European equities: Defensive sectors outperformed

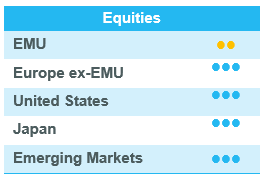

European equity markets continued their decline in October, for the third month in a row, as bond yields rose sharply. In addition, the conflict in the Middle East did not help an already nervous market and caused increased oil price volatility.

European equity markets continued their decline in October, for the third month in a row, as bond yields rose sharply. In addition, the conflict in the Middle East did not help an already nervous market and caused increased oil price volatility.

In this context, European equities fell over the past weeks. There was no strong performance dispersion between small and large caps.

With regard to sectors, performance dispersion was high. Cyclical sectors, such as Industrials, Financials and Consumer Discretionary, underperformed strongly over the past period. Surprisingly, the defensive Healthcare sector also underperformed, mainly due to the weak performance of smaller biotechnology companies and disappointing earnings from Sanofi.

Other defensive sectors nevertheless outperformed. Utilities was the strongest outperformer, followed by Consumer Staples, still one of our biggest sector convictions in an uncertain market environment.

Finally, despite the strong rise in long-term interest rates, Communication Services and Information Technology did quite well and outperformed the broader market.

Earning expectation, valuation and mitigated earnings season

In the meantime, the third-quarter earnings season is picking up speed. In Europe, the earnings season is mixed, with 58% of all STOXX 600 companies that have already reported beating consensus earnings expectations. Q3 earnings growth currently runs at -8%, which is broadly in line with expectations. As expected, Energy and other cyclical sectors, such as Consumer Discretionary, were the main negative contributors. Companies that were unable to report in-line earnings were severely penalised by the market. Defensive sectors, such as Consumer Staples, performed much better.

Following those earnings reports, investors now expect European earnings to grow 6.5% in 2024. The strongest sectors contributing to that expected growth include Healthcare, Communication Services and Consumer Staples.

Considering earnings growth and the recent market decline, valuations look attractive at less than 12 times expected earnings in 2024, which is significantly lower than the long-term median.

Comfortable with defensive bias

We made no significant strategic changes over the past month. We remain convinced that it makes sense to adopt a cautious position in more cyclical sectors, expressed by our neutral grade in Consumer Discretionary and Industrials, among others, and a bias towards defensive sectors.

Despite the recent weak performance we have kept our overweight and positive grade on Healthcare and Consumer Staples. Within Consumer Staples, our preferred industries remain Food and Beverage and Household and Personal Products, as both are driven by top-line growth and resilient margins. We remain cautious on Food Retail, which is suffering from margin pressure.

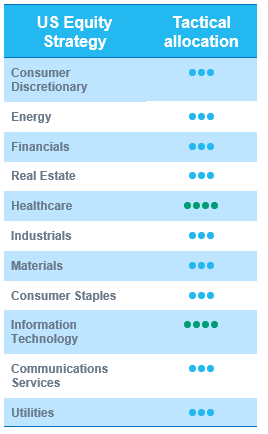

US equities: Defensive bias warranted

Global equity markets lost some ground again in October, as US long-term interest rates broke through the 5% level for the first time since 2007, on the back of better-than-expected economic data and concerns around government finances. November has nevertheless so far sparked an equity market rebound, on the back of declining Treasury yields (a slightly more dovish message from the Fed and slighty weaker macro data in early November).

Small caps underperformed again

US equity markets closed October more than 2% lower. Small caps once again underperformed throughout almost all sectors due to the strong increase in long-term interest rates. Surprisingly, growth stocks held up quite well and even outperformed value.

From a sector perspective, all sectors posted a negative performance over the past month, except for the Utilities sector which gained more than 6%. The defensive Consumer Staples sector also outperformed the broader market, whereas Healthcare was unable to outperform, mainly due to weak performance of smaller companies and biotechnology.

Materials and Information Technology was another sector that outperformed the broader market, whereas the biggest underperforming sectors over the month included Energy and Industrials.

Traditional year-end rally?

It is nevertheless worth noting that the picture has changed since early November. Declining Treasury yields have sparked a rebound in US equities, opening the door for a traditional equity market rally towards the end of the year. The market context has become more constructive following the Q3 earnings season as well, as almost 80% of all S&P 500 companies beat earnings expectations.

Following the decent earnings season, analysts now expect earnings to grow by almost 12% next year, mainly supported by growth in Information Technology, Communication Services and Healthcare.

In addition, US equity market valuations came down further following the recent market decline and earnings season. The US equity market is currently trading at just above 17 times expected earnings in 2024, which is only slightly above the long-term median.

Upgrade of information technology

In early November, we decided to upgrade our grade on Information Technology to +1 from neutral. We are convinced Information Technology will outperform the broader market on the back of:

- Long-term interest rates calming down significantly in the coming months;

- An increased probability of a soft landing of the US economy;

- An increased probability of Fed interest rate cuts in 2024;

- A good earning season for most Information Technology companies without big outliers and an increased focus on cost discipline and margin improvement;

- Encouraging company comments suggesting a bottoming-out of memory semiconductor prices and smartphone and PC markets;

- Artificial intelligence remaining a positive driver;

- Reasonable valuations.

Within Information Technology, we have upgraded all sub-sectors. We currently do not have a particular preference for any of the sub-sectors, as there are pockets of weakness and pockets of strength within each of them.

Emerging equities: More pronounced decline than developed markets

October proved to be a challenging month for Emerging Market (EM) equities, with a 3.9% correction (in USD terms), slightly underperforming Developed Market (DM) equities (-3%). The primary cause for concern was the rising US 10-year Treasury yield, reaching levels not seen since 2007. Even some of the more defensively positioned emerging markets saw corrections, with Mexico experiencing a 7% decline and India witnessing a 3% correction for the month.

In Asia, China's performance closely aligned with emerging market equity returns, experiencing a 4% correction for the month. This was noteworthy, given incrementally positive data points that suggested a potential bottoming of economic indicators. The prospects of further US-China dialogue also supported sentiment. However, these positive signs appeared to be overshadowed by the prevailing risk-off sentiment. Of particular significance in the Chinese context was the shift in fiscal policy stance, as the 3% cap on fiscal deficit was removed, creating room for increased fiscal support to the economy.

In North Asia, Korea experienced unexpected volatility, correcting by 7% in USD terms, especially in thematic and long-duration stocks. This volatility could possibly be attributed to the regulator's removal of the short-selling ban in the previous month. On the other hand, Taiwan remained relatively resilient, with a 2% correction, as the tech giant TSMC indicated the possibility of a recovery in demand and pricing for its semiconductor products.

Among emerging markets, Poland was the top performer during the month, with a significant gain of 16%. Turkey was hit by UST yields and stronger USD. This was driven by anticipation of more reformist economic policies following a surprising election outcome. In Latin America, Brazilian equities performed in line with emerging market returns, even as rising US yields raised questions about the pace of policy easing by the central bank.

Emerging market currencies weakened during the month, with the dollar index gaining 0.5%. In the commodity complex, the most notable development was the strength observed in gold, which held above the $2,000 per ounce mark. This increase was driven by heightened demand for the safe haven asset due to geopolitical conflicts in the Middle East. EM Equity-fund outflows worsened in October, following large outflows in September

Outlook and drivers

Despite our overall positive outlook for EM equities over the longer term, we have maintained a cautious near-term perspective. This caution has been primarily driven by the challenges posed by “high for longer” US Treasury yields, which have created headwinds for EM valuations. Additionally, geopolitical tensions have remained elevated, further contributing to our near-term caution. As a result, we have retained a slightly defensive and balanced position within our strategy to navigate this environment.

In October, we unfortunately witnessed the emergence of another geopolitical conflict in the Middle East, intensifying the risk-off sentiment in the market.

However, the current landscape is starting to change. We have begun to observe signs of softening in US economic activity, which suggests that the Fed may be nearing the end of the current rate-hiking process initiated in March of last year. This development has made us more optimistic about the near-term outlook.

The challenges around the potential for EM equities to outperform become more pronounced as long-term US interest rates rise. It appears that investors are waiting for a full cycle to play out in the US, which includes a GDP recession and subsequent rate cuts, before a robust and lasting demand for EM equities can take hold.

In terms of our positioning, we will continue to maintain a slightly defensive and balanced stance while awaiting further confirmation that the peak of interest rates is behind us and that China's economic recovery is gaining momentum, contributing to the differential growth of EM.

Positioning update

We upgrade South Korea from 0 to +1 for the month – while maintaining selective overweight on ASEAN and Brazil (Latin America region).

No change to our sector views. Last month we downgraded Capital Goods to neutral following concerns over pricing pressure, while maintaining a positive stance on semiconductor space.

Regional views:

Korea: Overweight. Improving outlook for tech hardware and semiconductor heavyweights (Samsung Electronics, SK Hynix, etc.) provide support for the region’s recovery, in addition to thematic opportunities. Valuations are more reasonable following recent correction. High volatility is the only remaining concern, although we have upgraded the region to overweight.

China: Neutral. Macro data from China shows signs of economic activity forming a bottom. Geopolitical headwinds are receding, with an upcoming meeting between US President Biden and Chinese President Xi Jinping. Policy stance continues to turn supportive, especially fiscal-led, for instance issuance of a 1 trillion yuan bond and lifting of the 3% fiscal deficit ceiling. We maintain a neutral exposure on the region.

India: Neutral, although positive on the long term. Corporate profits continue to soar, driven by sustained government spending and recovery in consumption demand as we approach the festive season.

Sector and Industry views:

No changes to sector views. We continue to montor the Semiconductor sector (maintain neutral), where some demand support from AI and Cloud-driven investments could prompt an earlier-than-anticipated recovery.