Central bank tightening monetary measures continue to progressively slow the economic growth rate of most regions around the world. This helped bring the VIX level back over 20. Markets are more nervous and volatile as economies decouple from one another, and it is becoming ever more challenging for corporations to maintain their margins within a higher rates for longer environment and a tense geopolitical context that gets more complex by the day.

Central bank tightening monetary measures continue to progressively slow the economic growth rate of most regions around the world. This helped bring the VIX level back over 20. Markets are more nervous and volatile as economies decouple from one another, and it is becoming ever more challenging for corporations to maintain their margins within a higher rates for longer environment and a tense geopolitical context that gets more complex by the day.

Equity valuations broadly softened around the globe over the month. Small capitalisations suffered the most from renewed expectations of interest rates remaining higher for longer and the flattening of the US yield curve. In terms of sectors, energy, consumer discretionary and industrials lagged defensive sectors such as utilities and consumer staples. Sovereign and corporate credit spreads were volatile during the month, but ended the period broadly unchanged from the end of September.

The HFRX Global Hedge Fund EUR returned -0.95% over the month.

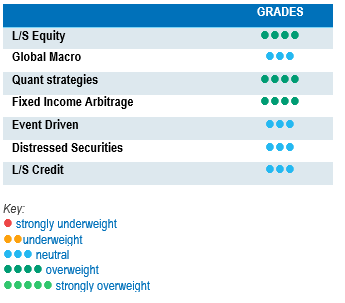

Long-Short Equity

Long-Short Equity strategies were relatively resilient during October. Their average performance was negative but captured only around 30% of the equity downside. Performance dispersion across the different strategy styles was relatively high. Market-neutral strategies averaged positive returns for the month, benefitting from alpha generation on the short book, while directional Long-Short equity strategies with a bias to growth were on average down for the month. According to Morgan Stanley Prime Brokerage, since the start of the year, Long-Short Equity funds investing in the US have generated the highest absolute returns but the up capture ratio of strategies investing in US, Europe and Asia is relatively similar and stands at around 40% of the regional equity index. Performances for the strategy were relative muted since the start of the year due to low-breadth markets, which are not ideal for deploying well-diversified Long-Short Equity strategies, but these market moves tend to be of limited duration, with the trend normalising after August. After periods like these, market trading tends to normalise, offering a larger spectrum of long and short opportunities based on company fundamentals.

Global Macro

Macro strategies averaged modest but positive returns during October. The main performance drivers were short positions in equities, the long on the US dollar and the long on a selective number of commodities. Currently, Global Macro strategies tend to be diversified, holding a wide variety of small bets across equities, rates, currencies and commodities, rather than concentrating their portfolio in just a couple of high conviction trades. Returns generated by macro strategies since the start of the year have been relatively muted and below expectations. However, the current and foreseeable environment is expected to offer interesting investment opportunities.

Quant strategies

October was a good month for Multi-strategy Quantitative strategies, which managed to monetise rising volatility levels across asset classes. Equity statistical arbitrage was one of the best performance contributing models during the period. Trend followers tended to lag more diverse strategies due to the impact of energy price trend reversals after the outbreak of the war in Israel. Since the start of the year, Multi-strategy Quantitative strategies have been more resilient than CTAs, balancing negative contributions from trend models with positive contributions from non-directional arbitrage models.

Fixed Income Arbitrage

Fixed income arbitrage specialists have managed to navigate a tricky year for the strategy generating decent performances. On one hand, strategies that combine pure price arbitrage with fundamental relative value positions have been able to capitalise on fixed income market volatility. Meanwhile, on the directional side, if market participants suffered in March, some managers were able to capitalise on the recent environment to recover their losses with a more measured risk. Relative value traders will still benefit from a healthy opportunity set, while directional funds will continue to face a more challenging environment to take directional bets compared to 2022.

Risk arbitrage – Event-driven

Performances were challenging during October for Event-driven strategies. Merger arbitrage strategies were negatively affected by the Broadcom – VMware deal, whose spread widened on concerns it might be blocked by the Chinese regulator on antitrust issues. Special situation investments continued to face a difficult environment in the face of the ongoing market sell-off. Special situation strategies invest in soft-catalyst situations, which are more correlated to market direction. Merger strategies invest in deals announced by companies wishing to acquire or merge with another company. According to strategy specialists, the number of deals announced is more correlated to the level of visibility corporate management has on the state and direction of the economy rather than the level of the cost of debt itself. As inflation slowly trickles down and interest rates near their peak, we might be at the beginning of a nice cycle for the strategy.

Distressed

The distressed community got an adrenaline shot in March with the collapse of several US financial institutions and Credit Suisse. The surprise failure of Silicon Valley Bank provoked a panic, leading to an indiscriminate sell-off of financial stocks, which progressively reversed for most assets. This was a major event due to the size of the failed banks but contained to a limited number of institutions exposed to a big percentage of uninsured bank deposits. Although the amount of non-performing loans, defaulting issues and bankruptcies remains relatively low, investors are much more alert to the risk of cracks in the market, as economic fundamentals might continue to deteriorate. One area of particular attention is commercial real estate and the percentage that the financing of these assets represents in US regional banks.

Long short credit

Long-short credit strategies seem to be gaining in appeal. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance, as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, again giving fixed income a seat at the asset allocation table. However, as recent events have demonstrated, risk diversification is very important and should be an integral part of the investment allocation process.