Why are index rebalancings important for investors?

Damien Vergnaud : When index managers modify the composition of a stock market index, such as the CAC 40 or S&P 500, by removing certain companies, adding others or readjusting the weights of existing stocks, these adjustments have a direct impact on investors' portfolios. These transactions generate substantial flows of purchases and sales, creating both opportunities and risks for investors. Understanding and anticipating the mechanisms and factors behind these rebalances is therefore crucial to making informed investment decisions.

What are the practical consequences for investors?

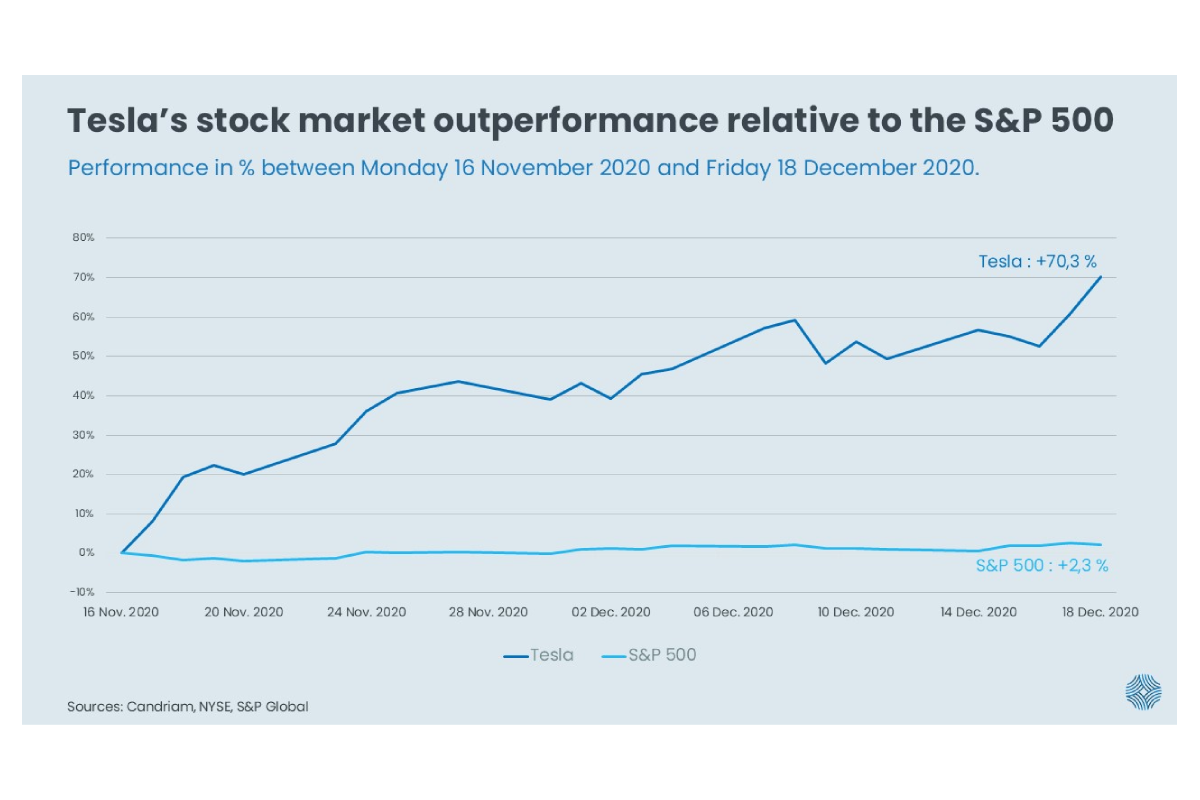

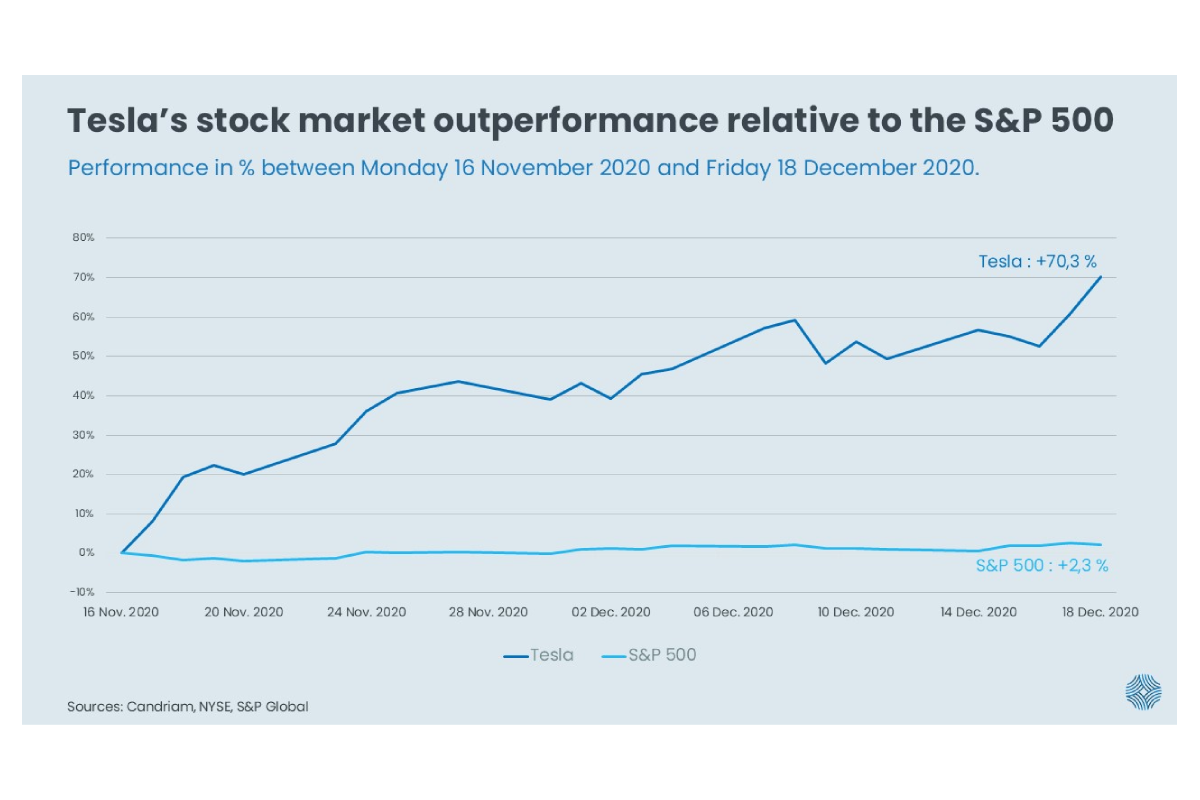

D.V. : Investors can miss out on major opportunities or even suffer substantial losses if index rearrangements are not properly anticipated. This is illustrated by our study on the subject (downloadable from here). For example, Tesla's addition to the S&P 500 index at the end of 2020 triggered an exceptionally large rebalancing, due to Tesla's high market capitalization and strong investor interest in the company. Between the announcement of Tesla's integration on November 16 after the close and its effective entry on the morning of December 21, the stock outperformed the S&P 500 index. . The Tesla case clearly shows that it was better to anticipate such a change.

What are the main factors influencing the scale of index recomposition?

D.V. : Our study highlights several key factors. The number of entries in an index can increase the scale of rebalancing. Market volatility, although its impact is more complex and variable, can also influence the extent of recomposition in certain cases. The role played by market capitalization is another element we have analyzed. Exceptional events such as delistings or large-scale mergers and acquisitions can also lead to major shifts in the indexes.

What are the main findings of your study?

D.V.: Our study highlights the complexity of the mechanisms underlying index recomposition, and the importance of adopting an approach combining quantitative and qualitative analysis to anticipate these changes. The results show that index rebalancing is influenced by a multitude of factors, both structural and cyclical. Consequently, an experienced team with access to vast databases for quantitative research, and the ability to deepen these analyses with a fundamental approach, can be a valuable asset.