European equities: Strong finish to the year

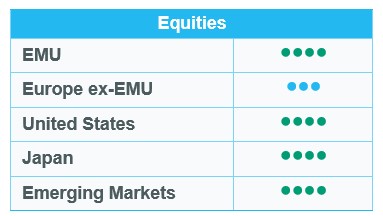

European equities have risen sharply since the last Equity Committee in December, with small caps outperforming large caps. The European macroeconomic environment remained fairly favourable, with inflation still under control, allowing the ECB to stay the course, and with GDP growth prospects showing resilience.

Cyclicals led the way

Since the last committee, there has been no clear performance dispersion between growth and value stocks, both of which have shown a positive trend.

From a sector perspective, cyclicals have outperformed defensives, with industrials leading the way, driven by the Aerospace & Defence segment, which benefited from increased geopolitical tensions. Materials, Financials and Real Estate also posted strong performances, while Consumer Discretionary showed a more limited return.

Within defensives, the best performances came from Healthcare (notably thanks to Novo Nordisk’s strong rebound) and Utilities, while Consumer Staples remained broadly flat, and Energy posted a negative performance.

Lastly, IT remained very well oriented, still driven by the semiconductor segment (especially ASML, which was one of the best individual performers during the period), and Communications rebounded, recovering its recent losses.

Earnings expectations & valuations

EPS growth expectations in Europe for 2025 have been slightly raised but remain limited (+0.8% vs +0.3% five weeks ago), due to the impact of tariffs and the weak US dollar. Several sectors are expected to report negative earnings growth in 2025 (Consumer Discretionary, Materials, Energy, Communication Services Consumer Staples).

For 2026, consensus still expects a strong rebound in earnings growth (+12.1%), driven by Consumer Discretionary (+60% thanks to a favourable comparison basis), Materials (+20%), Communication Services (+19%), Industrials (+12%), Financials (+10%) and IT (+10%). No sector is expected to report negative earnings growth in 2026.

Since the last Equity Committee, European valuation multiples have remained unchanged, with 12-month forward P/E remaining at 15.2x, very close to the high end of the historical range. IT and Industrials remain the most expensive sectors (28.6x and 21.7x, respectively), while Energy is still the cheapest (9.5x).

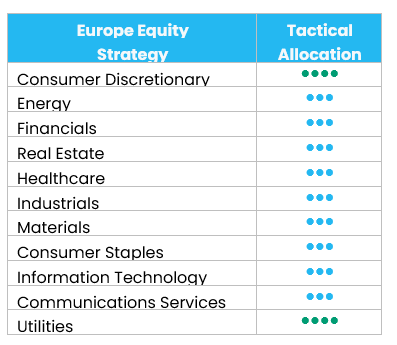

No change in sector grades

We maintain our sector grades.

At Level 1, we remain positive (+1) on Consumer Discretionary (luxury goods, which account for 50% of the sector, benefiting from stabilising revenue growth and a favourable outlook for 2026) and Utilities (growth story for the next few years, driven by electrification and grid connections; reasonable valuations).

We maintain our neutral stance on the other sectors, i.e. Energy (imbalanced market – more supply than demand – and geopolitical tensions, such as in Venezuela), Materials (base chemicals cheap but still trending downwards; more positive trends in metals & mining), Industrials (structural growth in defence and electricals, but expensive valuations), Consumer Staples (subdued volume growth), Healthcare (interesting valuations but prices impacted by tariffs), Financials (good visibility on 2026 EPS growth but consensual long), IT, Communication Services and Real Estate.

US equities: Constructive end to a volatile year

The recent period marked a stabilisation phase following November’s volatility, as markets absorbed the reopening of the US government and the release of delayed economic data. Improved macroeconomic visibility, softer inflation trends and a widely expected Fed rate cut helped anchor sentiment into year-end. While concerns around the sustainability of the AI-driven investment cycle persisted, risk appetite gradually improved as earnings visibility and policy clarity increased.

Increased risk appetite

US equity markets ended December broadly flat, but market internals improved meaningfully. Inflation data continued to trend lower, while labour market indicators pointed to a gradual cooling rather than a sharp deterioration. Against this backdrop, the Federal Reserve’s rate cut and a more accommodative policy outlook supported risk appetite. In this context, small caps extended their outperformance, supported by easing financial conditions and improving growth visibility, while mid-caps also posted solid gains. Large caps were more mixed, reflecting ongoing consolidation in AI-heavy names.

Style performance remained balanced, with value outperforming growth and small caps leading across both styles. At sector level, cyclicals outperformed defensives, with Materials, Industrials and Financials benefiting from improved activity signals and a more constructive yield backdrop. Information Technology underperformed, driven primarily by concerns around software disruption and continued weakness in technology hardware. Defensive sectors lagged overall, although Healthcare showed relative resilience, while Utilities remained an underperformer.

Earnings and valuation

As the new earnings season gets underway, investor focus is shifting back to corporate fundamentals. The reporting period has been kicked off by the largest financial institutions, following a period of upward revisions to earnings expectations, which has helped support a constructive market backdrop. Consensus expectations now point to around 15% earnings growth, driven primarily by Information Technology and complemented by more moderate contributions from Industrials, Healthcare, Financials and Communication Services. By contrast, Energy and Real Estate remain the weakest contributors.

In this context, US equities are trading at approximately 22 times forward earnings, above long-term averages but not excessively high given the current growth outlook. Valuation support therefore remains underpinned by robust earnings growth rather than broad-based multiple expansion. While US equities are trading at elevated valuation levels, the bulk of market performance has been driven by strong EPS growth, reflecting resilient corporate profitability and sustained revenue growth.

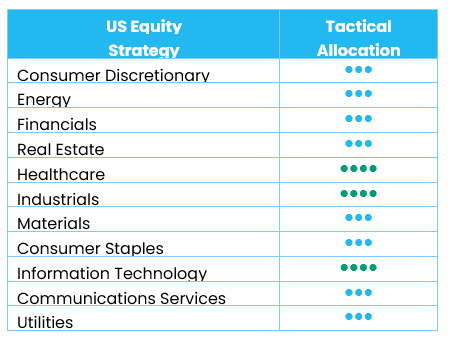

No changes in sector allocation

We maintain our current allocation, with continued overweight positions in Industrials, Healthcare and Information Technology. We remain positive on the Information Technology sector, supported by improving earnings revisions, a resilient Asian supply chain and upcoming earnings that should further validate the sector’s fundamental momentum. Meanwhile, we will closely monitor results and market reactions in the coming weeks in case a shift to a more neutral stance becomes warranted.

Emerging equities: Closing the year with confidence

EMs closed the year with confidence in December (+2.7% in USD), comfortably ahead of DMs (+0.7%). This was the result of a gradual easing of financial conditions, a weakening US dollar and a growing acceptance that the most acute trade fears of the year had begun to recede.

Asia remained the principal engine of returns, led decisively by South Korea (+12%), where equities surged again on the back of strong momentum in Technology and Capital Goods tied to AI infrastructure. Taiwan (+5.7%), Malaysia (+6.3%) and Thailand (+2.4%) also delivered solid gains, supported by technology demand and improving domestic liquidity. China (-1.5%) ended the month lower, weighed down by continued sector-specific weakness and a cautious domestic growth outlook. LatAm (-0.5%) was mixed: commodity-linked markets such as Peru (+9.8%) and Chile (+7.1%) benefited from a sharp rally in industrial metals, while Brazil (-3.5%) lagged as financials came under pressure and local currencies softened. Elsewhere, South Africa (+9%) stood out, supported by a renewed surge in precious metals and falling bond yields, while Central European markets such as Poland (+7.9%) continued to build on a strong fourth quarter.

For commodities, gold (+1.9%) continued to gain, while Brent crude decreased (-3.7%). US yields finished the year at 4.18%.

Outlook and drivers

Emerging-market equities enter 2026 with joining tailwinds. Valuations remain reasonable, financial conditions are easing, and the long shadow of an overvalued US dollar is gradually retreating. After years marked by inflation shocks, aggressive tightening and tariff distortions, the global economy is moving towards a more orthodox expansion, one in which growth is broader and less reliant on policy artifice. Emerging economies, carrying lighter public debt burdens and benefiting from incremental reforms, are positioned to grow faster than their developed peers. This does not imply an indiscriminate rally. The coming year will reward discipline over enthusiasm, fundamentals over slogans.

The technology sector remains a principal engine of the EM earnings cycle. Asia, particularly Korea and Taiwan, sits at the centre of the AI-driven capital expenditure wave, which continues to reshape global equity leadership. Key memory and semiconductor producers have been demonstrating pricing recovery, improving utilisation rates and structurally higher margins. The earnings inflection remains underappreciated relative to the scale and durability of the cycle.

China remains crucial to the way in which the broader EM narrative turns. Policy settings have become more supportive, liquidity conditions are improving, and corporate behaviour is adjusting towards greater capital discipline and investor returns. The earnings recovery is uneven, but it is re-emerging in areas aligned with advanced manufacturing, export-oriented industrial systems and the monetisation of AI. The gap between Chinese equities and the wider EM universe provides a margin of safety that is rare in a world of compressed risk premia. China’s tech edge is underpinned by its coordinated industrial policy, ample financing and rapid execution. It reinforces its role not as a drag, but increasingly as a stabiliser of regional sentiment.

For metals, price strength continues to be resilient. Precious metals have led with conviction. Gold’s advance has been orderly and structurally supported, driven by central bank accumulation, declining real yields and persistent geopolitical unease. Silver has moved faster and further, amplified by its dual role as monetary hedge and industrial input. Among industrial metals, copper has emerged as the clearest signal of the cycle’s next phase. Its strength does not reflect exuberant growth assumptions, but rather rising concern over future supply adequacy amid years of underinvestment and resilient demand from electrification and energy infrastructure.

In 2026, EMs are no longer markets that can be approached as a single trade on global liquidity or dollar weakness. Outcomes diverge across countries and sectors, shaped by governance, reform momentum, technology exposure and execution. The market is evolving into a place that rewards judgement, patience and a clear-eyed view of where power and profit are truly accumulating.

Positioning update

Among regions, we upgraded Korea from neutral to overweight, and downgraded China from overweight to neutral. This is not a negative call on China’s fundamentals, rather a reallocation towards higher-conviction opportunities where earnings visibility and cycle durability are strongest, particularly the Korean technology sector. Meanwhile, we remain positive on China’s technology sector.

Among sectors, we downgraded those most exposed to China, including Consumer Discretionary (from overweight to neutral; including the retailing subsector, from overweight to neutral), and Communication Services (from overweight to neutral; including the media & entertainment and telecom services subsectors, both from overweight to neutral). We upgraded Materials from neutral to overweight owing to the strength of commodity prices.

Regions

Korea upgraded from neutral to overweight

Korea merits an upgrade on the strength of the memory upcycle now unfolding. The combination of AI adoption, accelerating data-centre build-out and surging demand for high-bandwidth memory is tightening supply, lifting prices and pushing utilisation rates higher. Few markets offer such concentrated access to this theme: Samsung Electronics and SK Hynix remain the pivotal beneficiaries, and margin structures are improving as the mix shifts to premium products. In our view, the scale and longevity of the earnings inflection are still underappreciated, creating a favourable setup for active allocation.

China downgraded from overweight to neutral

China steps down to neutral purely as a funding source, for reallocation purposes. We are not revising the core thesis on the country’s technological self-reliance and improving corporate execution; rather, we are redirecting capital to opportunities where earnings trajectories and cycle durability are clearer today.

In line with the country shift, we also normalised China-heavy sector tilts, including Consumer Discretionary and Communication Services, to neutral. We remain constructive on China’s semiconductor and hardware localisation beneficiaries, and retain exposure to select names consistent with our 2026 Outlook.

Recently, several positive policies have been developing. The “anti-involution” campaign, aimed at curbing destructive competition, has been extended. Meituan, for instance, rose sharply on the headlines as investors bet that a stricter framework could rationalise pricing and ease promotional intensity across the sector. Other major governmental measures included cutting taxes, and trade-in programmes encouraging spending.

Venezuela & Latine America

We have no direct or indirect exposure to Venezuela. The country is not represented in the mainstream EM or Frontier benchmarks we track, and international sanctions and market-access constraints have long limited foreign participation in Venezuelan capital markets.

That said, Venezuela remains a latent, long-duration opportunity given its resource endowment: it holds the world’s largest proven oil reserves and significant gold deposits, although production is far below historical peaks and would require substantial reinvestment and policy clarity to normalise.

Regionally, Latin America’s macro backdrop is constructive. A softer US dollar alongside global easing tends to support the region’s currencies and risk assets, amplifying the leverage that commodity exporters have to external cycles. Recent research and market commentary highlight how the dollar’s weakness and easier financial conditions have underpinned flows towards Latin America.

The political map has tilted right in several countries over the past year, most visibly in Argentina, while debates about great-power influence have intensified. Washington’s renewed focus on the hemisphere adds another layer to the investment narrative, even as details and timelines remain fluid. We continue to monitor these dynamics primarily for their implications on energy, trade and capital access rather than as direct portfolio exposures.

Sectors

Consumer Discretionary downgraded from overweight to neutral (including the retailing subsector, from overweight to neutral); Communication Services downgraded from overweight to neutral (including the media & entertainment and telecom services subsectors, both from overweight to neutral).

We downgraded these sectors where China possesses a dominating presence.

Materials upgraded from neutral to overweight

The upgrade reflects continued support from the strength of commodity prices, particularly in precious metals and copper. Structural demand drivers, such as energy transition, electrification and infrastructure investment, combine with constrained supply dynamics to sustain favourable pricing. This provides both earnings momentum and diversification benefits in the portfolio. In addition, it acts as a hedge against currency debasement as budget deficits continue to widen.

Technology: Asia’s AI complex has opened 2026 in front. Tech-heavy regional benchmarks have been clear winners, helped by company updates that reaffirm resilient demand, capex staying power across the AI stack and firmer memory pricing. Optimism around China’s push for tech self-sufficiency has added another leg, with locally-listed semiconductor names rallying and several AI start-ups posting strong debuts in Hong Kong and onshore exchanges.

The relative scorecard versus the US reflects both performance and valuation. Year-to-date, the MSCI Asia-Pac IT (Information Technology) index is up roughly 6% versus around 2% for the Nasdaq, and since the end of 2024, the Asia gauge has outpaced the Nasdaq by a wide margin. Nevertheless, valuations remain sensible, with forward P/E near 16x for Asia IT compared with roughly 25x for the Nasdaq. At the same time, US technology exuberance has cooled: the “Magnificent Seven” have risen only fractionally this year and leadership there looked increasingly narrow through 2025.

Earnings expectations help explain the gap. Aggregate EPS for South Korea and Taiwan is forecast to climb sharply – around the high-70s percent and mid-30s percent respectively, versus growth in the high-20s for the Nasdaq. China’s technology mega caps are also expected to outgrow the US leaders this year for the first time since 2022. With AI infrastructure still in an investment phase and memory suppliers benefiting from product-mix improvements led by HBM (High Bandwidth Memory), Asia’s combination of better growth and more grounded multiples remains compelling.