by colleagues working harder or for longer hours”. On top of this 'supply' shock, a demand shock is bound to affect many services sectors (transportation, restaurant, hotels….). At the current juncture, to estimate the total magnitude of the possible domestic shock, we assume that in a severe scenario 10% of US GDP will be lost for one month. Note that a drop of 10% of US GDP implies a much sharper drop of activity in many sectors, because close to half of GDP will be less affected (rents, financial services, government…). Hence, the shock calibrated here is much stronger than assumed by the Fed in 2009. It seems, for the moment at least, to provide an upper bound to the impact of the Covid-19.

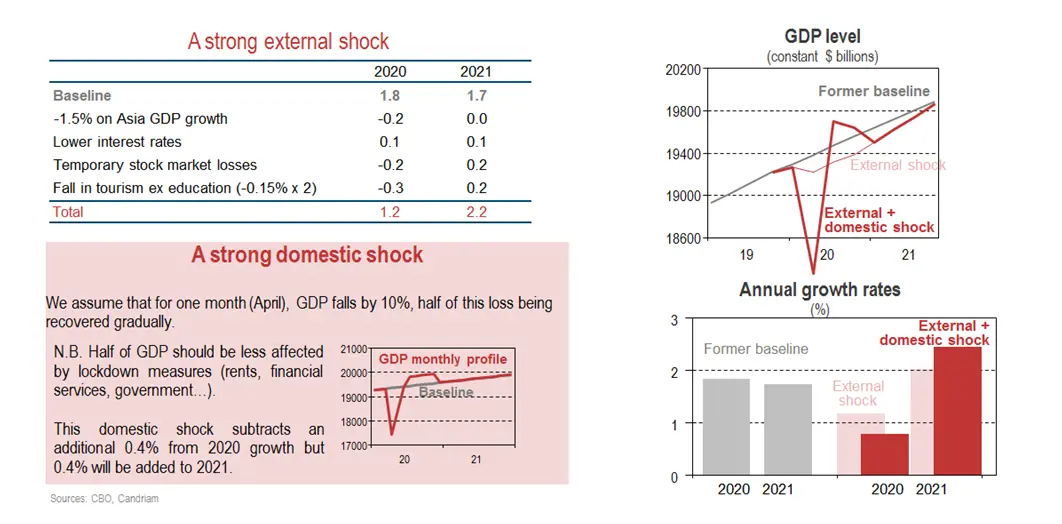

Using our proprietary macro model to assess the external shock and adding our estimate of the 'domestic shock' gives a ballpark estimate of the impact of a severe Covid-19 crisis on the US economy (Box 1):

- The “external” shock – less growth in Asia, a fall in tourism, and a fall in the stock-market –subtracts 0.6% to GDP growth in 2020, 0.5% being recovered in 2021 ;

- The “domestic shock” subtracts an additional -0.4% in 2020 (to be recouped in 2021).

Box 1. Impact on the US economy of Covid-19 in a severe scenario

In this 'severe' scenario, growth in the US would fall from 1.8% to 0.8% in 2020. A similar approach for the Euro area gives growth close to 0% in 2020. If such a scenario were to play out, some aggravating factors could of course amplify the impact of the shock (for example, leveraged companies having difficulties because of revenue losses), but remember also that mitigating policies would also likely be put in place. On Friday February 28, the Fed already announced it was ready to act if needed and, in the Euro area, governments have already announced they are ready to provide some fiscal support. A response by central banks and looser fiscal policies should help offset the economic fallout… if only by preventing markets from further spiralling downwards.

Upcoming data on the spreading of the epidemic and on recent economic developments will help assess the severity of the shock on the global economy. For the time being we continue to believe that, while the shock to the economy will be significant, it should prove temporary.

Implications for our Asset Allocation

Given the current context and its evolution, we have become more cautious in our portfolios at the beginning of February, buying options to protect our equity exposure. Those options have played their role during the stock market plunge last week and hedged part of our equity exposure. The markets have since reached some extreme levels in terms of the rise of volatility, and the depth and steepness of the downturn in equity markets in only one week.

In the short term and given the information that is currently at hand, we believe we will eventually find entry points in a full-blown bear market. Patience will be key as the market may still be shaken by the spread of the disease through Europe, the US and the Southern Hemisphere.

We remain slightly underweight equities for now but recognize that investors are integrating part of the anticipated economic slowdown linked to the outspread of the coronavirus.

We will consider progressively buying equities to neutralise this position if markets continue to decline. The risk/reward should continue to improve with the correction in equity valuations.

In the medium term, there are rising expectations of policy easing from central banks, and of fiscal support. Overall, we do not expect a protracted global recession: with the receding of the epidemic, we project growth will pick up. If this scenario holds, we will consider becoming positive on equities again, in line with our longer-term scenario either at a lower price (assuming the market is correctly pricing the temporary shock and the economic downturn) or positive news about the epidemic.

1 Cf. https://www.federalreserve.gov/monetarypolicy/files/FOMC20091104gbpt120091029.pdf

2 Note here that Covid-19 is much more contagious (the transmission rate – which describes how many additional cases of a disease each infected person will cause during their infectious period – is currently estimated to be between 2 to 3 as against 1.5 in the case of H1N1 influenza.