The multiple shocks experienced so far in 2022 have led to a rare simultaneous decline in equity and bond values. As uncomfortably high inflation leads major central banks to tighten monetary policies, investors are preparing for the landing of the global economy. Our Multi-Asset strategy is positioned to cope with the economic slowdown underway, and is ready to shift gear depending on the unfolding economic sequence and central banks’ reactions. Our exposure maintains an overall broadly balanced allocation ahead of positioning for the next stage of the cycle, whether it be a soft or hard landing.

Multiple shocks in 2022

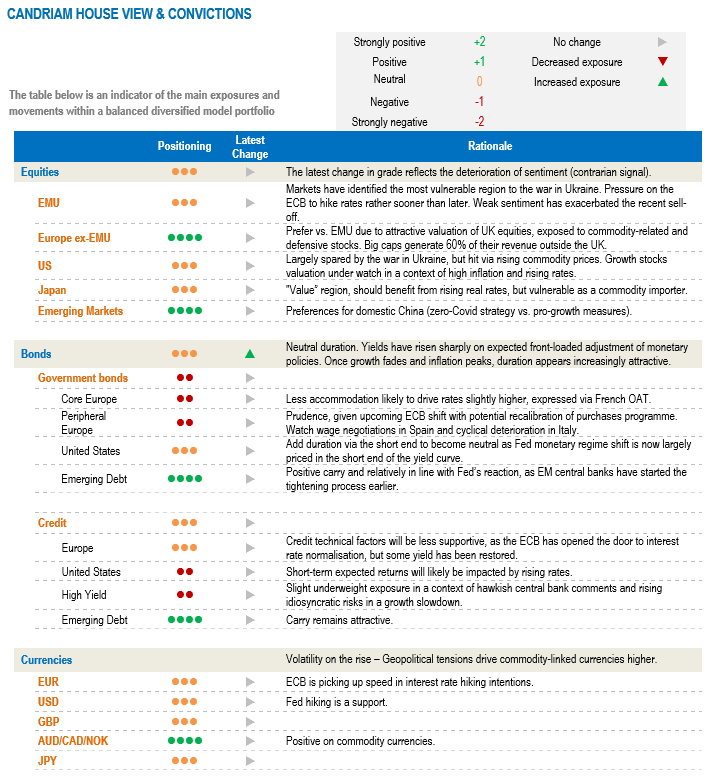

Since the start of the year, investors have had to face a series of shocks, most of them unexpected, which have weighed on activity and fuelled prices, leading to rising inflation. The last to acknowledge this backdrop have been global institutions, such as the World Bank (cutting its global GDP growth expectations for this year from 4.1% in January to 2.9% in June) and the OECD, now estimating 2022 world growth to land at 3%, down from 4.5% projected last December. Confronted with the surge in inflationary pressures, monetary authorities have tightened their policies almost everywhere, with the notable exception of Japan and China. We identify the following series of shocks:

- The war in Ukraine suddenly took centre stage in February. Headwinds from the war via higher costs and a fall in confidence in Europe are weighing on activity and especially on the manufacturing sector. Energy and agriculture commodity prices in particular remain at very high levels.

- Covid-related lockdowns in China during the second quarter have further prevented a normalisation in supple-side tensions. The strict application of a “zero-Covid policy” in China has pushed consumer confidence and spending downwards. As a consequence, authorities have now stepped up both their monetary and fiscal support, contrary to what can be observed in the Western world.

- Sharp monetary tightening, unseen since 1994, has been the consequence, as inflation hit a multi-decade high of 8.6% in May in the United States. The central banks’ firm response had the merit to push US real rates back into positive territory and push long-term inflation expectations towards 2.67%, clearly below the 2.85% hit at the end of April, according to the widely followed 5-year, 5-year USD inflation swap rate.

Without doubt, the first half of 2022 has seen an acceleration towards the end cycle. For investors, it comes as no surprise that economic growth has slowed down and inflation has risen significantly following these multiple shocks. As passengers of the global economy, we have to prepare for landing.

Our medium-term outlook is cautiously optimistic for a gradual recovery once the landing is absorbed.

Negative market performances reflect mediocre growth/inflation mix

Given heightened economic and geopolitical uncertainty, volatility among asset classes has risen in recent months. The central bank reactions to this – again! – unprecedented environment have added further market risks for investors, witness the European Central Bank’s latest decision to speed up its own monetary tightening after months of inaction.

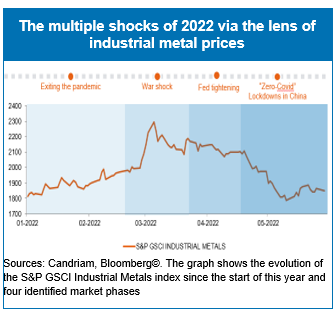

Clearly, the negative performance registered simultaneously on equities and bonds so far this year reflects the deterioration in the growth/inflation mix: simply put, bonds are suffering as a result of rising inflation rates, while equities have been hit both by rising interest rates and by falling growth prospects.

Candriam has been looking into the books of the past 50 years, and discovered that the years in which sovereign bond and equity investments in the US posted negative performances simultaneously are relatively rare occurrences. The only precedent we have found is 1994… i.e. the last time the Federal Reserve started a sharp monetary tightening cycle.

The good news is that these kinds of simultaneous drawdowns are statistically rare events in recent history, even in periods marked by stagflation or recession. The bad news is, of course, that we are currently experiencing this rare event, uncertainties still abound and, technically speaking, the current level of sovereign bond yields offer only a small carry compared to the 1970s.

Our current multi-asset strategy

If 1994 is any guide, the current period should be followed by a soft landing, which is currently the most likely “guesstimate” in our view. We nevertheless have to prepare for the current slowdown ending in a hard landing, if other shocks, including potential central bank errors, occur.

Our multi-asset strategy is positioned for the current slowdown: we reduced our equity exposure in early February and are staying neutral on equities, with some exposure to commodities, including gold.

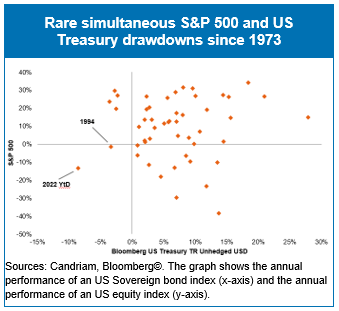

The rise in (real) yields has led to a substantial contraction in equity multiples. The decrease in valuations has been the main trigger of negative equity index performances this year. Earnings have kept growing in all regions except emerging markets, while the US market has been the most impacted by the decrease in valuations.

We are overweight on emerging markets, specifically via China, where we expect an improvement both on the Covid/lockdown and stimulus fronts during H2. The downward adjustment in earnings is more advanced than elsewhere and the policy cycle appears more favourable.

Our overall stance towards equities remains neutral and recent market evolutions confirm our assessment of “fat and flat” price ranges or “wide and volatile” markets.

The longer-term outlook for equities continues to deteriorate, as revenues, margins and, ultimately, profits could be revised down due to high inflation (historically, inflation above 5% has led to a weak equity performance) and an economic slowdown.

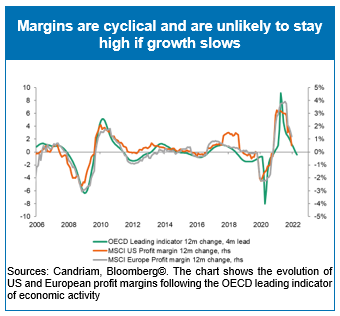

The OECD leading indicator of economic activity, which is now slightly below the level registered last year, has historically shown a four-month lead versus European and US profit margins. Therefore, we should not expect any improvement on this front.

Our active tactical portfolio management will explore investment opportunities, as markets are moving fast and adjusting to the environment.

As we expect growth to fade, inflation expectations at highs and central banks willing to tighten, we continue to think that a longer fixed income duration appears increasingly attractive, in particular following the recent sell-off. The short end of the yield curve in the US seems to be a sweet spot, with decent carry and low duration risk. Further, we are diversifying and sourcing carry via emerging debt, although slower global growth and a strong US dollar represent headwinds.

In our currency strategy, we have exposure to the CAD, which is playing a role as a commodity currency and as a neighbour economy.