European equities: Defensive sectors outperformed the market

European equity markets continued their rally that began at the end of October, with the Stoxx Europe 600 ending 2023 just a tad below its all-time historical high. Inflation figures continue to show a cooling down of price pressures and convinced investors that central banks could start cutting rates in 2024. Economic growth continues to slow, but remains more resilient than previously anticipated.

European equity markets continued their rally that began at the end of October, with the Stoxx Europe 600 ending 2023 just a tad below its all-time historical high. Inflation figures continue to show a cooling down of price pressures and convinced investors that central banks could start cutting rates in 2024. Economic growth continues to slow, but remains more resilient than previously anticipated.

In the meantime, conflicts in the Middle East and in Ukraine are far from resolved, but didn’t materially impact market sentiment.

In terms of performance, small caps outperformed the broader market while being severely penalised by the rise in interest rates over the past few months.

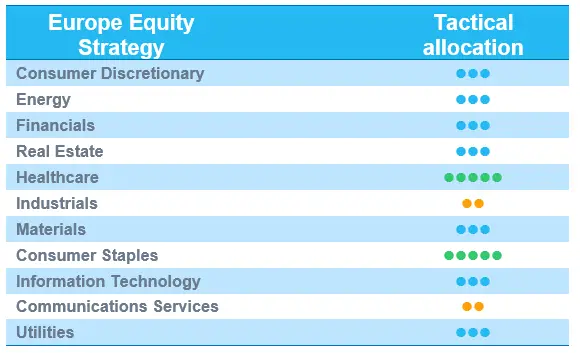

From a sector perspective, defensive sectors outperformed over the same period. Healthcare was the top performer, followed by utilities, which benefited from lower interest rate prospects. Separately, consumer staples also did quite well.

Within cyclical sectors, the two strongest sectors were financials and materials, while consumer discretionary was the worst performer.

Finally, information technology closed the year with a negative performance, but clearly remained the best performing sector of 2023.

Earning expectations and valuations for 2024

Ahead of the start of a new earnings season, analysts have significantly revised down earnings growth expectations. Expected European earnings are now more in line with our macroeconomic scenario. Consensus expectations point to earnings growth of around 5% in 2024. This will be mainly fuelled by materials, healthcare and industrials. Considering this earnings growth, European equity markets look quite attractive. They are still trading at the bottom of their historical range when looking at the 12-month forward price-earnings ratio of around 13.

Upgrade of the healthcare sector

Following the last strong rally of the year and taking into account deteriorating economic activity, we have made one important change to our sector allocation, upgrading our conviction on healthcare to +2 from +1. The sector offers an interesting risk return in Europe on the back of reasonable valuations and high visibility on expected cashflow and earnings growth. We see opportunities in large pharmaceuticals and biotechnology, but also in healthcare equipment. The subsector has been affected by destocking over the past year, but this is now clearly coming to an end. Upside potential in the market segment is significant.

In the meantime, we remain convinced that a cautious approach remains the order of the day, as expressed by the recent changes and our neutral grade in among others consumer discretionary and financials, and a bias towards defensive sectors, such as healthcare and consumer staples.

Don’t chase the small cap rally

The relative rebound of European small caps at the end of last year was impressive. Should we chase it? As of today, we are convinced that it is still too soon to implement a strong conviction on European small caps. After the strong technical rebound, valuations have become less appealing. In order to confirm the recent rebound, earnings momentum will have to improve. In addition, we are not yet at the turning point for the European Central Bank to start cutting interest rates. We are nevertheless convinced that a meaningful correction after the strong rally we have had might create an attractive entry point in the coming months for qualitative European small caps.

US equities: Strong end to the year

US equities ended the year at an all-time high. Investors welcomed recent figures showing inflation continuing to cool down, raising hopes of Fed interest rate cuts in 2024. Fed Chair Jerome Powell confirmed these expectations with a significant shift in the Federal Reserve’s communication. That shift resulted in a strong bond and equity market rally.

Small caps and cyclicals strongly outperformed

Risk sentiment was clearly risk-on in the last month of the year. The rally was mainly driven by small caps and more cyclical and interest rate-sensitive sectors. The best performing sector in December was real estate, followed by industrials, materials, financials and consumer discretionary. More defensive sectors, such as consumer staples and utilities underperformed the broader market. The sole sector ending the last month of the year with a negative quarterly return was energy.

To sum up, 2023 was a great year for US equities, but with considerable performance dispersion. Consumer discretionary, communication services and especially information technology ended the year with impressive gains. A big part of those gains came from the so-called Magnificent Seven, which contributed to more than two-thirds of the S&P’s performance.

Looking forward to 2024

Going into January, some profit taking doesn’t come as a big surprise following the strong year-end rally. The underlying fundamentals have not changed and remain broadly constructive for US equities:

- The US economy is heading towards a soft landing;

- Inflation continues to cool;

- Interest rates have stabilised after the significant decline at the end of 2023;

- The Federal Reserve is expected to start cutting rates this year.

The only downside is perhaps the relatively high expected (consensus) earnings growth of almost 11% this year and the expected price/earnings of 20, which is rather expensive, but not excessively high either. The upcoming earnings season is nevertheless increasingly important and might give a clearer view on equity market direction.

No structural changes

We haven‘t made any structural changes to our sector allocation. We feel comfortable with our positive grade on the defensive healthcare sector: high visibility, increasing M&A activity and attractive valuations justify the positive stance, especially in an environment with slowing economic growth. We also keep our positive stance on the technology sector. The sector benefits from stabilising interest rates, the prospect of Fed rate cuts and the support of artificial intelligence. With the upcoming earning season, selectivity remains key.

Emerging equities: Positive returns in all regions

In December, emerging markets (+3.7% in USD) posted positive returns in all regions, underperforming developed markets (+4.8%). The US saw lower inflation, bolstering expectations of a possible peak in the rate tightening cycle in the US, leading to a decline in the dollar index and also providing tailwinds for the emerging market asset class. China (-2.4%) ended the month with continually mixed economic indicators, including positive export growth, negative import growth, softer CPI and weaker PPI. The country’s December manufacturing PMI decreased to 49, marking another month in the contraction zone. In a year-end recap, the government said it would pursue stability, with the central bank pleading for more injections of liquidity. No breakthrough was observed in government decisions. Top ratings agency Moody's downgraded the Chinese government credit rating outlook from “stable” to “negative”, pointing to concerns over the country’s medium-term growth.

India (+8.1%) put in a positive performance across all sectors. The country managed to maintain an excellent economic trajectory. Sentiment continued to be strong on the Indian stock market, marked by growing foreign inflows. The positive news from the Fed also contributed to India’s sustained growth.

South Korea (+7.1%) witnessed more signs of a bottoming-out, with increasing exports and climbing industrial production. The performance was led by the IT sector. Taiwan (+6.0%) also gained over the month, led by the industrial and IT sectors.

In Latam (+7.7%), the central bank of Mexico (+9.2%) revised up its GDP forecast. Brazil (+6.5%) underperformed while showing positive returns. Meanwhile, the Brazilian central bank implemented another rate cut of 50 bps.

During the month, world leaders concluded the COP28, a crucial global summit on carbon emissions. The urgency of coping with climate change was emphasised. More quantitative requirements were proposed based on the Paris Agreement.

US 10-year treasury yields ended the month at 3.86%. Gold stayed well above USD 2,000, with growth of 1.3%. Oil prices fell 7%.

Outlook and drivers

We are now more optimistic on the outlook for emerging equities, given that a number of the headwinds that they have been facing over the past year have now started to recede. Higher rates in the US and consequently a strengthening dollar had been a key factor weighing on emerging equity returns over the past couple of years. The possible peaking in US rates and a more accommodative rate environment should provide tailwinds to emerging market returns. This tailwind could even be more pronounced for emerging market growth and ESG factors, which are integral to our emerging market strategies.

From a regional perspective, emerging markets outside China have displayed strong resilience, withstanding the weakness triggered by China’s slowdown – turning challenges into opportunities as supply chains are being reshuffled and AI is expediting a recovery in tech hardware and the semiconductor industry.

We are cautious on China, as the road to recovery appears to be a slow and gradual process, aided by selective bouts of monetary and fiscal support, focusing on the longer-term goals of reducing income inequality, data protection and societal benefits. Our exposure to the region is slightly underweight.

In alignment with our strategic outlook, we will maintain a slightly defensive and balanced stance while awaiting further confirmation that interest rates have peaked and that China's economic recovery is gaining momentum, contributing to the differential growth of emerging markets.

Positioning update

We are more optimistic on the outlook for emerging equities given receding headwinds, peaking Fed rates, the weaker USD and Growth performing better as an investment style.

We upgrade India and Taiwan to OW among regions.

No change to our sector views. We maintain a positive stance on the semiconductor space.

Regional views:

India: Overweight. India’s real GDP growth is projected to be 6-7%, making it the fastest-growing major economy in the world. This growth is supported by its favorable demographics. Riding on the geopolitical tailwind, India is positioning itself as a competitor to China, building international alliances and attracting foreign investors. The growth of its domestic investor base is another advantage.

Taiwan: Overweight. Better outlook for tech, especially semiconductors, signals a cycle bottom. Thematic opportunities such as AI provide additional support for growth. TSMC has experienced notable improvements in recent months.

China: Neutral. Macro headwinds persist, including contracting PMIs, the real estate crisis, low consumer confidence and geopolitical pressures. The government is likely to provide more fiscal and monetary support, but growth is likely to be below pre-pandemic levels. China’s outperformance will eventually be more tactical.

LatAm: OW. One of the best performing regions in 2023, and we remain OW. For Mexico, we are closely monitoring the country’s performance given the potential deceleration of US economy, as Mexico is now the US’s largest trading partner. Brazil has already entered an easing cycle, with stronger-than-expected GDP growth and a favourable political environment.

Sector and Industry views:

No changes to sector views. We continue to montior technology and semiconductors (maintain neutral) in particular. Samsung Electronics missed Q4 earnings targets but saw a sequential improvement, signaling a turnaround in Q1 2024. We are probably in the early stages of an upcycle. According to SK Hynix’s CEO, the company’s market value could double within three years due to high AI chip demand. TSMC is bottoming, experiencing 20%+ revenue growth and inventory restocking. It also sees margin improvements and capital expenditure peaking. AI’s contribution to revenue will more than double within five years.