By Servaas Michielssens, Head of Healthcare, Thematic Global Equity at Candriam

On Sunday, July 27, 2025, the EU and the US successfully concluded a trade agreement, paving the way for strengthened economic relations between the two regions. While initial reports caused some confusion, it now appears that most pharmaceutical products—excluding certain generics—will be subject to a 15% tariff. However, this does not represent the conclusion of the discussion. The pharmaceutical tariffs are still subject to change. An ongoing investigation under Section 232, which explores national security implications, could still be used as a lever to modify tariffs on the pharmaceutical sector.

What are the objectives of the Trump administration? We have identified three primary objectives.

The main and primary objectives of this initiative are to reshore pharmaceutical production, generate domestic employment opportunities, and minimize the nation's reliance on foreign supply chains. This initiative is part of a comprehensive strategy aimed at enhancing economic and healthcare security.

Secondly, there is a tax implication. Many pharmaceutical companies manufacture drugs in countries like Ireland, where favorable tax structures lower their overall tax burden. Onshoring production would allow the US to collect more corporate tax revenue.

Third, tariffs could be used as leverage to address the persistent issue of drug pricing disparities. US consumers often pay significantly more than patients in other developed nations, and the administration may use tariffs to pressure companies into narrowing that gap. Even if pricing and manufacturing are separate issues, they remain politically intertwined.

Impact on the Industry

In the short term, the impact on pharma companies is limited. Many have pre-emptively increased inventories in the US to insulate against near-term disruptions. In the medium term, the industry has already responded with over $200 billion[1] in announced investments to expand US domestic manufacturing capacity.

The Trump administration has publicly praised several companies for these efforts, signaling a willingness to allow time for implementation before enforcing new tariffs. The reality is that building out production infrastructure cannot happen overnight.

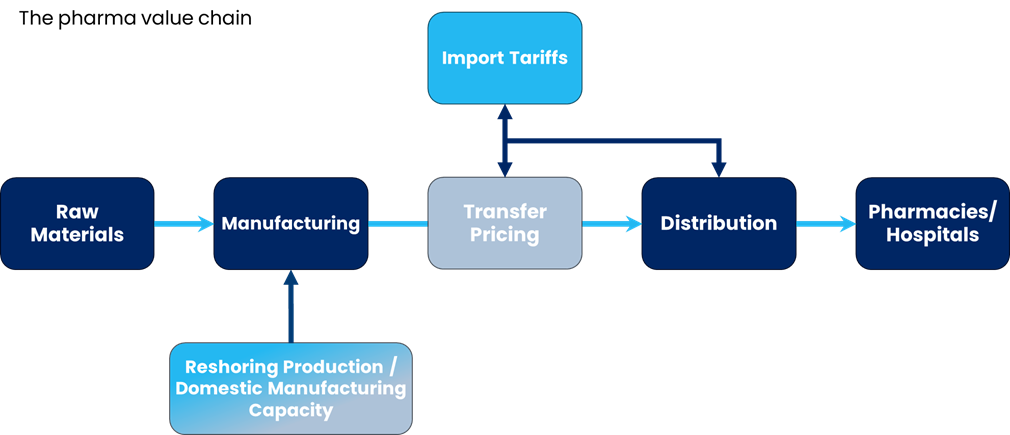

From a business standpoint, pharmaceutical tariffs may not be as disruptive as those in other sectors. With high gross margins, pharma companies can absorb modest increases in costs. However, the complexity lies in transfer pricing. Many firms assign a high internal value to drugs manufactured abroad, partly due to the intellectual property attached to them. This practice shifts profits—and therefore taxes—to lower-tax jurisdictions. If tariffs are implemented, this accounting approach would likely come under scrutiny.

Interestingly, it is worth noting that US-based pharmaceutical companies may be more exposed than their non-US counterparties. Many American firms have relocated their manufacturing operations and intellectual property offshore in order to take advantage of tax arbitrage opportunities. In contrast, foreign firms often maintain significant US production capacity and have less incentive to use aggressive transfer pricing.

Which impacts for our portfolios?

Tariffs are not a major factor in the positioning of our healthcare portfolios. Our investment decisions are primarily driven by a bottom-up approach, focusing on companies whose products and services make a meaningful difference for patients, address large market opportunities, and are led by capable management teams. While we assess potential exposure to geopolitical risks — including tariffs — as part of our position sizing, these considerations rarely serve as key drivers of portfolio construction. Instead, we prioritize factors such as a company's competitive advantage, growth potential, and management quality. Although tariffs may impact certain companies, particularly those with significant international supply chains or manufacturing operations, our research indicates that many healthcare companies have already begun to adapt to potential trade policy changes by diversifying their supply chains and investing in domestic manufacturing capacity. As a result, while we continue to monitor the evolving trade landscape, our investment thesis remains centered on the fundamental strengths and growth prospects of the companies in our portfolios

A Clear Direction Amidst Uncertainty

An initial pharma tariff has now been announced, but it remains a moving target given the ongoing section 232 investigation. Overall, as it stands today, the impact can be absorbed, but we await further details on the exact implementation. The direction is clear, greater US control over the pharmaceutical supply chain, increased tax revenue, and the potential to use additional tariffs via section 232 as a bargaining chip in the drug pricing discussions.

[1] source: Candriam, based on different articles & figures published among main players