If you were intrigued by our June comment on the return of the money markets (Money markets: From liquidity solutions to core investments), you might be curious about some of the other changes.

Invest in ….. cash?

The idea seemed absurd a few months ago, especially in Europe, given the zero or even negative return on bank balances and so-called ‘cash equivalents’. But the situation has changed. Money market funds are regaining some lustre. The asset class has been recording positive average monthly performances since August 2022.

Money Market funds are back in Europe and growing in the US …and not only thanks to inflation

Of course, central banks have been gradually raising refinancing rates from zero since 2022. And we think this monetary tightening should continue in the months to come. The question is, as always, what is the level of inflation in each part of the world.

Just to lay out our definition

With goals of immediate liquidity, low volatility, and a bit more return than cash, money market funds typically invest in short-term government and corporate debt securities (such as treasury bills issued by governments, certificates of deposit issued by banks, or commercial paper issued by companies).

The typical return objective is to mirror the key rate(s) of central banks. Typical benchmarks include the Secured Overnight Financing Rate (SOFR) or the Euro Short-term Rate (ESTR, or €STR), which represent average overnight or 24-hour rates for lending between banks. Money market funds therefore invest in short-term, high-quality securities. The expected return is in line with these short-term rates.

Structural changes have improved the liquidity and reduced the volatility of these strategies

A bit of money market fund history from the US. Decades ago, money market funds were a standard product in the US. After the bank prime rate hit 20.5%, retail customers began to use money market funds with same-day redemption and checking privileges instead of normal bank demand deposit accounts. US money market funds became less ubiquitous as rates fell, but remained a core product. The 2008 Lehman Brothers bankruptcy changed the entire shape of the asset class in the US. The key to using a money market fund instead of cash is that each share maintains a Net Asset Value of $1, remains liquid, and pays competitive interest rates. American investors may not remember the name of the “Reserve Primary Fund”, but they do remember that it ‘broke the buck’ – that the day after the Lehman bankruptcy, because of the portfolio’s holdings in Lehman Bros commercial paper, the NAV of that fund declined below the expected $1 per unit.

This particular instance changed the expectation of immediate liquidity and low volatility. Because investors in US money market funds became easily spooked, the US has bailed out these funds twice, creating an implicit support. US regulators are working to change this.

Before Lehman, US money funds held meaningful amounts of corporate commercial paper. Now, they are more heavily invested in US Treasury bills.

And Europe? Thanks for asking. The 2007 financial crisis highlighted the systemic risk carried by money market funds. Banking regulations were strengthened, and to be effective, it is necessary to prevent a transfer of certain banking activities to a less-regulated ‘shadow banking’ sector.

The Money Markets Fund Regulator (MMFR) provides a more secure framework, intended to provide a minimum level of liquidity through then-new constraints, particularly in terms of investment rules, valuation, knowledge of liabilities and transparency. Among the main developments:

- Specific authorization is required for any UCI[1] using the description of ‘monetary’.

- Tighter investment rules, in particular the obligation to maintain reserves, or pockets, of daily and weekly liquidity, or even limits on specific holdings.

- An assessment of the credit quality of investments established according to an internal methodology

- A ‘mark-to-market’ valuation, ending linearization of fixed-income securities at less than 3 months;

- Knowledge of the liabilities, in order to better anticipate the behavior of investors in the strategy.

- More frequent and comprehensive reporting to both customers and regulators.

Not just structure of the money market funds, the alternatives differ by continent, too. Along came March 2023, when Silicon Valley Bank and CSFB dominated the financial headlines.

The European money market fund sector is much smaller than in the United States. The assets in US money market funds jumped to $5.2 trillion in March from $2.5 trillion in 2014.[2]

European-domiciled money market funds - including sterling and dollar funds - have risen from €1 trillion in assets in 2014 to around €1.5 trillion, according to the European Fund and Asset Management Association (EFAMA). Around 40% of these are denominated in euros.

Analysts say the massive inflows into US money market funds in March were largely due to companies and investors pulling their money out of banks. Do investors trust European banks more than US banks?

We see additional factors :

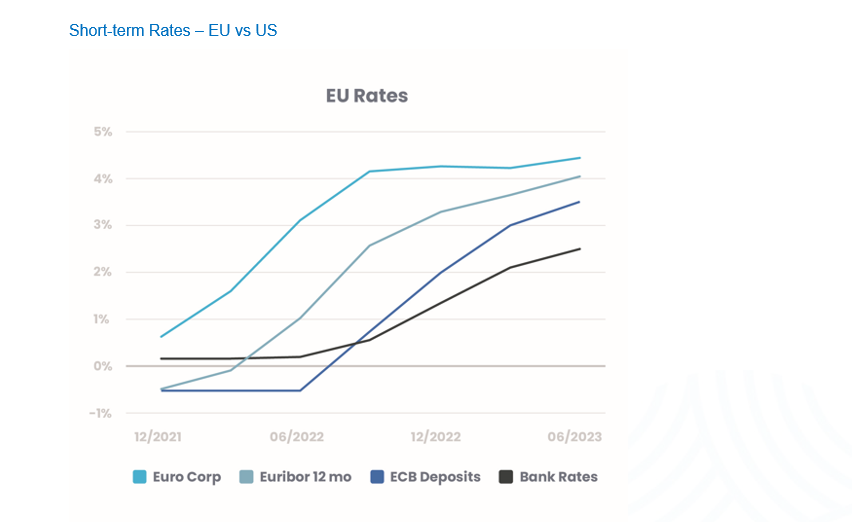

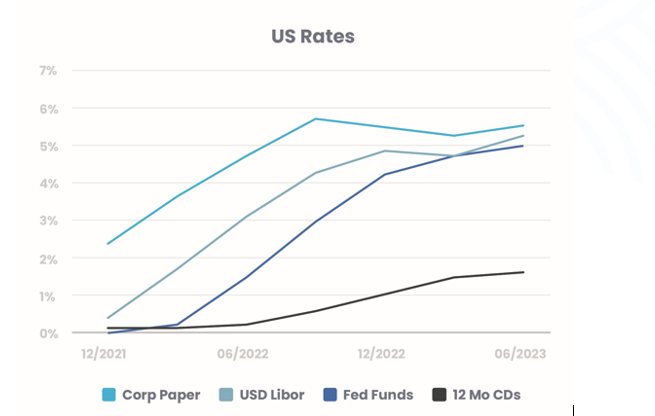

- European banks are passing on rising rate rates more effectively, encouraging customers to keep their money locked up. New deposits with maturities up to one year can yield 2.5% on average in the Euro zone, not too far below the 3.5% interest rate of the European Central Bank, or the return on money market funds, which is close to the ECB rate. In the United States, one-year certificates of deposits (a common proxy for term savings) are remunerated at 1.65%, while Federal Reserve interest rates are in the range of 5% to 5.25% -- a wider gap.

- Some investors remain hesitant to put their money into European money market funds, which are typically invested in bank debt. Around 90% of European money market funds are so-called ‘prime’ funds with notable investments in bank debt. On the other hand, nearly 90% of American money market funds only invest in US Treasury bills, a vast and market which investors consider a safe haven. EU sovereigns do not have the same credit rating, except maybe the German government. The 2015 Euro crisis provides an example.

Source: Candriam and Bloomberg®, some figures estimated. 12month Euribor and 12m $ibor are used as proxies for money market funds. Certificate of deposit rates (CDs) represent the national average of the $100,00 product tier, as published by the FDIC. A one-year CD provides a guaranteed return, secured by the FDIC, and with the option to withdraw or reinvest funds at the end of the term.

Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future.

A suitable choice if you have short-term liquidity needs, or seek a safe haven in market turbulence.

Obviously the main advantage of a money fund is the assumption of very low volatility -- savings are stable and do not vary much. There should be no exposure to either equity markets or to changes in long-term interest rates. Your expected return depends only on the deposit rate and projections set by central banks, helping you to sleep on both ears.

Not enough? Whether you are an institutional or individual investors, we hope our notes are helping you to think about cash alternatives. Happy hunting!

This is a marketing communication. This document is provided for information purposes only and does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Warning: Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance does not predict future returns. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.