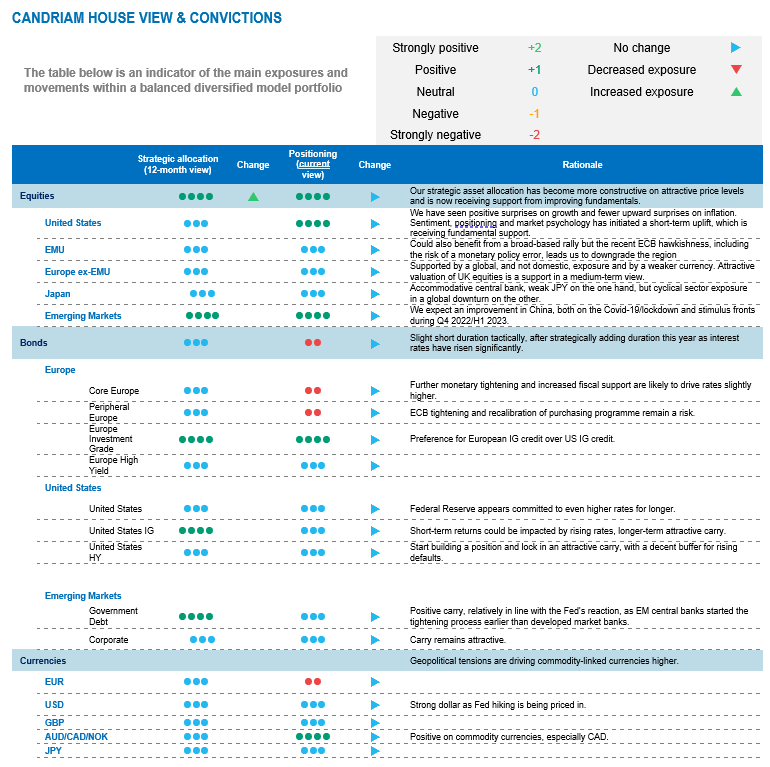

We end 2022 with a preference for equities over bonds, as our investment strategy became more constructive on attractive price levels at the start of the fourth quarter. Chinese re-opening in 2023 would be a substantial support. In addition, central bank actions are almost priced for peak hawkishness and positioning and sentiment are neutral, but not euphoric. Listening to central banks worldwide, we think however that the anti-inflation stance is capping upside for risk assets.

Starting from excessive levels

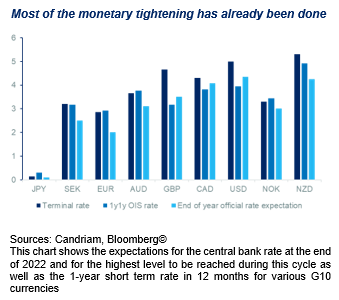

The past year will go down as the sharpest monetary tightening episode in more than four decades. We note that inflation is now showing real signs of deceleration and China is now exporting deflation rather than inflation. Rate hike expectations now see central banks as very close to their terminal rate. The bulk of expectations of monetary tightening are therefore now behind us – a prerequisite to start a bullish trajectory on stocks. The recent monetary tightening phase coincided with the fall in the equity markets and the end of rate hikes should conversely support equities.

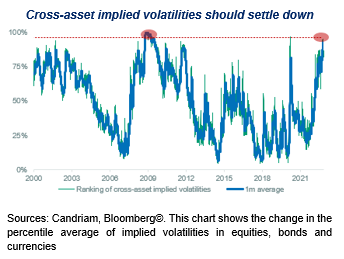

As a result, 2022 performances have been very negative overall for most asset classes year-to-date, with emerging assets the most penalised. It is remarkable that equities and bonds show equivalent negative performances, which is exceptional. We have never had such a negative year for both equities and bonds in recent decades. In this context, we have also seen very high volatility across all asset classes and it seems logical to expect a drop in cross-asset volatility after such an extreme point.

Looking forward, we would expect a new equity market low coming from a tail-risk event. This could trigger a major capitulation in retail investor flows, which has not yet occurred, as private investors have sold little of their equity portfolio.

Equity upside is capped

In our central scenario, investor focus will shift from inflation to growth, as there appears to be less visibility on the outcome than on the inflation path.

In 2022, valuations, measured via the P/E ratios, have experienced one of the worst valuation drawdowns in recent decades showing the pessimism that investors have expressed. However, this has already been partially unwound during the fourth quarter. Better inflation publications have led to improved forecasts of inflation expectations: as far as our economic scenario is concerned, we expect headline CPI to land at 2.3% year-on-year at the end of 2023. Current equity valuations, which are dependent on the evolution of interest rates via discounting future cash-flows, have already taken into account part of this inflation easing going forward. Valuations could certainly improve further.

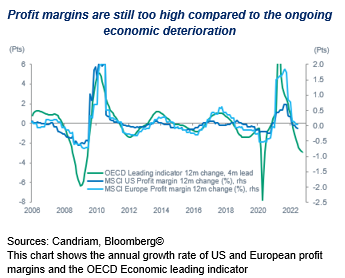

On the growth side, leading indicators show more pain to come on expected profits. Earnings per share (EPS) in the US are set to be negatively impacted in 2023 as we expect a further decline in leading indicators and a deterioration in margins. Overall, we expect EPS growth to fall to zero in 2023.

The end of TINA?

Listening to central banks worldwide, we think that the anti-inflation stance is capping upside for risk assets. Contrary to the high inflation episode of the 1970s, the Federal Reserve has made clear that only tangible signs that inflation will return to its target would put an end to its restrictive stance. We expect its funds rate to hit 5% next spring. In Europe, the ECB is also likely to increase its reference interest rate well into next year.

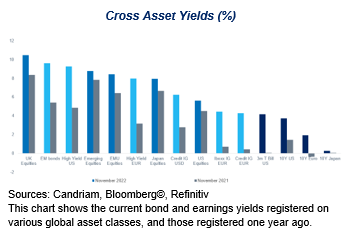

Over the course of the past year, some yield has been restored and expected returns on fixed income holdings have become positive again, in sharp contrast to the situation a year ago. Clearly, our multi-asset strategy has gradually started to lengthen portfolio durations and we expect this to continue in the coming months. We have identified European investment grade issuers with good quality as the sweet spot. We also source carry via emerging debt and global high yield bonds. Overall, yields have increased on both equities (earnings yields) and bonds.

Our outlook for 2023

To sum up, we have chosen the following three directions for our multi-asset portfolios:

- We are overweight on equities, with a preference for Emerging Asian and US regions, and maintain a controlled risk budget.

- We maintain a slight short portfolio duration via EU bonds.

- We have a constructive view on credit, including high yield.

Downside risks would be a monetary policy error via over-tightening in the US or in Europe, a sharp recession risk via a deeper energy crisis in Europe or an unexpected new, harsh Covid-related winter lockdown in China.

Overall, however, inflation is declining and a rise in growth at some point in 2023 is limiting the market downside.

On the other hand, we know that the central bank anti-inflation stance is also capping upside for risk assets. Upside risks include that central bank actions are nearly priced for peak hawkishness and neutral sentiment and positioning. Chinese re-opening in 2023 would also represent a substantial support for the global economy.