European equities: Large caps at the forefront

Global equity markets steamed ahead, after a hesitant start of the year. Strong Q4 results in the US and a resilient global economy were the main drivers behind the stock market rally. In the meantime, sticky inflation figures pushed out the expected interest rate cuts further into the year and drove long-term interest rates higher almost everywhere in the world.

Global equity markets steamed ahead, after a hesitant start of the year. Strong Q4 results in the US and a resilient global economy were the main drivers behind the stock market rally. In the meantime, sticky inflation figures pushed out the expected interest rate cuts further into the year and drove long-term interest rates higher almost everywhere in the world.

Separately, conflicts in the Middle East and in Ukraine are far from solved, but they did not really impact market sentiment.

European equities performed well over the past four weeks, mainly driven by large cap companies that continued to outperform small caps since the last Equity Committee four weeks ago. That doesn’t come as a surprise, as Europe’s PMI, although better than anticipated, remained below 50, the level that divides growth from contraction.

From a sector perspective, cyclicals sectors significantly outperformed the broader market. Consumer discretionary was the biggest outperformer over the past weeks, followed by financials, materials and industrials. Also information technology continued to perform well. With regards to the defensive sectors, the health care sector stands out with an outperformance compared to the broader market, while other defensive sectors, such as consumer staples and utilities clearly lagged.

Earning expectations and valuations

Meanwhile, the earnings season is coming to an end as 70% of European companies reported Q4 earnings over the past weeks. In contrary to US, earnings growth was negative in Europe (-11% year-on-year). Commodity sectors were a significant drag on earnings evolution and also cyclicals fared poorly with negative earnings growth for industrials, materials and consumer discretionary.

Looking ahead, consensus expectations count on 5% earnings growth in the coming twelve months. Energy and real estate are among the main sectors dragging expected earnings down, whereas materials, industrials and health care are part of the sectors with the highest expected earnings growth in the coming twelve months.

Even considering that moderate earnings growth, European equity markets look quite attractive. They still trade at the bottom of their historical range when looking at the 12-month forwards price-earnings ratio of below 13.

Comfortable with defensive bias

In this context, we are convinced that it continues to make sense to keep a balanced approach with defensive tilt. We haven’t made any structural changes to our sector allocation over the past few weeks as we still feel comfortable with our positive grade on the defensive health care sector (high visibility, benefits from increasing M&A activity and attractive valuation in an environment of slowing economic growth).

We also maintained our +2 on the consumer staples sector with a favour for food & beverage and household & personal products that are attractively valuated and might benefit from the easing of the negative sentiment surrounding the GLP1-story and stabilizing long-term interest rates.

US equities: Markets buoyed by resilient economic data and robust earnings reports

US equity markets continued to perform well over the past weeks, buoyed by resilient economic data and robust earnings reports. Concurrently, investors remain optimistic about a potential interest-rate cut by the Federal Reserve before summer.

Growth leads US market

Growth stocks have continued to lead US equity markets higher since early February and we have witness the recent relative outperformance of small and midcaps.

From a sector perspective, there was no clear distinction between cyclicals and defensives. Information technology continued to perform well, while materials, utilities, energy and industrials were the strongest outperformers of the past few weeks. Consumer discretionary, consumer staples and health care underperformed the broader market.

Good earnings season

In the meantime, the earnings season has come to an end as almost all US companies reported Q4 earnings over the past weeks. Earnings growth came in a 8% year-on-year in the US and generally beat consensus expectations. Most of that earnings growth can nevertheless be attributed to the biggest technology-related stocks, such as Nvidia, Microsoft, Alphabet and Meta Platforms. Otherwise, earnings might have even declined for the S&P 500 when excluding information technology and communication services.

With this in mind, investors now count on a high single-digit earnings growth for 2024, mainly driven by IT, communication services, consumer discretionary and health care. The latter should see earnings increase again this year now that the post-covid normalization is behind us. Energy, real estate and materials are the sole sectors for which the consensus expects and earnings decline this year.

Partial profit taking on IT

In this context, we haven’t made any structural changes to our sector allocation. We continue to feel comfortable with our positive grade on the defensive health care sector that offers high visibility, benefits from increasing M&A activity and attractive valuations in an environment of slowing economic growth.

We nevertheless did change our short-term view on information technology. The sector has clearly outperformed the broader market since the start of the year, with semiconductors as main driver of outperformance on the back of the artificial intelligence revolution.

The sector’s fundamentals remain strong. Revenue growth for the IT sector came in at almost 6% and earnings growth even exceeded 20% on the back of a continued margin expansion. As a result, the IT sector was able to beat high consensus earnings expectations.

After the good start to the year, valuation has nevertheless creeped up. Although not excessively high yet, consensus expectations imply a strong rebound in IT spending towards the end of the year that might be a tad too optimistic. As a result, we decided to take (partial) profit on some of the companies for which we don’t feel comfortable with valuation multiples anymore. Therefore we temporarily decided to change our grade on information technology to neutral from +1, while keeping a strongly positive long-term view.

Emerging equities: Positive returns

In February, emerging markets (+4.6% in USD) delivered positive returns, outperforming developed markets (+4.1%).

China (+8.4%) led the contributors with a notable rebound. The country’s manufacturing PMI remained in the contraction territory but was in line with expectations. China celebrated the lunar new year during the month, spurring consumer spending on travels, which eventually surpassed the 2019 level. Beijing nominated a new head for the securities regulatory commission. As a result, in pursuit of stock market stability, new policies were launched, including restrictions on short-selling and heightened scrutiny on quant trading. China’s sovereign fund also increased ETF holdings, which effectively reversed the downward trend of the domestic stock market. As for the central bank, it reduced 5Y loan prime rate by 25bps, the first cut since last June.

Taiwan (+5.5%) continued to benefit from the global tech recovery. The country saw robust sequential growth in merchandise export, particularly in information and communication products. South Korea (+6.4%) also exhibited strong performance, helped by improving exports. The South Korean government announced a corporate value-up programme, aiming to improve the valuations of local stocks trading at a discount relative to fundamentals. The plan was still at its early stage, but already attracted investors’ attention.

India (+2.6%) had another positive month. The country’s healthy development was again confirmed by the latest economic indicators, including better-than-expected December industrial production, and easing January CPI. India’s Q4 GDP growth also beat expectations. In addition, MSCI raised India’s weight in the index.

LatAM (-0.5%) lagged emerging markets peers in February with a slight decline. Brazil (-0.3%) outperformed and the local economy saw more improvement, including higher industrial output, and lower deficit. Meanwhile, consumer confidence did not fully recover, showcased by tepid December retail sales data. Similarly, Mexico (-2.9%) led the underperformance in emerging markets, with mixed figures amid a strong recovery trajectory.

US yields rose slightly and finished the month at 4.25%. Crude oil saw an increase of +2.3%. Gold increased +0.2% while silver decreased -2.2%.

Outlook and drivers

We are increasingly optimistic on emerging markets equities, as a convergence of previously constraining factors begins to dissipate. Favourable tailwinds remain present for emerging markets returns, including a possible peak of US rates, and followingly a shift towards a more accommodative monetary policy. In particular, the tailwinds are expected to benefit emerging markets growth and ESG factors, which are integral to our emerging markets strategies.

Regionally, emerging markets outside China have been demonstrating notable resilience, weathering the weakness associated with China’s slowdown. India, in particular, has witnessed a gradual increase in its weight in the MSCI index, while the government implements pragmatic development plans expanding public capital expenditure and managing deficits at reasonable levels. LatAm have provided encouraging signals, initiating early easing cycles. For Brazil, MSCI recently announced that several Brazilian foreign listings are eligible for index inclusion.

The semiconductor industry's recovery, bolstered by advancements in AI, positions Taiwan and South Korea favourably within the global supply chain. Corporate leaders have reported promising order pipelines, further affirming this upward trend. In South Korea, the value-up programme awaits further details to be unveiled. Currently, South Korean governors are actively communicating the initiative with investors.

For China, the country still grapples with its multiple crises entering the year of the dragon. Efforts to achieve stabilisation are underway, and hardly impressed consumers and investors. Meanwhile, the new director for the securities regulatory commission is known to be pro-market with an emphasis on investor protection, and is determined to enhance market transparency with strict requirements. The upcoming Two-Sessions meeting in March, where thousands of provincial representatives convene to discuss the country's blueprint, presents an opportunity for further policy clarity.

Aligned with our strategy, we will dynamically calibrate the portfolio’s risk appetite in response to evolving market conditions, when maintaining a balanced position. We are awaiting further confirmation that the peak of interest rates is behind us, and that China's economic recovery is gaining momentum, thus contributing to the differential growth of emerging markets.

Positioning update

We are more optimistic on EM equities outlook for receding headwinds, peaking Fed rates, weaker USD, and Growth performing better as an investment style.

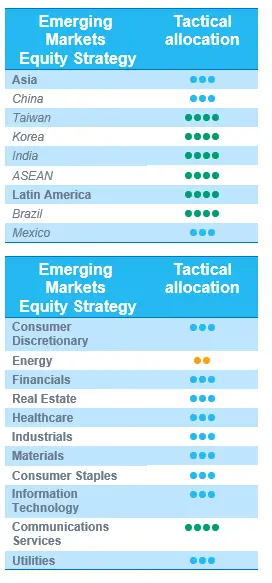

No change to our region views. We remain OW in Taiwan and South Korea for semi recovery, in India for robust growth. For China, we remain neutral, monitoring policy changes.

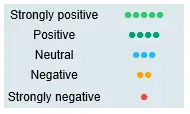

No change to our sector views. We are positive on the semiconductor recovery, being further aided by the AI development.

Regional views:

No change to regional views

Taiwan – Overweight: TSMC delivered a strong performance, and we continue to be positive on the company. The company’s AI exposure is expected to grow from 6% to 25% in 3 years. For the Taiwanese semi sector, the growing penetration of AI integrated hardware devices can be interesting opportunities.

Korea – Overweight: The government has launched a Value-up program aiming at improving companies’ corporate governance. This is seen positively, as the initiative results in companies’ paying more attention to shareholder returns. Retail investors have a strong presence on the domestic market, helping the Value-up program’s progress. For instance, Samsung Electronics’ retail shareholder base has increased by five times despite the company’s year-to-date detraction.

China – Neutral: China saw a strong bounce with fund flows turning positive for the first time in 6 months. The government implemented several measures to stabilize the market performance, including appointing a new head for the China SEC, and investing US$60 billion through ETFs. Otherwise, new policies are in line with expectations, while economic data remain weak. 2024 GDP growth target is set at 5%. Geopolitical concerns continue. We are selective on Chinese names, picking beneficiaries of policy support. We are increasing H shares position, especially in China proxies such as financials and consumer names.

India – Overweight: India’s long-term growth is solid, supported by the public expenditure in the near term and favorable demographics in the long term. The strong market performance can ease in the short term, as China regained some attention.

Sector and Industry views:

No changes to sector views. We remain OW in Tech, while monitoring the semiconductor’s cyclical evolution. AI-related names experienced important re-ratings. TSMC and SK Hynix continue to be strong, while Samsung Electronics detracted YTD. We see interesting progress in AI integration into hardware devices, and we think it is not yet in the price. We will be more selective being in the mid-cycle of the semi sector.