European equities: Volatility continues into April

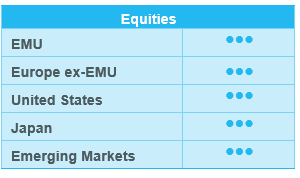

“Volatility” would be the key word to describe global markets in April, as the set of tariffs announced by President Trump were broader and more punitive than expected.

In Europe, the manufacturing PMI was supported by lower energy prices and expectations for fiscal stimulus, which helped offset trade-related headwinds. The eurozone consumer confidence index also dropped, confirming that trade tensions and the unresolved conflict in Ukraine are weighing on economic sentiment.

The European Union decided to suspend retaliatory tariffs on steel and aluminium in an effort to create the conditions for negotiations with the US administration. This decision, coupled with political agreement in Germany to form a new government, provided partial relief.

Since our last committee in April, European markets rebounded strongly after President Trump softened his approach, announcing a “90-day” pause in the implementation of reciprocal tariffs.

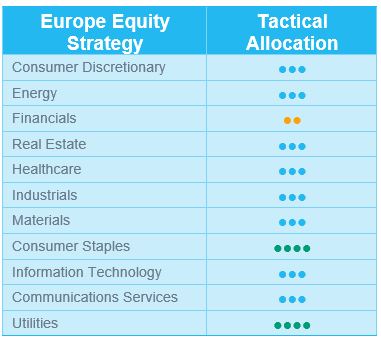

This has led to a solid outperformance across sectors and styles in the past four weeks. In this environment, investors have shifted their focus from defensive to cyclicals stocks. Cyclical companies have led the way, with a clear outperformance from Financials, Industrials and the Real Estate sector. Materials and Consumer Discretionary have also performed well.

Within defensive sectors, Utilities was the strongest outperformer, followed by Healthcare and Consumer Staples. Finally, Energy has been broadly flat over the past few weeks due to the trend in Brent oil prices.

Finally, Information Technology (IT) and Communication Services have also performed well over the past few weeks.

Earnings expectations & valuations

Meanwhile, the earnings season is close to an end. Several companies in the Stoxx Europe 600 have already reported Q1 results. According to JP Morgan data, 55% of those companies were able to beat consensus revenue expectations.

Against this backdrop, investors now count on low single-digit earnings growth for 2025 (+3.7% vs. +6.2% four weeks ago). Consensus expects EPS growth to be mainly driven by Real Estate and Healthcare (with double-digit growth for each). Energy is the sole sector for which consensus expects an earnings decline this year. Concerns around tariffs and the risk of an economic slowdown are the main reasons for these revisions.

Since the last committee, European valuation multiples have remained broadly stable, with 12-month forward P/E of 14.2x (vs 14.4x four weeks ago), which remains well below US multiples (20.9x), despite their recent decrease. IT and Industrials remain the most expensive sectors (P/E of 24.9x and 19.8x respectively), while Energy and Financials are still the cheapest (P/E of 8.2x and 10.1x respectively).

Utilities and Consumer Staples remain our sole positive convictions

We have not made any structural changes to our sector allocation over the past few weeks.

We have maintained our positive (+1) rating on Utilities (given the upside potential from Germany’s upcoming €500bn infrastructure plan) and on Consumer Staples. Both sectors have continued to outperform the broader market in recent weeks.

As a reminder, over the past few weeks, we have downgraded Healthcare to neutral (profit taking on some European pharma companies, which have outperformed on a year-to-date basis). We have also downgraded Financials to -1 from neutral due to stretched valuations and our expectation that the ECB will continue its ongoing rate-cutting cycle, which is expected to weigh negatively on banks’ net interest income.

At this stage, we feel comfortable in our stance and see no reason to make dramatic shifts, as maintaining a cautious approach continues to make sense.

US equities: “Softer Trump” lifts market mood

After a spike in volatility and a broad-based sell-off following 'Liberation Day', investor sentiment has recovered somewhat in recent weeks amid signs of a softer trade stance from President Trump. Markets took comfort in his announcement of a 90-day pause in implementing reciprocal tariffs for countries that had not yet imposed retaliatory measures, alongside ongoing negotiations with China. As a result, US equities have rebounded, though we’re not out of the woods yet.

Midcap growth leads market rebound

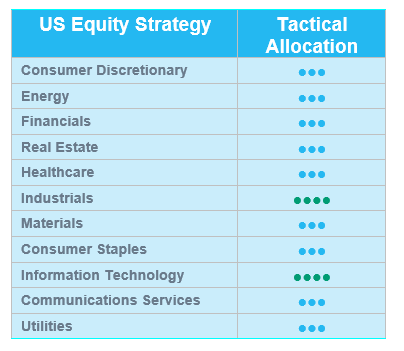

US equities have gained over 10% since the market bottom on April 8th, driven by mid- and large cap growth. Cyclical sectors also played a strong role in the market rebound. We recognise among others the outperformance of industrial companies, but the strongest gain was for Information Technology.

Following this rebound, the US S&P 500 has entirely recovered from the sell-off following ‘Liberation Day’ in early April.

Ongoing Q1 2025 earnings season

Meanwhile, the US earnings season is gaining momentum. At the time of writing, 72% of S&P 500 companies have reported first-quarter earnings. Over 75% have beaten earnings expectations—though it’s worth noting that these expectations had already been significantly revised downward ahead of the reporting season. For Q1 2025, the blended year-over-year earnings growth for the S&P 500 stands at just below 13%, marking the second consecutive quarter of double-digit growth.

However, corporate guidance has turned more cautious amid ongoing trade tensions instigated by the Trump Administration. According to FactSet Research, nearly 60% of companies that have reported so far have issued negative forward guidance. This has prompted analysts to continue revising earnings expectations downward for the remainder of the year. Concerns around tariffs and the risk of an economic slowdown—or even a recession—are the key drivers behind these revisions.

In light of this cautious tone and after the recent rebound, the S&P 500 is now trading above 20 times forward earnings, exceeding both its 5-year and 10-year averages.

For now, President Trump continues to hold the key to the market’s next move.

Upgrade information technology

In today’s rapidly evolving market environment, it remains difficult to hold strong convictions. However, following the positive developments towards a US-China trade deal and Donald Trump’s intention to tackle drug pricing, we have tactically adapted our sector grades on both information technology and health care.

- We have upgraded information technology to +1 on the back of a changing investor positioning (less defensive) after the announcement on the US-China trade deal. Meanwhile, we recognize excellent Q1 earnings for US technology companies and a strong contribution of the AI ecosystem.

- Separately, despite very supportive (long-term) fundamentals, we have tactically downgraded US Healthcare as investors are positioning less defensively and newsflow has become less supportive (FDA nominations, ‘Most Favored Nation’ drug pricing).

Within industrials, we made one slight adjustment: we downgraded the transportation segment from +1 to -1. Transportation is very sensitive to economic activity, which was made very clear in the revenue guidance of the heavy weights in the sector. Earnings have been revised negatively already, but more negative surprises are likely, given the deteriorating economic activity.

Emerging equities: Investor confidence remains cautious

In April, Emerging Markets (EM) delivered gains of 1.0% in USD terms, outperforming Developed Markets (DM) at +0.7%, particularly the US, which posted a 0.6% decline. EM initially experienced a sharp drawdown of 10.6% following the announcement of new US tariffs by the Trump administration. However, markets quickly rebounded as China responded with measured retaliatory actions, helping stabilise sentiment. Nonetheless, investor confidence remained cautious, amid ongoing geopolitical tensions and inconsistent global policy signals.

Asia continued to demonstrate resilience and momentum, with India (+4.7%) leading gains on the back of sustained economic strength and improving macro fundamentals. In contrast, China (-4.6%) faced renewed pressure. Although policy support is improving and valuations appear attractive, investor concerns intensified around the potential impact of declining exports in light of escalating trade tensions with the US.

Latin America (+6.3%) emerged as one of the best performing regions. Mexico (+12.6%) led the charge, benefiting from its strong trade alignment with the US, which shielded it from the brunt of tariff risks. Brazil (+4.3%) also gained despite a mixed macro picture, supported by further easing measures amid persistent inflation.

Emerging Europe benefited from stabilising energy prices and optimism around a potential Russia–Ukraine ceasefire. Hungary (+9.6%), Greece (+6.0%) and Poland (+4.6%) posted strong gains as the region regained investor interest.

In commodities, Brent crude prices dropped 15.5%, while gold continued to rally (+5.3%) as a safe haven amid geopolitical uncertainty. US Treasury yields closed the month at 4.17%.

Outlook and drivers

Geopolitics remains a dominant force shaping the world, as Trump’s escalating rhetoric on tariffs and trade policy continues to inject volatility into daily market movements. With uncertainty now entrenched at historically elevated levels, investment adaptability has become indispensable in navigating this rapidly shifting landscape.

Following Trump’s ‘Liberation Day’ declaration, China responded with its most forceful trade stance in years, announcing reciprocal retaliatory tariffs on US imports. Tariff rates soared, reaching 145%. While some of these measures appear more symbolic than substantive, the domestic response has been very supportive: Chinese investors have accelerated equity market participation, driving robust capital inflows. Still, the significant blow to China’s export sector could weigh significantly on GDP growth this year.

Signs of de-escalation are emerging. The Trump administration has indicated a willingness to negotiate, while China has quietly introduced tariff exemptions on select US goods. Meanwhile, emerging markets offer diversified investment opportunities insulated from direct tariff exposure. LatAm is relatively less impacted, as the US has material needs to cooperate with these neighbours, and Emerging Europe has also gained renewed investor attention.

On currencies, a notable trend of a weaker USD is paving the way for EM equities to move higher once there is a clear outlook in terms of the recession and its impact in the US. This feature is even more important during periods of global growth deceleration, which typically has an outsized impact on trade volumes, even given stable trade relations.

On currencies, the notable weakening of the USD is creating a favourable backdrop for EM equities, especially when clarity increases over a possible US recession. Historical studies show this trend is especially relevant during periods of decelerating global growth, which tend to disproportionately affect trade volumes. A softer dollar not only improves EM countries’ external balances but also supports local liquidity, easing financial conditions and boosting risk appetite.

In terms of themes, AI remains a powerful growth engine in Asia. DeepSeek, already recognised as one of the most promising open-source alternatives to ChatGPT, is set to release its next-generation model in May. Major Chinese tech firms, including Alibaba, are ramping up AI investment, catalysing innovation across verticals such as robotics and autonomous driving. AI adoption across the Asia Pacific region continues to accelerate, creating fertile ground for structural growth.

In this complex environment, a disciplined yet agile investment approach is critical. The portfolio remains positioned to respond dynamically to macroeconomic inflections, while maintaining exposure to high-conviction, long-duration themes. Our commitment to selective, flexible and forward-looking allocation enables us to navigate volatility while capturing the most compelling opportunities across emerging markets.

Positioning Update

We have upgraded China, given the recent positive developments in US-China trade relations. Market sentiment was quite bearish on China, while valuations are attractive and positioning is light. The agreement between the US on China for major tariff cuts for 90 days to cooldown trade tensions is a short-term game changer. As a result we have upgraded China to +1 from neutral. Also Taiwan and Korea have been upgraded to +1 from neutral.

We are downgrading Mexico from +1 to UW. Mexico has been one of the best performing markets YTD and we are taking profits given stretched valuations.

In sectors, we are downgrading Technology from +2 to neutral..

Regions

Asia: China upgraded after trade truce announcement

With regards to China, as mentioned above, the recent positive developments in US-China trade relations are clearly positive for the performance of Chinese equities that trade at a forward P/E of 10, below its long-term average of 12. An upgrade to +1 from neutral is warranted in this context. We monitor the evolution of the tariff deal within this 90-day period, as both sides agree to establish a stable communication channel for further negotiations.

Following the trade truce announcement between the US and China we also upgraded technology-heavy countries. Both Taiwan and Korea have been upgraded to +1 from neutral. Geopolitcial tensions have been alleviated following the US-China talk. Also, US delivered a message of loosening restrictions on chip export, as proved by the trade deal made by Trump in Saudi Arabia.

ASEAN had benefited from the temporary reprieve in US tariffs and a weaker USD, but the region now faces renewed challenges. The re-acceleration of tariffs and softening FDI trends weigh on the region’s outlook.

Mexico

We are taking profits on our rather contrarian overweight position in Mexico, which has performed very well. Mexico has been the second-best performing country in emerging markets YTD, behind Poland. The MSCI Mexico Index is up 23% this year and 13% this month alone (in USD terms), compared to a 5% MTD gain for MSCI Latam. Following a steep rally, we believe the market may consolidate. Valuations appear stretched, and as such, we are looking for a better re-entry point.

India

Despite a strong market performance recently, driven partly by inflows shifting away from China, investors now face increased uncertainty stemming from escalating tensions with Pakistan. The recent terror attack in Kashmir has intensified investor anxiety, prompting traders to book profits amid fears of potential retaliatory measures. Additionally, India's equity markets, already richly valued, could experience selling pressure if investors decide to “sell the news” following optimism around a US trade deal.

Sectors

Following the 90-day trade truce between China and the US, we have adjusted our EM allocation to reflect improved global growth prospects and reduced trade tensions.

- We upgraded cyclicals, raising energy and materials from neutral to +1.

- We similarly increased our exposure to technology and technology-heavy markets such as Taiwan and Korea.

- Conversely, we downgraded the “Pharmaceuticals, Biotechnology and Life Sciences” from +1 to neutral due to rising US healthcare policy uncertainty, including the potential for executive action aimed at lowering drug prices.