European equities: Still up, but at a slower pace

European equities: Still up, but at a slower pace

European equities closed May higher but are no longer outperforming US equities. Progress in US–EU trade talks helped to alleviate fears of recession, while expectations for fiscal support continued to underpin regional sentiment.

Outperformance from IT and Cyclicals

Since our last committee in May, European markets have continued to post positive performances, albeit at a slower pace than in previous months.

There was no clear performance dispersion between large-cap and small- & mid-cap segments. Similarly, value stocks and growth stocks performed broadly in line.

From a sector perspective, Information Technology was the best performer, notably thanks to the rebound of the semiconductor segment.

Defensive sectors underperformed cyclicals during the period, except the Energy sector, which rallied strongly after months of underperformance. Consumer Staples remained flat during the period, while Utilities and Healthcare delivered limited returns.

Within cyclical sectors, Industrials led the way (still driven by the Aerospace & Defence segment), followed by Materials, Real Estate and Financials. Consumer Discretionary continued to lag behind, due to the impact of tariffs.

Earnings expectations & Valuations

Earnings growth expectations for 2025 have been revised downwards, at +2.8% (vs +3.7% four weeks ago). Consensus expects 2025 EPS growth to be driven by Healthcare and Real Estate (+10% each), while Energy and Consumer Staples are the only sectors with negative earnings growth expected this year (-10% and -1% respectively).

Since the last Equity Committee, European valuation multiples have slightly increased, with the 12-month forward P/E now at 14.8x (vs 14.2x). IT and Industrials are the most expensive sectors (27.3x and 21.0x, respectively), while Energy is the cheapest (9.0x).

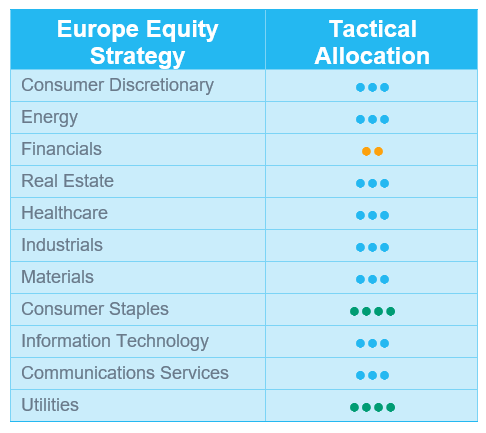

Utilities and Consumer Staples remain our sole positive convictions

We made no structural change to our sector grades over the past weeks.

We have maintained our positive (+1) rating on Utilities (given the upside potential from Germany’s upcoming €500bn infrastructure plan) and on Consumer Staples.

As a reminder, over the past weeks, we have downgraded Healthcare to neutral (profit taking on some European pharma companies, which have outperformed on a year-to-date basis). We have also downgraded Financials to -1 from neutral due to stretched valuations and our expectation that the ECB will continue its ongoing rate-cutting cycle, which should negatively weigh on banks’ net interest income.

At this stage, we feel comfortable in our stance and see no reason to make dramatic shifts, as maintaining a cautious approach continues to make sense.

US equities: “Softer Trump” lifts market mood

In May, US equities continued their recovery that began in April, as consumer sentiment improved and trade tensions eased. Progress in US trade negotiations with the European Union, along with a temporary delay to planned tariff hikes, reduced fears of a global recession and fuelled equity gains.

Solid market performance

US equities have continued to rebound since the last Equity Committee meeting, gaining almost 10%. This strong performance was underpinned by a robust first-quarter earnings season, with 77% of companies reporting positive earnings surprises.

The IT, Consumer Discretionary and Communication Services sectors were particularly strong, while Utilities, Consumer Staples and Healthcare lagged behind.

Outperformance from growth and cyclical stocks

Since the last Equity Committee in May, growth stocks have outperformed value stocks across both large-cap and small- & mid-cap segments. This confirms the trend reversal observed in April, following a first quarter dominated by value.

Cyclicals clearly outperformed defensive sectors during the period. Industrials led the way, with all other cyclical sectors also delivering double-digit returns.

Defensive sectors posted more modest gains but remained in positive territory. Energy was the best-performing sector, while Healthcare, Consumer Staples and Utilities showed only marginal gains.

IT and Communication Services also delivered double-digit returns, supported by strong results from Nvidia, Microsoft and Meta, which reinforced positive momentum in the AI ecosystem.

Earnings expectations & valuations

Earnings growth expectations for 2025 have been slightly revised downward but remain solid at +9.3%. Growth is expected to be driven by IT (+18.8%), Communication Services (+16.6%) and Healthcare (+15.6%). In contrast, Energy and Real Estate are expected to report negative earnings growth.

Since the last Equity Committee, US valuation multiples have increased, with the 12-month forward P/E now at 22.1x. Real Estate, Consumer Discretionary and IT are the most expensive sectors, while Energy and Healthcare are the cheapest.

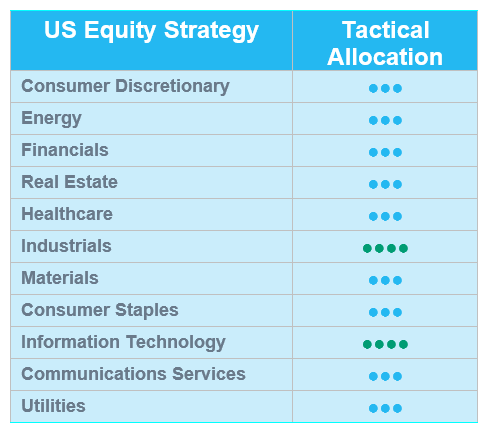

An approach that remains balanced

No changes were made to sector ratings during the Committee meeting. Our approach remains balanced, reflecting the current market uncertainty. At this stage, we see no reason for major shifts in sector allocation and continue to maintain overweights in both the defensive Healthcare sector and Industrials.

As a reminder, we implemented two tactical changes on 12 May, ahead of the Committee:

- We upgraded IT to +1 from neutral, based on shifting investor positioning (less defensive) following the announcement of the US-China trade deal. We also acknowledged excellent Q1 earnings among US tech companies and strong contributions from the AI ecosystem.

- We downgraded Healthcare from +1 to neutral, as investor positioning became less defensive and the newsflow turned less supportive (e.g. FDA nominations and ‘Most Favoured Nation’ drug pricing policy concerns).

Emerging equities: Improvement in US-China trade discussions

In May, emerging markets (EM) posted a steady gain of 4% (in USD) but trailed developed markets (+5.7%). The lift in sentiment was tied to the improved tone in the US-China trade discussions held mid-month, which eased concerns around a global slowdown and prompted upgrades to China's growth outlook.

Asia rose by 4.8% and was a leading performer regionally. Apart from China (+2.4%), Taiwan (+12.8%) and Korea (+7.8%) saw technology names supported by upbeat investment plans from major US firms. Meanwhile, Latin America (+0.9%) delivered flatter returns after a strong start to the year. South Africa rose by 5.2%, buoyed by currency strength and unexpectedly dovish rhetoric from the central bank. Saudi Arabia (-5.6%) declined on weak oil prices. Greece (+11.3%) was among the best-performing individual markets.

Currency moves were generally supportive, with emerging market currencies strengthening for the third straight month. The Taiwanese dollar rallied sharply, followed by gains in the Korean won and South African rand. Equity flows returned to positive territory, reversing sharp withdrawals from the prior month.

In commodities, Brent crude edged higher by 1.2%. Precious metals softened slightly, reflecting reduced demand amid a stabilising macro backdrop. US Treasury yields ended the month at 4.41%.

Outlook and drivers

The recent Geneva talks between the US and China delivered a positive surprise, with both parties issuing a joint statement expressing their intent to move “forward in the spirit of mutual opening, continued communication, cooperation, and mutual respect”. While this signals a potential de-escalation in trade tensions, caution is still required given President Trump's unpredictability. His rhetoric often oscillates, accusing China of having “totally violated” the agreement shortly before giving extravagant praise to the Chinese president. Meanwhile, it is worth noting that Chinese companies have become increasingly diversified in their client portfolios and limited direct exposure to the US, helping to buffer external challenges.

On the currency front, the deteriorating US fiscal outlook continues to weaken the dollar, supporting a structurally bullish case for emerging market currencies, particularly in Asia. This dynamic becomes even more critical during periods of global growth deceleration, when the sensitivity of trade volumes to currency movements tends to be oversized. A softer dollar not only improves emerging countries’ external balances, but also supports local liquidity, easing financial conditions and boosting risk appetite.

Region-wise, Korea has elected a new president from the Democratic party. He has been pushing for a practical approach in terms of governance and diplomacy, which should be supportive to stronger market discipline and improved shareholder protection.

Within the AI investment theme, structural growth drivers remain intact. Taiwan and Korea continue to lead globally in AI development, underpinned by advanced technological capabilities and deep integration with US hyperscalers. Meanwhile, China is pushing AI as a top-down national strategy, catalysing investment booms in multiple application areas such as humanoid robotics, autonomous driving and smart home ecosystems.

Positioning Update

We are downgrading Korea from overweight to neutral. We are taking profit on Korea following its strong recent performance. It is a leading performer year to date, outperforming MSCI Emerging Markets and MSCI Asia Pacific, which showed signs of being overbought.

Regions

Korea downgraded to neutral

We are downgrading Korea as the country’s relative strength index (RSI) climbed to a very high level. The Korean stock market has shown notable strength, buoyed in part by recent political developments. The outcome of the elections has removed a key overhang, fostering a more stable political environment. Market sentiment remains constructive, underpinned by the ongoing optimism surrounding the government’s value-up programme. This initiative, aimed at enhancing corporate governance and improving shareholder returns, draws parallels with similar reform efforts in Japan and continues to support the investment case for Korean equities.

Select pockets of the market are outperforming, particularly holding companies, shipbuilders and firms tied to the energy and infrastructure value chain. The defense sector is also showing resilience, benefiting from structural tailwinds and a renewed focus on national security.

China

On the geopolitical front, tensions have eased, supporting cautious optimism. Progress around trade negotiations is encouraging, with the possibility of a reciprocal tariff deadline extension should both sides continue to negotiate in good faith. The recent earnings season delivered a mixed picture: Tencent posted solid results, while Alibaba disappointed. This divergence reinforces the need for a bottom-up approach.

Taiwan

Taiwan benefited from a strong recovery in May, supported by easing geopolitical tensions and a resilient outlook for the technology sector.

LatAm

The region underperformed recently. Brazil and Mexico came under pressure from stretched valuations, while improvement was seen in Peru.

Sectors

Technology

Nvidia posted nice results, which firmly supported a positive outlook for AI demand. Meanwhile, TSMC saw a recovery after the weakness in Q1.