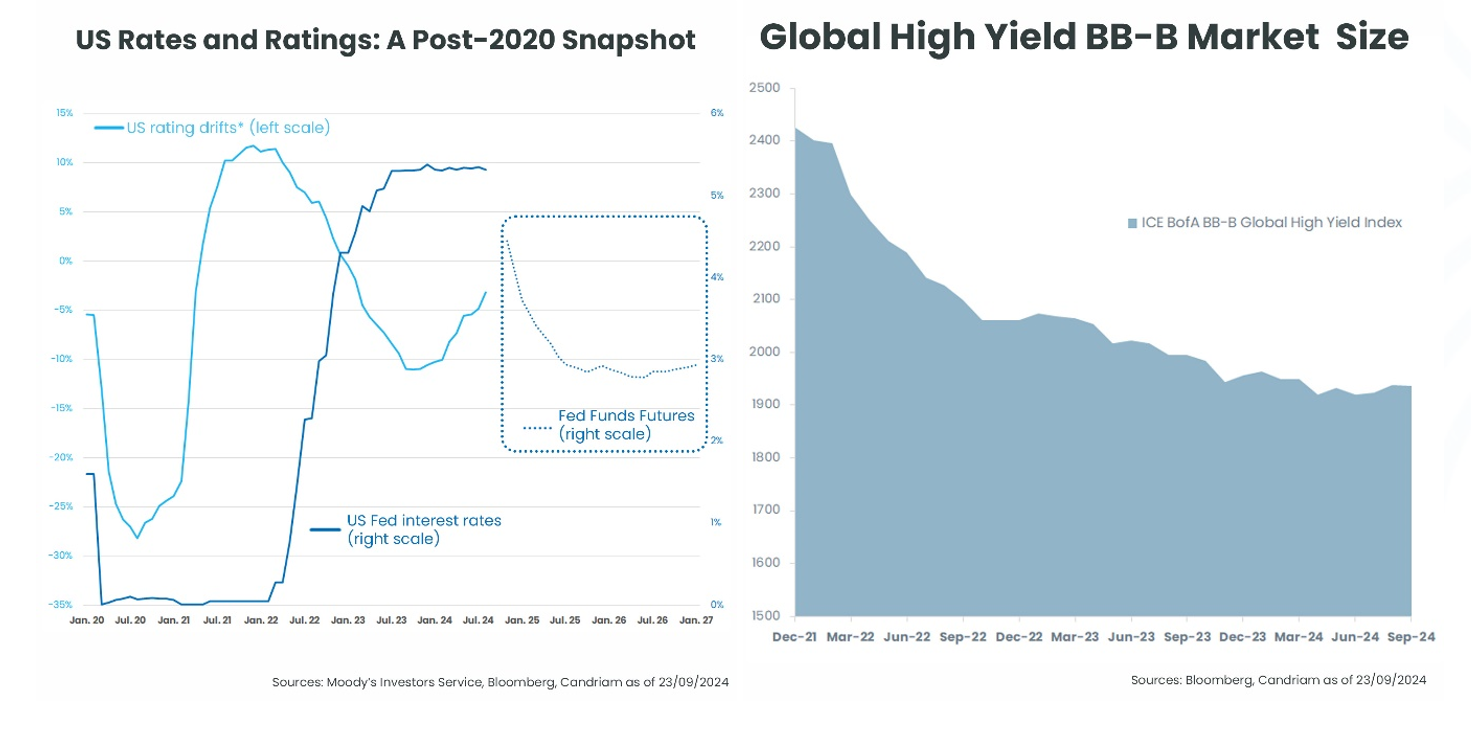

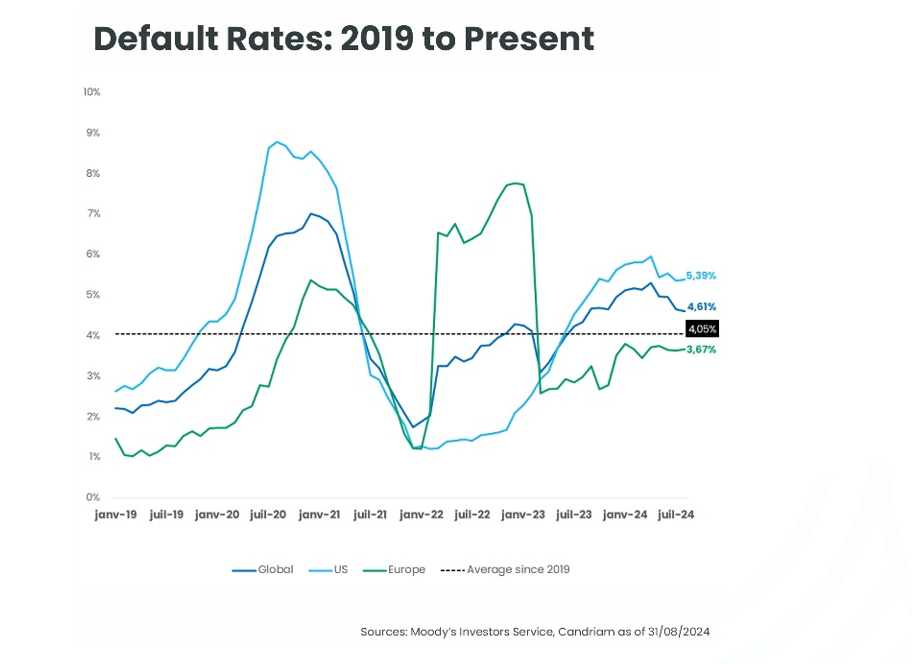

Over the last 2 years Central Banks-driven rates hikes have deeply impacted the High Yield markets globally. Higher rates triggered potential refinancing issues for some corporate borrowers, creating movements at both ends of the High Yield spectrum: Rising stars in the High Yield space moved to the Investment Grade stratosphere (e.g. Ford, Rolls-Royce or Lufthansa), whilst some issuers have moved to distressed ratings. As a consequence the supply of high yields bonds has significantly decreased, leading to a shrinking universe.

Explore Our In-Depth White Paper: “High Yield: The Big Shrink

Yet the current environment is supportive, as inflation is trending lower and the economic slowdown in the US and Europe is fueling hopes for rates cuts, as ignited by the Fed on the 18th of September 2024 .

"Mind the Gap!"

The London Subway

High Yield bonds provide attractive yields, but spreads are currently at very low levels both in the US and in Europe. While the potential for spreads to tighten further is limited, they are becoming more and more vulnerable to potential widening, triggered by a deteriorating economic environment or exogenous geopolitical risks. Fundamentals are holding up, but cracks are appearing, as some issuers are experiencing weakening financial indicators. And with the upcoming elections, volatility on financials markets is very likely to remain high, or even higher.

These dynamics are causing greater market dispersion, which presents both ample investment opportunities and elevated risks in the US and European markets.

Discover our expert's analysis of Candriam's approach to high yield bonds

"Taking calculated risks is quite different from being rash"

George S. Patton

In this challenging environment, understanding downside risk for each issuer is today more than ever a key factor to select the most appropriate bonds in a High Yield portfolio.

“Managing Risks and Seizing Opportunities” is precisely the investment philosophy Candriam has implemented in its High Yield portfolios over the last 20+ years.

Our tried and tested process, implemented by our portfolio managers working together for over a decade can be summarized as follows:

- We filter our investment universe based on company-wide ESG exclusions and liquidity criteria.

- We find investment candidates through a rigorous bottom-up fundamental research for each individual issuer prior to investing: Business profile, Financial profile, ESG profile, Legal covenants and stipulations.

- We select the bonds to be invested according to our highest convictions, after assessing the macroeconomic and market context, including technical and relative value analysis.

- We actively trade bonds and manage our portfolios with a flexible use of derivatives to properly gauge overall credit exposure, currency exposure and duration.

- We monitor our portfolios, everyday, with a strict sell-discipline should our internal credit rating deteriorate, our macro outlook change or better relative value opportunity arise.