One year after the discovery of anti-Covid vaccines, financial markets have already left the pandemic behind. The economy has not.

This is demonstrated by the numerous disruptions among supply chains, on labour markets or on commodity markets. The longest economic expansion in American history – 128 months – has been followed by the shortest recession – 2 months – and registered the sharpest rebound ever measured until now.

Ongoing growth recovery in developed economies

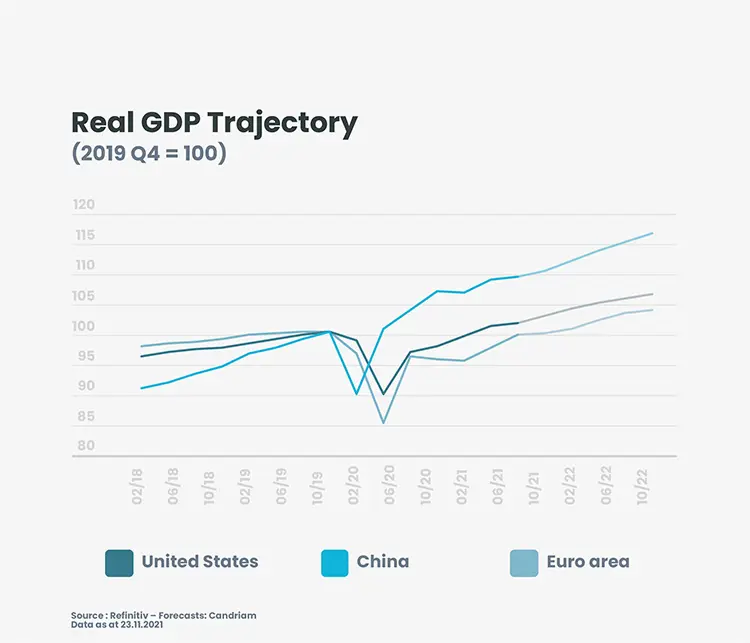

As hoped for, 2021 has been a year of rebirth, a year focused on healthcare developments, of gradual re-opening and return to a more “normal” life. The strong economic performance should continue into 2022, with growth of around 4% both in the United States and in the Euro area. And yet, we are all feeling that this is only the beginning of something new as the pandemic has been a game-changer. We expect all developed economies to regain pre-pandemic output levels by the end of next year, while some emerging market and developing economies will continue to register output losses. Further, employment growth is expected to lag the output recovery as global employment is projected to return to only two-thirds of its pre-pandemic level, due to lingering health concerns and an accelerated shift to automation, among other elements.

Higher inflation for longer… and more lift-off

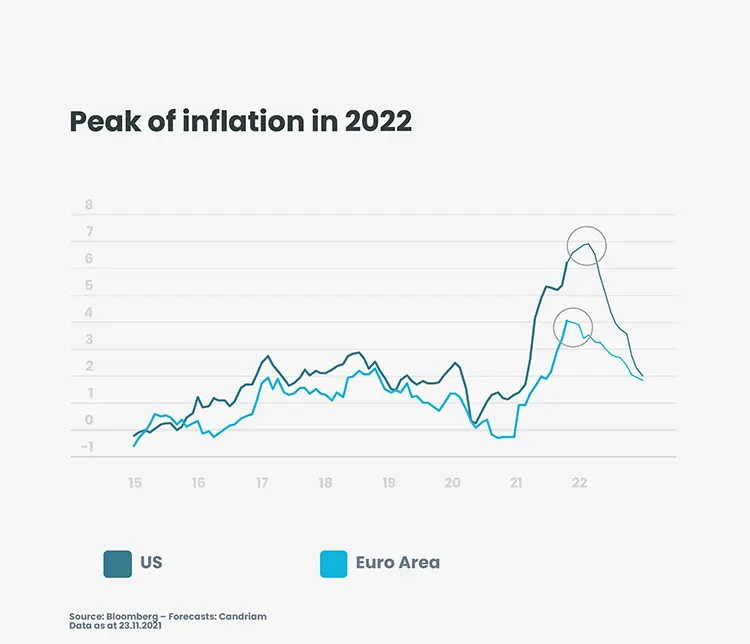

We expect supply and demand will gradually rebalance in an above-potential growth context in major developed economies. As strong demand faces pandemic-related supply bottlenecks, tensions arise and are leading to higher prices. Inflation should remain uncomfortably elevated, at least during the winter months. Hence, we agree with Fed Chair Jerome Powell that the term “transitory” does not mean short-lived, but rather something that is unlikely to result in “permanently or very persistently higher inflation.” We expect inflation expectations to peak in 2022. That being said, inflation worries should fluctuate during the first half of 2022, thereby testing the patience of central banks and bringing volatility to the fixed income markets and impacting equity factors.

We acknowledge that risks of an earlier start to Fed hikes and a much less benign tightening cycle than the previous one are rising. An extreme risk to our central scenario would be that the unprecedented global fiscal and monetary stimulus, which created the economic boom currently underway, could become unsustainable and morph into a high-inflation boom and bust cycle, leading to a double-dip recession. This is not our main scenario. We do not expect any curve inversion during 2022, as we see sufficient margin of manoeuvre for a flattening movement.

Cross-asset approach: Enter 2022 with a preference for equities over bonds, remain flexible

In this environment, 10-year US Treasury yields should evolve between 1.5% and 2.5%, warranting a short duration. This volatile environment will likely lead the yield curve to alternate between steepening and flattening, depending on fears regarding inflation and, more importantly, the Federal Reserve’s reaction function. With the economy getting closer to full employment in the US, we expect the central bank to conclude its tapering by June 2022 and lifting rates during the second half. The transition of a Fed rate hike cycle is a very delicate time, which has historically been associated with a flattening of the yield curve. Therefore, we would underweight US credit combined with a constructive position for European credit. For equity markets, the context of an initial yield curve steepening combined with above-potential growth leads us to begin 2022 with a positive stance. Responsibility remains our active equity choice, seeking opportunities and selecting innovative companies that invest in the world of tomorrow -- healthcare providers, corporates accelerating their decarbonization transition, minimizing waste, and embracing the mobility revolution. Companies 'playing the card' of disruptive technologies also deserve a prominent place in portfolios.

Investment opportunities arise in a challenging environment for Emerging economies

Monetary tightening in the US usually represents a headwind for emerging asset classes. This time around, financial markets have already begun to integrate this development, as most of Latin America and Eastern Europe central banks – Brazil, Mexico, Russia, Poland– have already become less accommodative.

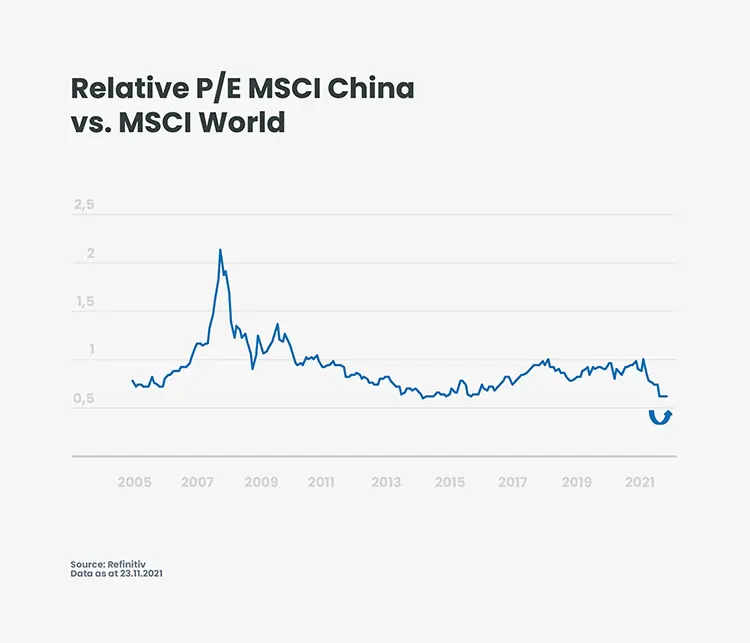

After being the only G20 country registering positive GDP growth in 2020, the investment environment in China has become particularly challenging in 2021. Growth momentum has weakened, affected by the zero-Covid strategy, measures to curb carbon emissions and a deliberate cooling of the property market. While Beijing is likely to step up monetary and fiscal easing measures (without softening its hard stance on the property sector), the risks for growth are skewed to the downside. Our analysis shows that financial markets have integrated this bad news and Chinese valuations look increasingly attractively, Chinese authorities are confident that a new “historical starting point” has been achieved under Xi Jinping’s leadership. He appears set to receive a third 5-year term as paramount leader at the 20th Party congress scheduled for mid-October 2022, providing continuity and visibility for investors.

Euro area still supported

Closer to 'home', the ECB should retain its dovish stance. With the Euro area further from full employment, the ECB will remain accommodative -- it would be a surprise to see the ECB start hiking its short-term rate before mid-2023. Even if pandemic emergency purchases (PEPP) end in March as is widely expected, other asset purchase programs could be amended to ease the fading out of the PEPP. With the ECB continue to by paper in 2022 while the Federal Reserve is phasing our purchases, we find European more attractive than US credit. Following the US leadership, bond yields should however trend higher in the Euro area, and we target a 0.2% yield on the German 10-year. Conversely, investors should become more cautious on peripheral European spreads as we believe that a lot of good news has already been priced in.

On the fiscal front, the rollout of the Next Generation EU plan will be gathering speed, while budgets for 2022 do not look restrictive. At the top of the agenda will be the reform of the Stability and Growth Pact, which dates back to 1997 – a time when Euro area bonds yields were several hundred basis points in positive territory.

Investing for a new era

After two years of lockdowns and reopenings, we expect 2022 to be a more “normal” year in what will be, we hope, the post-Covid era, the New Normal.

Covid-19 has been a global wake-up call to our greatest challenge -- the development and implementation of a just and inclusive energy transition to fight climate change. In the wake of the UN’s COP26 conference, a multitude of announcements and pledges have been made to reduce harmful emissions and limit temperature rises. The new year will be pivotal. As Responsible investors, we have a duty to facilitate and accelerate this transition. We believe that Sustainability is a key driver of investment performance, and that active management will be key in selecting those corporates whose business models make a positive contribution to the world of tomorrow.

It is on this hopeful note that I wish you a very happy 2022.