Analysing an investment is only the first step. How might your new investment affect the rest of your overall portfolio of investments?

Private Debt Complements Publicly-traded Equities and Fixed Income.

Ideally, investors would like each element in their portfolios to be moving in different directions, so that the overall portfolio does not take too much of a plunge, or drawdown, in difficult markets. Managing your mix of asset types can help.

The key is to achieve a blend of assets which complement and offset each other. It is worth remembering what makes debt structurally complementary to equity – it has a fixed end date, a fixed value, usually offers interim cash flows in the form of interest payments, and comes higher in the balance sheet hierarchy (and so the initial investment is more secure).

- Private Debt is an investment in smaller, rapidly-growing companies. As we outlined in our article, Private Debt and the Real Economy, euro private debt is predominantly loans to growing, small- to medium-sized enterprises (SMEs) with national or regional businesses in Europe. Often, these are smaller than publicly-traded SMEs. So private debt is a complementary exposure to young companies at the center of European competitiveness that might not be available as public equity or public bonds.

- Private Debt instruments are more aligned with like-thinking investors. What we sometimes call ‘control’ might better be described as alignment. As a shareholder in a public company, you have a vote. And you should exercise it. Large public companies have many types of shareholders. Publicly-traded debt, or bonds, also have many types of stakeholders, with different needs and preferences, which become relevant if the company is under pressure. Private debt is a much more direct form of investment, into companies are usually matched with groups of debtholders with similar investing preferences, and into groups whose preferences align with the needs of the particular companies.

Private Debt is Resilient.

“Resilience”, says Private Debt Investor senior editor Andy Thomson, “is a word frequently used when describing how private debt has responded to previous challenges.”[1] The control, alignment, and generally close working relationship between private debt asset managers and their SME borrowers facilitates this. Private debt investment managers accompany the borrower throughout the years of the loan, providing industry knowledge and management advice. This gives early warning before any problems become serious. In public debt of large corporations, the role of the underwriter is to place the debt then step away unless and until a real problem or missed payment actually occurs.

Can you solve this math problem?

For those readers who like to play with math, recall that we like to consider the correlation of asset prices to quantify the level of diversification a new investment adds to a portfolio. With no public market price for private assets, what’s your solution?

We try to answer this conundrum by offering qualitative differences. We also show the volatility of estimated historical valuations of the private debt market against the historical volatility of publicly-traded assets.

Stability in Uncertain Markets? Think Cash Flow.

Some equities do generate cash flow through dividends, although not usually rapidly-growing or SME companies. In uncertain markets, public SMEs are inherently more volatile than the larger, dividend-paying equities. Bonds, you say? Of course, publicly-traded bonds do pay interest, providing cash for investors in uncertain markets. But private debt tends to pay higher rates than for similarly-rated public bonds. (The downside of this trade-off is the illiquidity of private debt.)

Stability in Uncertain Markets? Think Adjustable Interest Rates.

Reading about the risk of stagflation? In contrast to most publicly-traded corporate debt,[2] a major proportion of long-term private debt offers floating rates to their investors.

And while we are on the topic of stability and interest rates, bear in mind that the market value of higher-coupon debt is less volatile than for lower-coupon debt, and the same is true for longer-tenure higher-interest debt.

Other Private Assets?

And compared to private equity? There are, of course, other private asset classes. Private equity has a higher inherent risk than private debt, just as public equity has higher risk than publicly-traded debt. While private equity and private debt are both illiquid, private debt makes scheduled interim payments and has a contractually-specified date for the return of your capital, while private equity has neither. With its high expected returns, private equity has place in some portfolios, but it is far less liquid. If private debt is reserved for cash which is not needed a long but predictable period -- for example, ten years -- most private equity has to be reserved for funds with no foreseeable date of access. And of course, expected returns are just that – expected. With some private or illiquid assets, average returns are high, but the occasional fairy tale is offset by more losses of capital than are typical in public markets. All of these choices – whether and how much – depend on your personal risk/reward trade-off.

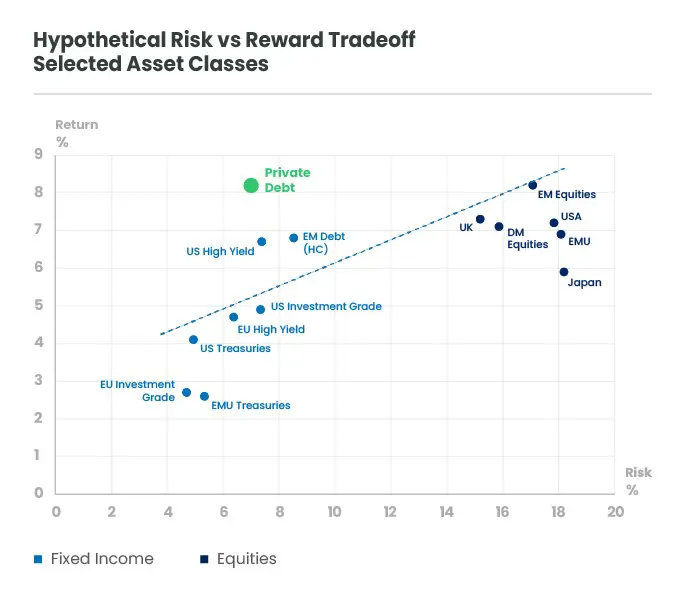

Asset Classes: a Menu of Risk/Reward Trade-offs

Risk is 5-year historical volatility. Returns for publicly-traded asset classes are 10-year projections from Candriam. Return projection for private debt is current €STR of 2.2% plus 6%; typical interest rates are 6% to 7% above Euribor or €STR.

Source: Candriam,[3] Kartesia, Bloomberg.

Looking for an asset which will complement your portfolio, not duplicate it?

With the new European ELTIF[4] investment product in Europe, asset managers can now slice portfolios of these long-term investments in sizes for individual investors. The EU only allows asset managers to make these available to those who are able to invest a portion[5] of their savings in illiquid assets and understand that the investment will be for a number of years, in return for a steady expected income and a lump sum at the end. Not only should you read the prospectus, you should remember that private debt is illiquid until the maturity date, so part of this higher projected return is in exchange for that illiquidity (also known as an ‘illiquidity premium’).

Interested in private assets to diversify your portfolio, but looking for scheduled cash flows? We’ll be back with more on private debt. Watch this space!

[1] Private Debt Investor, 15 May, 2025. Five takeaways from PDI Europe

[2] Exceptions include the very small market of Floating Rate Notes, which are usually very short term, and of course some non-corporate debt such as treasuries or sovereign debt, which may offer inflation-linked interest payments.

[3] Returns of publicly-traded assets are 10-year published forecasts from Candriam (Capital Market Assumptions, June 2025).

[4] ELTIF = European Long-term Investment Fund, ELTIF

[5] Less than 10%. There can be no assurance that the investment objective of the investment product will be achieved or that investors will receive a return. The possibility exists for a partial or total loss of the investment.