As a signatory to the Montreal Carbon Pledge Initiative, Candriam discloses the carbon footprint of all its SRI funds

Candriam, which signed the Montreal Carbon Pledge Initiative in 2015, has undertaken to regularly publish the carbon footprint of its SRI funds.

Candriam’s evaluation of its portfolios’ carbon footprint takes into account scopes 1 and 2 of the greenhouse gas (GHG) emissions of the different private issuers included in the SRI funds and their benchmark indices. These GHG emissions are standardised with respect to issuer turnover (tons of C02 emitted per million eur of turnover), thus enabling a comparison among differently sized companies within the respective portfolios.

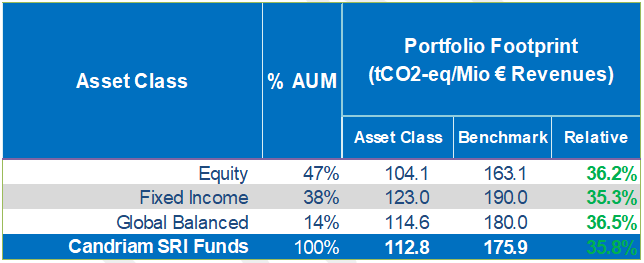

All Candriam’s SRI funds have a carbon footprint of 112.8 tons C02 / EUR million of turnover, i.e., a footprint that is 35.8% lower than that of the composite benchmark index.

The table below shows the results for Candriam’s SRI funds and their benchmark index per asset class. The differences highlighted in green indicate that the total carbon footprint of the SRI funds comprising this asset class is lower than that of the composite benchmark index for the same asset class.

Sources: Candriam calculations based on data output by Trucost, Facset and the MSCI, iBoxx and Citi WBIG index constituents.

100% = 20.548 mia €

This indicator is one of the environmental indicators on which are based SRI-fund ESG evaluation.