Are Bonds Beckoning?

European yields have returned to more historical norms following the years in the low-yield wilderness, while the German fiscal situation is reaching an inflection point. Fundamentals create a case for a larger long-term allocation to euro bonds, and an argument for the lower relative volatility of bonds when compared to equity.

Consider a Euro Aggregate Strategy

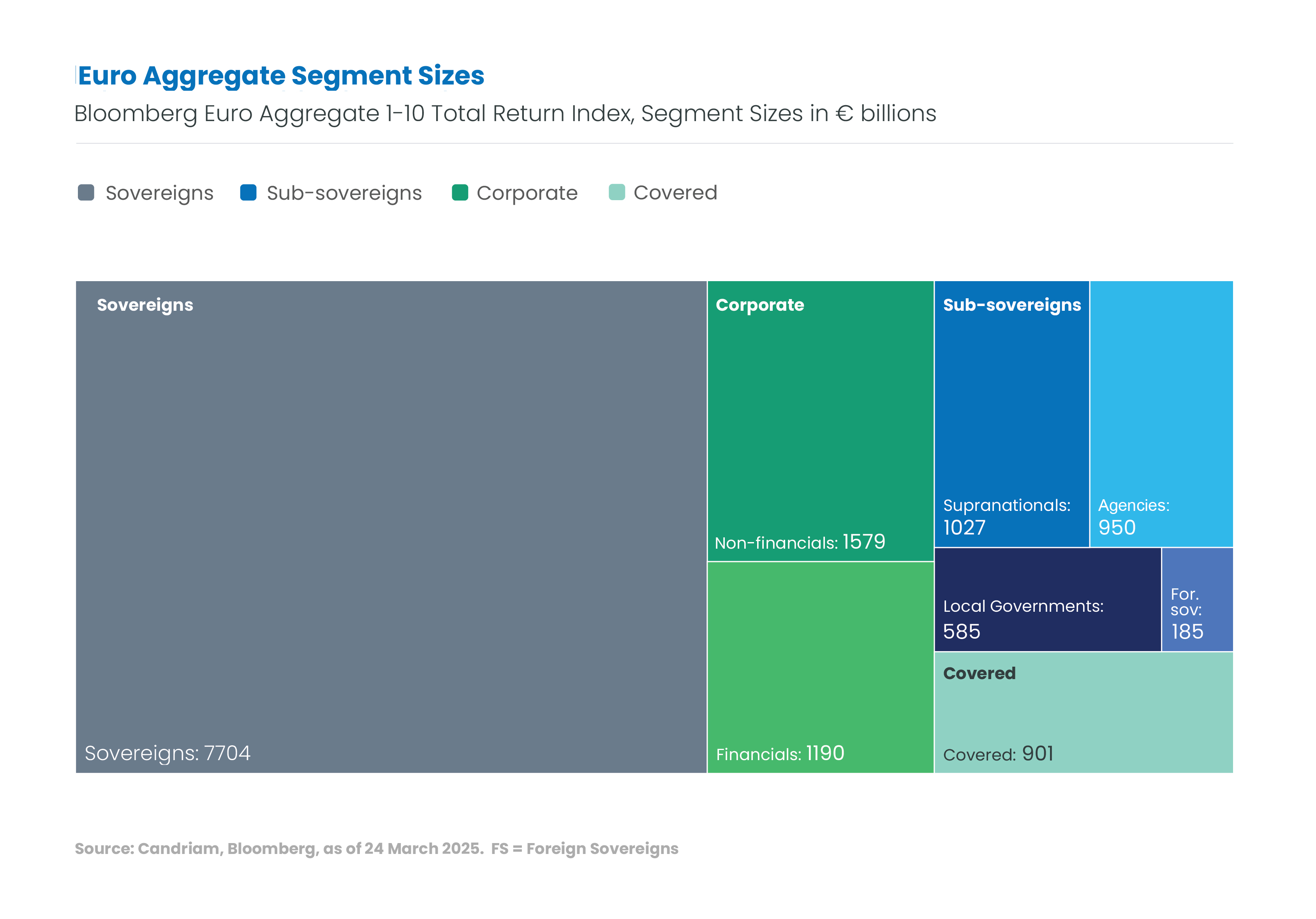

But which fixed income segment or segments should a euro-based investor emphasize? Some investors may prefer to leave the rebalancing decisions within the euro fixed income segments to asset managers by choosing an aggregates strategy. The Bloomberg© Euro Aggregate Universe, for example, includes sovereign, agency, supranational, corporate, and collateralized sectors. At Candriam, when considering the euro aggregates universe we not only re-allocates among these sectors for you across the macroeconomic and market cycles, but from time-to-time we may also include high yield or convertible bonds when their risk/return characteristics are particularly attractive.

Risk-Adjusted Returns are Our Mantra

Read our work over time and you will find us devoted to risk-budgeting, but also to actively-managed, Conviction-based portfolios. We balance active positioning and portfolio manager Convictions against benchmark disciplines, constantly measuring and managing the risk exposure of your investments.

Interested in the basic principles of our Euro Aggregate strategy? Our portfolio managers describe how to benefit from active allocation among fixed income segments in our article

When you say “do the math”, are you the type who wants formulas along with your figures? Our quantitative team gives you that and more on our active risk budgeting in their new white paper

Fixed Income Asset Allocation: How to Leverage Portfolio Manager Convictions

The Euro Aggregate Universe (€ billions)

Candriam Bonds Euro Diversified

Built for shifting markets: a strategy designed to endure

What can a strategy focused on 1-10 year bonds offer to investors?

Many investors are looking for a single fixed income solution they can hold over the long term — one that offers limited risk, diversification and a regular source of income. They may not necessarily want to manage the shifting sectors within this market themselves — instead, they rely on us to do that. That’s where our bonds euro flexible strategy comes in.

We see it as a ‘core plus’ approach — a strategy that forms a central part of a portfolio while allowing flexibility. Its intermediate-term focus helps smooth volatility when interest rates are volatile or make a sharp move, as for many investors, bonds are first and foremost about stability. Compared to strategies specialising in short-term bonds, our intermediate-maturity portfolio offers more potential for decorrelation from equity markets. We believe the strategy sits in a ‘sweet spot’ between return potential and interest rate risk.

What does a ‘core-plus’ mean in practice?

‘Core plus’ means that while the heart of the strategy lies in core investment grade bonds — including sovereign, supranational, and agency debt, as well as corporate issuers — we also have the flexibility to go beyond this core when we see compelling opportunities. When the time is right, we can allocate to other areas such as high yield, emerging market debt, inflation-linked bonds, or convertibles. These are what we call the strategy’s ‘diversification buckets’, which can represent up to 30% of the portfolio.

We do not take on the additional risks of asset classes Emerging Market Debt, High Yield, or Convertibles in general. We do this selectively, only when our analysis suggests the potential reward justifies it. This approach aims to enhance yield over time, while also improving the portfolio’s overall resilience.

How do you select the bonds and build the portfolio?

The investment process starts with a top-down assessment of markets, the economic cycle, the likely course of interest rates, how credit spreads may behave, and which sectors are likely to outperform. This also informs our decisions about allocating to the ‘diversification’ asset classes.

We conduct in-depth, bottom-up analysis to select the individual bonds. We carry out deep fundamental analysis on each issuer, whether sovereign or corporate, assessing its long-term creditworthiness. As an ESG-integration process, each issuer is also evaluated by our in-house sustainability analysts. The resulting portfolio incorporates both our macroeconomic views and our conviction on the individual bonds, a control of the portfolio carbon footprint, and a strong emphasis on risk management.