September broke with its reputation for subdued volatility as global risk assets extended their summer rally. Global Equities gained +3.4%. This was driven by a mix of resilient US macro data, rate cuts and the unshakable enthusiasm around AI-related corporate announcements. The surge in technology names more than offset weakness across defensives. Gold surged on expectations that the Federal Reserve’s next move will be an easing cycle, following Chairman Powell’s tone at Jackson Hole.

September broke with its reputation for subdued volatility as global risk assets extended their summer rally. Global Equities gained +3.4%. This was driven by a mix of resilient US macro data, rate cuts and the unshakable enthusiasm around AI-related corporate announcements. The surge in technology names more than offset weakness across defensives. Gold surged on expectations that the Federal Reserve’s next move will be an easing cycle, following Chairman Powell’s tone at Jackson Hole.

Indeed, the US economy continued to show resilience, supported by consumption and services, even as manufacturing surveys softened. In Europe, momentum stayed weak, as Germany and France are near stagnation, Southern Europe remained comparatively resilient, led by continuous growth in Spain. In Asia, China’s recovery improved slightly thanks to targeted policy support and stronger market sentiment after stimulus headlines, though property-sector headwinds persist.

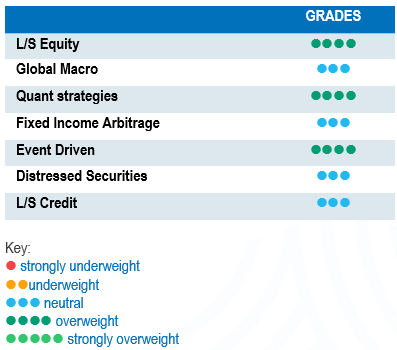

European stock-pickers leaned positive, but multi-strategy and quant funds in the region took more defensive stances. In Asia, despite rising equities, hedge funds were more inclined to short than go long. The monthly results underline a divergent landscape across hedge-fund strategies, with macro and systematic equity managers leading gains, while multi-strategy platforms remain more subdued.

The HFRX Global Hedge Fund EUR returned +1.26% over the month.

Long-Short Equity

September was another positive month for Long-Short Equity strategies, as equity markets extended their rally and sector dispersion remained wide. The S&P 500 rose by 3.4%, led by continued strength in Technology, Energy and Industrials, while defensives lagged. According to Morgan Stanley Prime Brokerage, managers maintained elevated gross exposure, with US L/S gross leverage near decade highs (216%) and net leverage stable at around 55%. Performance was positive across most regions. Global L/S funds gained around +1.5%, capturing roughly half of the market’s upside, while Asia-focused managers outperformed (+3.4%), supported by new inflows in China and semiconductor excitements. Europe-based funds lagged their US and Asian peers in absolute terms but outperformed on a relative basis, capturing over 100% of the European Equities index returns. Thematic leadership remained concentrated in AI and semiconductors. Although net exposure to long momentum names remains above the median level of the last 10 years, managers are reducing their net exposure. Overall, dispersion across regions, sectors and factors remains high, sustaining attractive conditions for active alpha generation.

Global Macro

Global Macro strategies continued their gains in September, supported by a renewed market directionality. The Fed’s dovish tone at Jackson Hole and softer US data reinforced expectations of an upcoming easing cycle. However, this sentiment faded at the start of October, as the US government began the 20th shutdown in its history on 1 October while in France, Lecornu’s government collapsed on 5 October. That reignited volatility and again highlighted the political fragility across major economies. Discretionary macro managers benefited from benefited from tactical positioning, maintaining long exposures to US and Asian equities, as well as to Western sovereign bonds, and short US dollar trades. This economic decoupling between a resilient US, a stagnating Europe and an uneven Chinese recovery continues to offer fertile ground for relative value and thematic macro trades.

Quant strategies

Overall, September delivered solid returns for Quantitative Strategies. A subset of the universe was challenged by the sale of crowded long and short positions. According to Goldman Sachs, Quantitative Strategies are up, providing low double-digit returns since the start of the year. Trend-following strategies have lagged so far in 2025 due to weak trend persistence. However, they outperformed the Quant space during September, with profitable trades in equities, commodities and foreign exchange. Elevated macro uncertainty and regional dispersion continue to provide fertile ground for systematic models, reinforcing quants’ role as resilient portfolio diversifiers.

Fixed Income Arbitrage

September presented notable challenges for fixed income arbitrage strategies. In the US, the yield curve steepening trend was interrupted following a weaker-than-expected labour report: long-end Treasury yields declined, while the front end remained relatively stable. At the same time, US swap spreads widened across the curve, complicating relative value positioning. In Europe, sovereign curves shifted lower in a broad-based rally. Meanwhile, Japan followed its own market dynamics, with 10-year JGB yields creeping higher over the month. Despite the challenging backdrop, fixed-income arbitrage managers were able to capitalise on both directional moves and relative value dislocations.

Risk arbitrage – Event-Driven

Event-Driven strategies delivered steady gains in September, supported by renewed merger-arbitrage activity and rising corporate confidence. According to Morgan Stanley, global Event-Driven funds were up +0.8% MTD and +11.6% YTD, as tighter deal spreads and higher completion probabilities boosted returns. The pickup in US and European M&A volumes was evident, led by large-cap transactions such as Electronic Arts’ $55bn sale to PIF (biggest LBO in History), Genmab’s $8bn acquisition of Merus NV and the $53bn Teck Resources Anglo American merger. Activity remained concentrated in TMT, Healthcare and Energy, where clearer regulatory signals in the US and lower financing costs supported confidence. After three years of disappointing returns, Event-Driven strategies rank among the top performers this year. Overall, managers continue to see improving deal momentum into Q4, with “paused” or delayed transactions expected to return to market as policy visibility and financing conditions stabilise.

Distressed

Distressed strategies posted mixed but overall positive returns in September, with slight gains coming mainly from idiosyncratic restructurings and asset-sale catalysts. In fact, gains were driven by asset-sale announcements and restructuring advances in selected issuers, while losses stemmed mainly from energy-related credits, where falling production guidance and commodity volatility weighed on valuations. Overall, managers remain constructive. Credit spreads stayed tight but refinancing needs are rising and, according to the J.P. Morgan Credit strategy report, this combination could create a broader distressed opportunity set into late 2025, particularly in highly leveraged US sectors and European cyclicals.

Long-Short Credit

Long-Short Credit strategies were broadly stable in September, according to Morgan Stanley. Corporate spreads remained tight, supported by steady earnings and limited new issuance. Managers maintained balanced positioning, favouring high-conviction longs in financials and industrials while keeping short exposure in lower-quality cyclicals. Alpha came mainly from security selection and event-driven credit rather than directional beta. On a year-to-date basis, Long-Short Credit funds are up mid-single digits, according to Goldman Sachs, continuing to attract inflows into credit arbitrage and relative value strategies. With spreads near cycle tights and idiosyncratic risks rising, managers are emphasising liquidity and diversification.