Last week in a nutshell

- Industrial production in Germany shrank by 0.8% MoM in July but rose by 0.8% in France, highlighting regional divergence.

- In the US, the Fed’s Beige Book confirmed slower activity growth and hiring while businesses renewed expectations for slower wage growth.

- The Japanese economy grew 1.2% QoQ in Q2, slightly less than market forecasts, amid declining service sector sentiment.

- In the euro zone, retail sales decreased by 0.2% MoM in July. On a yearly basis, retail sales were down by 1%, contracting for the 10th consecutive month.

What’s next?

- The ECB will be in the spotlight and confirm the need for a 10th consecutive hike or pause. Under the weight of the cumulative 425 bps points of hikes since July 2022, the 20-member bloc’s economic activity is slowing down leaving consensus at a crossroad.

- The UK will release a series of economic data, including its latest GDP growth rate and may reshuffle the ranking in the G7 growth rates by faring better than Germany while still lagging the US, Canada, Japan, Italy, and France.

- China will publish figures on vehicle and retail sales, house price index and unemployment as authorities just rolled out new stimulus measures to restore confidence in the world’s second largest economy.

- In the wake of the US CPI, the preliminary Michigan Consumer Sentiment, Inflation Expectations and Current Conditions data shall reveal a budding weakness: The US consumer no longer feels the need to make up for the lost time during pandemic-era shutdowns.

Investment convictions

Core scenario

- In terms of economic growth, the landing has started in the US where we witness the absence of a clear deceleration. In the euro zone, the ongoing dataflow is weak. Meanwhile, in China, we see growth losing momentum but triggering more action, in small doses, from authorities.

- The sticky inflation path is finally on a decelerating trend. In the US, the inflation downward trend is to resume in Q4 whereas the ECB will remain vigilant as core inflation is above 5% (but predicted to be below 4% in Q1 2024). China is still a candidate for exporting deflation to the world.

- The persistent tightening by central banks in developed markets is impacting financial conditions. The credit channel is still restrictive as central banks keep their policy rates higher for longer.

- In summary, markets were initially disappointed by higher Fed and ECB terminal rates, but activity deceleration is seen as an obstacle to further hikes. This supports our scenario of range bound markets: Capped by economic deceleration in developed countries but also floored by the end of Central banks’ tightening cycle.

Risks

- While economic policy uncertainty is declining in Europe from last year’s excessive levels, it is stable but high in the US, well ahead of the November 2024 presidential elections.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

Cross asset strategy

- We have a more cautious equities allocation than during the first half of the year, considering the limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

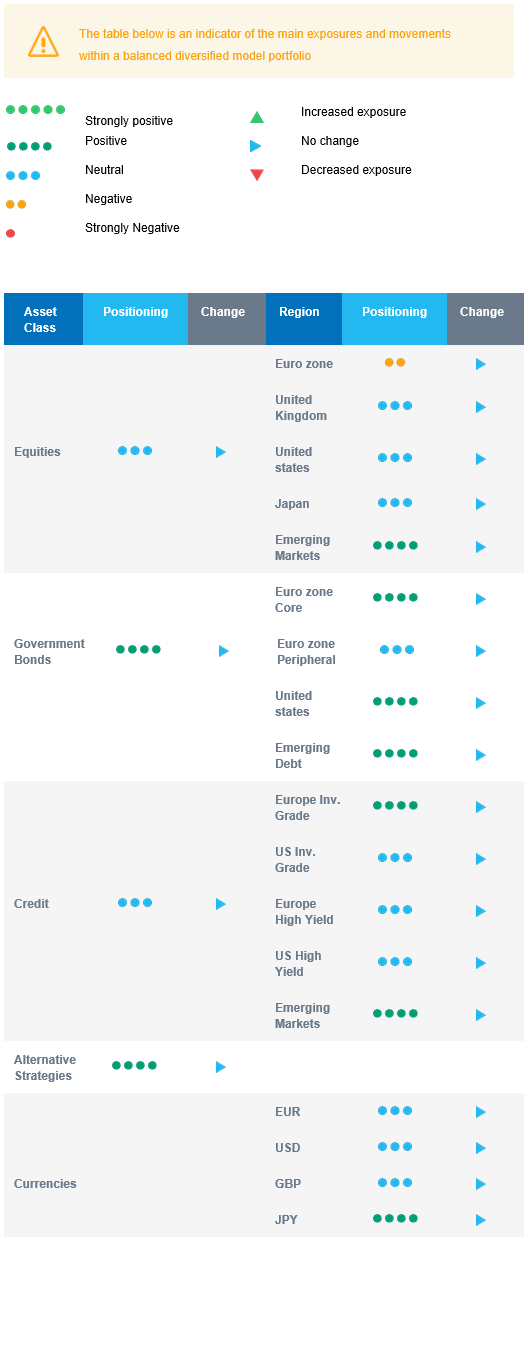

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive. We are overweight Emerging markets vs underweight euro zone where pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery which started in 2022, albeit at a reduced pace compared to the first half of this year.

- In the fixed income allocation:

- In government bonds, we remain positive on US and EU duration. While in the US, the landing has started, there is no reason for the Fed to become dovish. By the same token, there is less growth, but inflation is still too high in the euro zone.

- In credit, we also focus on carry and are positive on Investment Grade, especially by European issuers. The conviction has been strong since the start of the year as carry-to-volatility is attractive.

- We are more prudent on high yield bonds: After rallying in 2023, spreads are now close to historical levels. Strong tightening credit standard should be a headwind.

- We are positive on Emerging debt, hard and local currency, as the bonds continue to offer the most attractive carry. The accommodative stance of the central banks is positive for the asset class. Investor positioning is still light and as the USD is not expected to strengthen, this should represent a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into a long duration mostly via US and European government bonds, a focus on credit that brings carry, i.e. investment grade and emerging debt while being cautious on high yield and lastly a neutral equity stance but with regional nuances. We are positive on emerging equities, amid dovish local central banks and potential further Chinese stimulus. We are negative on euro zone equities due to continued negative economic surprises. We are neutral US equity as the positive US economic scenario seems priced for equities, capping further upside. In terms of sectors, our “late cycle” asset allocation strategy is axed around defensive sectors over cyclicals ones, which are already priced for a recovery.