European equities: A Good start to the year

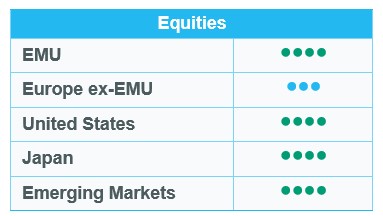

European equities have remained in positive territory since our last Equity Committee in January, benefiting from diversification outside the US and improved macro signals. GDP growth accelerated in the final quarter of 2025.

Value in pole position

Since the last Committee, value stocks have clearly outperformed growth stocks, both among large caps and among small and mid-caps.

From a sector perspective, defensives outperformed cyclicals. Utilities and Energy posted strong performances, benefiting from stable long-term interest rates, favourable regulatory measures, rising geopolitical tensions (including Venezuela, Iran and Greenland) and higher commodity prices. Consumer Staples also performed well during the period, while Healthcare remained flat, notably due to the significant underperformance of Novo Nordisk, which suffered as a result of its disappointing 2026 guidance.

Among cyclicals, the worst performance came from Consumer Discretionary, which fell sharply over the period, due to the negative impact from tariffs and exchange rates. The luxury goods segment was particularly hard hit, following disappointing Q4 results from companies such as LVMH, which suffered as a result of a tough comparison basis for the quarter. Other cyclical sectors, such as Financials, Industrials and Real Estate, posted slightly positive performances, with the exception being Materials, driven by metals and mining.

Communication was the best performing sector over the period, driven by telecommunications, which benefited from solid results and consolidation talks in France and the Nordic countries. IT remained broadly stable, with a significant performance dispersion between software (negatively impacted by AI disruption risks) and semiconductors (continuing to improve on AI development). To illustrate this dispersion, ASML was one of the best performing stocks of the period, while SAP was one of the worst performers.

Earnings expectations & valuations

European EPS growth is expected to rebound strongly in 2026, rising 11.7% (after +1.0% in 2025)[1]. However, a quarter of this rebound is expected to come from Consumer Discretionary, where EPS should grow by 51% thanks to a favourable comparison basis[2]. Other sectors are expected to post double-digit earnings growth in 2026 (Materials, Communication Services, Industrials, IT, Financials), with Real Estate being an exception. Expectations are more limited for defensive sectors, as most of them (Utilities, Consumer Staples, Healthcare) are expected to post single-digit EPS growth, while earnings are likely to be slightly negative in the Energy sector[3].

Since the last Equity Committee, European valuation multiples have increased, with the 12-month forward P/E ratio now at 15.6x (vs. 15.2x previously), which is at the high end of the historical range. IT and Industrials remain the most expensive sectors (28.5x and 22.0x respectively), while Financials and Energy are the cheapest (11.0x and 11.1x respectively)[4].

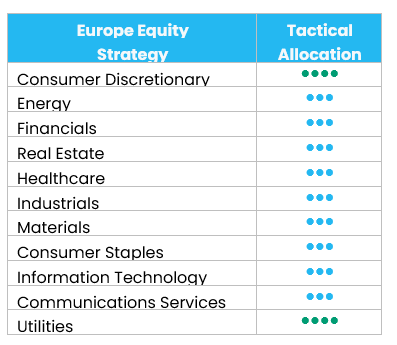

No change in sector grades

We maintain our sector grades.

At level 1, we keep our positive grade (+1) on:

- Consumer Discretionary, as luxury goods (50% of the sector) should benefit from stabilising revenue growth and a favourable outlook for 2026, while we are more cautious on automobiles (European OEMs under pressure due to Chinese competition).

- Utilities, on the back of strong growth drivers (electrification and grid connections) and reasonable valuations.

We also maintain our neutral stance on the other sectors, i.e. Energy (imbalanced market – more supply than demand – and geopolitical tensions), Materials (base chemicals cheap but still in downtrend; more positive trends in metals & mining), Industrials (structural growth in defence and electricals, but tight valuations), Consumer Staples (subdued volume growth), Healthcare (interesting valuations but prices impacted by tariffs), Financials (good visibility on 2026 EPS growth but a consensual long), IT (positive trend for semiconductors but tight valuations, especially for equipment providers; more interesting valuations for software but AI disruption risks), Communication Services and Real Estate.

US equities: Broader market leadership in early 2026

US equities have experienced a volatile but ultimately constructive start to the year. Investors welcomed strong growth figures, continued disinflation and expectations of gradual monetary easing. Sector dispersion increased, with software coming under pressure amid accelerating AI disruption concerns. In light of these developments, we downgraded software to neutral.

Value takes the lead

US equities are trading in a stable yet selective environment, supported by resilient economic growth and moderating inflation. Labour market data points to gradual cooling rather than a sharp slowdown, sustaining overall risk appetite. The steady policy stance of the Federal Reserve has also contributed to investor sentiment. Against this backdrop, style dynamics showed a pronounced rotation, with value clearly outperforming growth and small caps leading large caps. This shift reflects a broadening of market participation.

At sector level, both cyclicals and defensives present a mixed picture. Within cyclicals, Materials and Industrials delivered strong performances, while Consumer Discretionary was the main underperformer. Among defensives, Consumer Staples and Energy stood out positively, whereas Healthcare and Utilities were broadly flat. Communication Services and Information Technology were also relatively stable overall, as strength in hardware and semiconductors offset notable weakness in software. Together, these trends point to a healthier and more diversified market structure, with leadership extending beyond a narrow group of stocks.

Within Information Technology, software attracted heightened investor attention following the launch of Claude Cowork by Anthropic. This no-code AI assistant can autonomously handle specific workflows. Anthropic also released 11 plug-ins across areas such as legal, marketing, sales and data analysis, potentially disrupting a broad set of software companies. Software-as-a-service has always enjoyed structural growth, but markets are now questioning the durability of compounding earnings. This resulted in a strong sell-off in software companies.

Earnings and valuation

Meanwhile, we are more than halfway through the Q4 earnings season, and the S&P 500 is delivering solid results. According to FactSet, 59% of companies have reported, with 76% beating earnings estimates, slightly below the five-year average but in line with the ten-year norm. Revisions remain modestly positive and earnings surprises remain consistent with recent quarters.

Blended expected earnings growth now stands at approximately 15%, supported primarily by Information Technology, which accounts for roughly half of the expected earnings. Financials and Communication Services also provide meaningful support, while other sectors make more moderate contributions.

At present, US equities are trading at roughly 22 times forward earnings. Although this multiple sits above historical norms, it is supported by strong earnings growth.

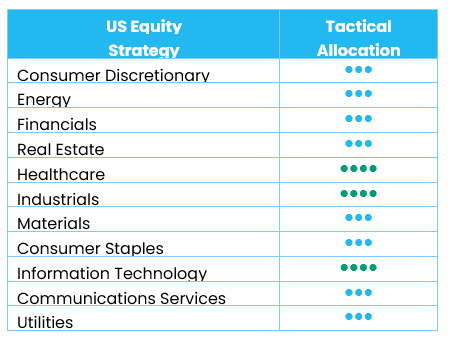

Sub-sector positioning adjustments

We maintain our overall sector allocation, with continued overweight positions in Industrials, Healthcare and Information Technology, consistent with the latest Committee grades.

Industrials (+1) remain supported by reshoring dynamics, fiscal stimulus prospects and improving manufacturing momentum. Within Industrials, we are reducing our grade on commercial & professional services to neutral from +1, reflecting potential AI disruption risks. We maintain a clear preference for capital goods.

Healthcare (+1) remains supported by policy clarity, solid earnings visibility and compelling relative valuations, particularly in pharmaceuticals and biotechnology. Within the sector, we nevertheless downgrade healthcare equipment & services to neutral from +1 in light of limited earnings visibility in managed care and facilities, where rates remain largely government-controlled.

Within Information Technology (+1), we are moving software to neutral from +1. AI disruption is unfolding faster than expected, with increasingly capable models potentially disrupting meaningful parts of the traditional software stack. We are observing some earnings downgrades in selected names, supporting a more cautious stance. We remain nevertheless constructive on technology hardware and semiconductors, where hyperscaler demand and AI infrastructure spending continue to provide strong structural support.

Emerging equities: reasonable valuations and easing financial conditions

Emerging market equities began 2026 with a powerful gain, delivering a sharp rebound in January and outpacing developed markets. Performance was supported by a confluence of cyclical, structural and macroeconomic tailwinds, with investors rotating back into higher-beta regions as global risk appetite improved. The asset class posted its strongest monthly advance in over three years. Currency conditions were broadly supportive. The US dollar resumed its downward trend at the start of the year, providing relief to EM financial conditions and underpinning both equity and FX performance.

The rally was led by technology-heavy markets, where renewed conviction around the AI investment cycle drove a sharp re-rating in semiconductor and hardware supply chains. Memory producers in Asia benefited from strong earnings momentum and constructive demand signals, reinforcing expectations of a prolonged upcycle. South Korea stood out as the top-performing market globally, buoyed by earnings upgrades, policy support and renewed foreign inflows. Taiwan also delivered solid gains.

Commodity-linked equities provided a second leg of support, as strength in precious and base metals translated into strong performance across materials-exposed markets. Latin America emerged as the best performing region within EM, benefiting from a weaker US dollar, resilient commodity prices and improving domestic macro dynamics.

Outlook and drivers

Emerging market equities enter 2026 with tailwinds accumulating. Valuations remain reasonable, financial conditions are easing, and the long shadow of an overvalued US dollar is gradually retreating. Emerging economies, carrying lighter public debt burdens and benefiting from incremental reforms, are positioned to grow faster than their developed peers. Meanwhile, Trump’s Warsh nomination has already sparked concerns over tighter liquidity, with equity markets signalling broad unease.

The technology sector remains a principal engine of the EM earnings cycle. Asia, particularly Korea and Taiwan, sits at the centre of the AI-driven capital expenditure wave that continues to reshape global equity leadership. Key players in memory and semiconductor producers have been demonstrating pricing recovery, improving utilisation rates and structurally higher margins. The earnings inflection remains underappreciated relative to the scale and durability of the cycle.

For metals, price strength remains resilient. Precious metals have led with conviction. Gold’s advance has been orderly and structurally supported, driven by central bank accumulation, declining real yields and persistent geopolitical unease. Silver has moved faster and further, amplified by its dual role as monetary hedge and industrial input. Among industrial metals, copper has emerged as the clearest signal of the next phase of the cycle. Its strength reflects not exuberant growth assumptions, but rising concern over future supply adequacy amid years of underinvestment and resilient demand from electrification and energy infrastructure.

In 2026, EM is no longer a market that can be approached as a single trade on global liquidity or dollar weakness. Outcomes diverge across countries and sectors, shaped by governance, reform momentum, technology exposure and execution. The market is evolving into a place that rewards judgement, patience and a clear-eyed view of where power and profit are truly accumulating.

Positioning update

No rating changes for the month. The year has started strongly in absolute terms and, just as importantly, flows are finally returning to the asset class. That combination continues to validate the core stance we set going into January.

Regions

Korea, which we upgraded again at the start of the year, has emerged as the best performing market year-to-date. Performance has been driven by powerful earnings revisions from the memory leaders we highlighted in January, particularly Samsung Electronics and SK Hynix, as the AI-driven memory upcycle gains traction. Tight supply conditions, improving pricing and rising utilisation rates have translated into a sharp inflection in profitability, while visibility on high-bandwidth memory demand continues to improve. The result has been a broad reassessment of earnings power and balance-sheet strength across the sector, reinforcing Korea’s leadership within emerging markets.

Within Latin America, we continue to favour Brazil over Mexico. Brazil benefits from a broader set of supportive drivers, including leverage to firm commodity prices, a more constructive election backdrop, and valuations that appear relatively favourable versus history and regional peers. In addition, easing local financial conditions and declining real rates are improving the outlook for domestic, long-duration assets. Mexico, by contrast, possesses a tighter valuation profile and higher sensitivity to the US cycle. Taken together, the strength in Materials and improving local rate dynamics leave Brazil better positioned to capture the current phase of the regional cycle.

The decision to downgrade China at the start of the year is proving prudent. The areas under the most pressure remain the large consumption proxies (Consumer Discretionary and Media), where macro data and policy signals have yet to translate into a sustained recovery in household demand. In this context, we are comfortable remaining patient, concentrating exposure on technology segments with clearer and more durable earnings visibility, and allowing the current leadership in Korea, Taiwan, and Materials to continue to compound.

Sectors

Beyond Samsung Electronics and SK Hynix, Taiwan companies are also delivering, with TSMC up and the broader AI supply chain reporting healthy order momentum. We retain a clear tilt towards semiconductors and hardware, where earnings visibility is strongest, while maintaining a modest underweight in software & services, reflecting our more cautious stance on the Information Technology sector in India. Earnings remain the anchor of the strategy. Technology companies’ results and guidance have been consistently strong, with revisions running well ahead of the broader EM universe.

[1] Source: Refinitiv, Bloomberg© – as of 6 February 2026

[2] Source: Refinitiv, Bloomberg© – as of 6 February 2026

[3] Source: Refinitiv, Bloomberg© – as of 6 February 2026

[4] Source: Refinitiv, Bloomberg©, as of 6 February 2026