The results of the US elections are quickly being absorbed by financial markets, propelling US equity indices to new highs. Looking forward, the investor focus will now quickly turn from politics to policy: taken together, the four policy areas president-elect Donald Trump is expected to operate significant changes in – tariffs, taxes, immigration and deregulation – appear overall reflationary for the US, bringing stronger growth and higher inflation next year. Conversely, these measures could weigh on growth for the rest of the world, notably due to trade policy uncertainty, without drawmatically changing the disinflationary path. Accordingly, we have adapted our portfolio positioning to this new context.

A “Smart Trump” scenario

Our outlook is largely guided by two main market drivers: growth and inflation. We anticipate outperformance from the US economy, driven by robust growth, no apparent disequilibrium and reflationary policies. US growth could benefit from tax cuts and deregulation, while Europe may be impacted by uncertainty surrounding trade policies, even though the actual scope of these policies remains to be assessed. As for China, it may require significant fiscal stimulus to overcome deflationary pressures.

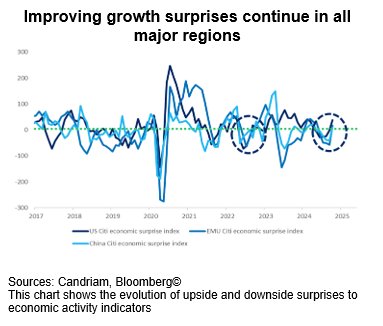

We assign a two-thirds probability to a scenario where the US administration implements some of its trade and immigration policies in a smart way. In this scenario, inflation would rise, but tax cuts would support household income, thereby boosting economic activity. This scenario notably comes just as activity reports from the US to China –and including the Euro area – have already shifted into higher gear in recent weeks.

Nevertheless, we remain cautious about a more extreme, but less likely, scenario: severe immigration restrictions and massive tariff increases could intensify inflation, while a tight labour market might force the Fed to increase its funds rate as early as next year. The growth/inflation mix would then deteriorate markedly.

America first – but who comes second?

In the wake of the US elections, which gave Donald Trump and his party unified control of the elected branches of government, we have adjusted our equity and fixed income positioning based on the potential policy shifts of the future US administration:

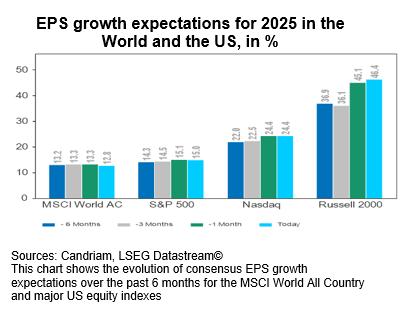

- We have increased our overweight position on US equities, via Financials, Industrials and Small-Cap stocks, sectors set to benefit from stronger GDP growth due to domestically-targeted stimulus policies. These segments will particularly gain from corporate tax cuts and deregulation, with banks accounting for 20% of the Small-Cap index. In this context, expected profit growth of 15% in 2025 for the S&P500 index look realistic.

- We have further downgraded EMU equities, on which we hold a negative view, and which appear most vulnerable to the announced policies of the future US administration. The downgrade includes UK equities, for which we have moved to a neutral view.

- Finally, in emerging markets, although the US election poses a challenge due to currency impacts and trade tensions, we are holding our position with an option on China, awaiting greater clarity from the Chinese authorities and potential further support measures as a response to new US tariff initiatives.

In summary, our current moves reflect a preference for US equities, especially cyclical sectors, while retaining some flexibility in emerging markets. We remain attentive to changes in trade policy and inflation, which will guide our adjustments throughout the coming months.

Germany: Eppur si muove

After three years of a difficult three-party coalition, the German government has finally collapsed at the very moment when results from the US elections came in. We have to go back more than two decades to find a comparable economic context of two consecutive years of growth contraction in Germany.

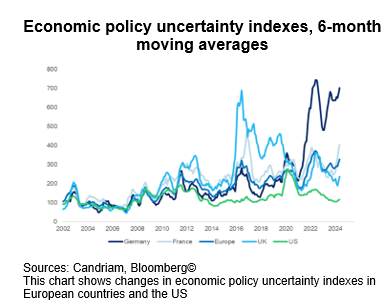

The political process in Germany should lead to a snap election on 23 February 2025. Political uncertainty in Europe – already high, rising and significantly above that in the US – is unlikely to abate sharply by then. However, the German snap elections do open the door to a bit more fiscal impulse: conscious of possibly falling short of a two-thirds supermajority in the new Bundestag, required to make changes to the constitution, the opposition Christian Democrat party (CDU) appears increasingly open to discuss reform of the debt brake ahead of the election. This would definitely create some fiscal headroom for the next government, which could be led by the CDU according to current polls.

Even the Bundesbank has already given its green light to reform of the debt brake, noting the impasse of this budget constraint: “a critical evaluation of economic policy priorities is almost certainly unavoidable, and that evaluation will remain on the agenda even if the debt brake were to be reformed. The Bundesbank would tolerate a reform if it would continue to guarantee sound government finances”. In our understanding, and given the situation in Germany, the introduction of a so-called “golden rule” appears likely, under which the government will borrow only to invest, and not to fund current spending, over the economic cycle.

Much like the result of the US presidential election, the proposals formulated by Mario Draghi to fundamentally reform Europe’s economic architecture to safeguard the future of European competitiveness should have served as a wake-up call, but European countries appear divided on these issues. It is therefore unlikely that his ambitious plan will be implemented swiftly.

In the short term, political differences between member states and resistance to deep fiscal reforms make its implementation difficult. We do not believe that such an ambitious plan will be adopted in the near future, due to the dominance of national interests.

Changes are possible in the medium term, however. The anticipated elections in Germany could pave the way for greater fiscal flexibility, thereby creating a more favourable backdrop for deeper economic reforms and better coordination of European integration. And yet it moves!

Post-election rebalancing: Rotate out of defensives, into cyclicals

In light of recent developments, we have adjusted our sector positioning.

Firstly, we have increased exposure to cyclical sectors in the US:

- Financials: We have increased our exposure to US Financials. The sector may benefit from looser regulation, easier M&A activity, higher long-term rates and potentially more shareholder-friendly policies (e.g. dividends and capital returns). Valuations remain reasonable and financials are supported by solid earnings.

- Industrials: We have also increased exposure to this sector, which is likely to benefit from ongoing reshoring trends and potential tax cuts following Trump’s election. Additionally, Industrials should gain from a potentially stronger economy. We hold a slight preference for capital goods.

Secondly, we have reduced our exposure to defensive sectors:

- Healthcare (reduced to neutral): While we maintain a positive long-term outlook, we have taken a neutral stance on Healthcare due to our more cyclical positioning and higher long-term rates.

- Consumer Staples: We have reduced exposure to US Consumer Staples, as rising tariffs could impact the affordability of many consumer goods. Additionally, potential retaliatory measures may significantly affect US consumer staples companies, which on average derive 40% of their revenue from outside the US.

Finally, we have also reduced Real Estate in the US to underweight, as we believe the changing interest-rate scenario could become a drag on the sector.

A broadly neutral currency allocation, with a preference for the US dollar

EUR: The EUR faces uncertainty over its activity and could see rapid monetary easing.

USD: Markets have re-adjusted Fed rate cut expectations following the US election, which represents a tailwind for the greenback.

JPY: We have reduced our long position on the Japanese yen and are now neutral. As seen during the summer, it continues to make sense to hold the currency as a hedge against rapid market disruptions.

AUD/CAD/NOK: We have taken profit on the AUD last summer and prefer staying on the sidelines of commodity currencies in the current context.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Decreased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|