Research Papers

Research Paper, Alix Chosson, Elouan Heurard, ESG, SRI, Biodiversity

While, according to the World Economic Forum, half of the global GDP is dependent on nature, biodiversity is experiencing an extinction that challenges the resilience of our economies. Deterioration of air, water and soil quality, decline in ecosystem services such as pollination: the physical impacts of this loss of biodiversity are already putting our economies under pressure.

Research Paper, Fixed Income, Diquel Dos Santos, Portfolio Construction

CoCo bonds: insights from a credit specialist

Candriam has long been recognised for its leadership in ESG, but our reputation is equally rooted in deep credit expertise — analysing not just issuers, but the entire architecture of financial markets. This perspective is particularly critical in complex areas such as bank capital, where instruments like CoCos play a decisive role.

Research Paper, Climate Action, ESG, SRI, Alix Chosson

Net Zero Progress Report

We promised you transparency. For a comprehensive discussion of our efforts and results, see our [annual] Net Zero Progress Report 2024. We frequently say that it is not just the carbon target, but the path to that target which affects the damage along the way. In this spirit, we share with you along the way our milestones for the four pillars of our Net Zero strategy.

Q&A's

Q&A, Money Market, Pierre Boyer

Money market strategies: when cash is king

Money market strategies aim to offer a low-risk and liquid way for

investors to generate higher returns than traditional savings

accounts. Pierre Boyer, Elodie Brun, and Benjamin Schoofs, portfolio

managers, share their insights on the asset class.

Q&A, Christopher Mey, Emerging Markets, Nikolay Menteshashvili

Unlocking opportunities: a guide to investing in emerging market corporate debt

In a constantly-evolving global environment, emerging markets present distinctive opportunities for investors looking to diversify and enhance their returns. Emerging market corporate bonds represent a $1trln+ asset class, combining robust fundamentals with strong return potential. Nikolay Menteshashvili and Christopher Mey, portfolio managers, explain in detail why this investment strategy deserves investors attention, how it may offer attractive risk-adjusted returns, and the key requirements for successfully navigating this complex yet promising universe.

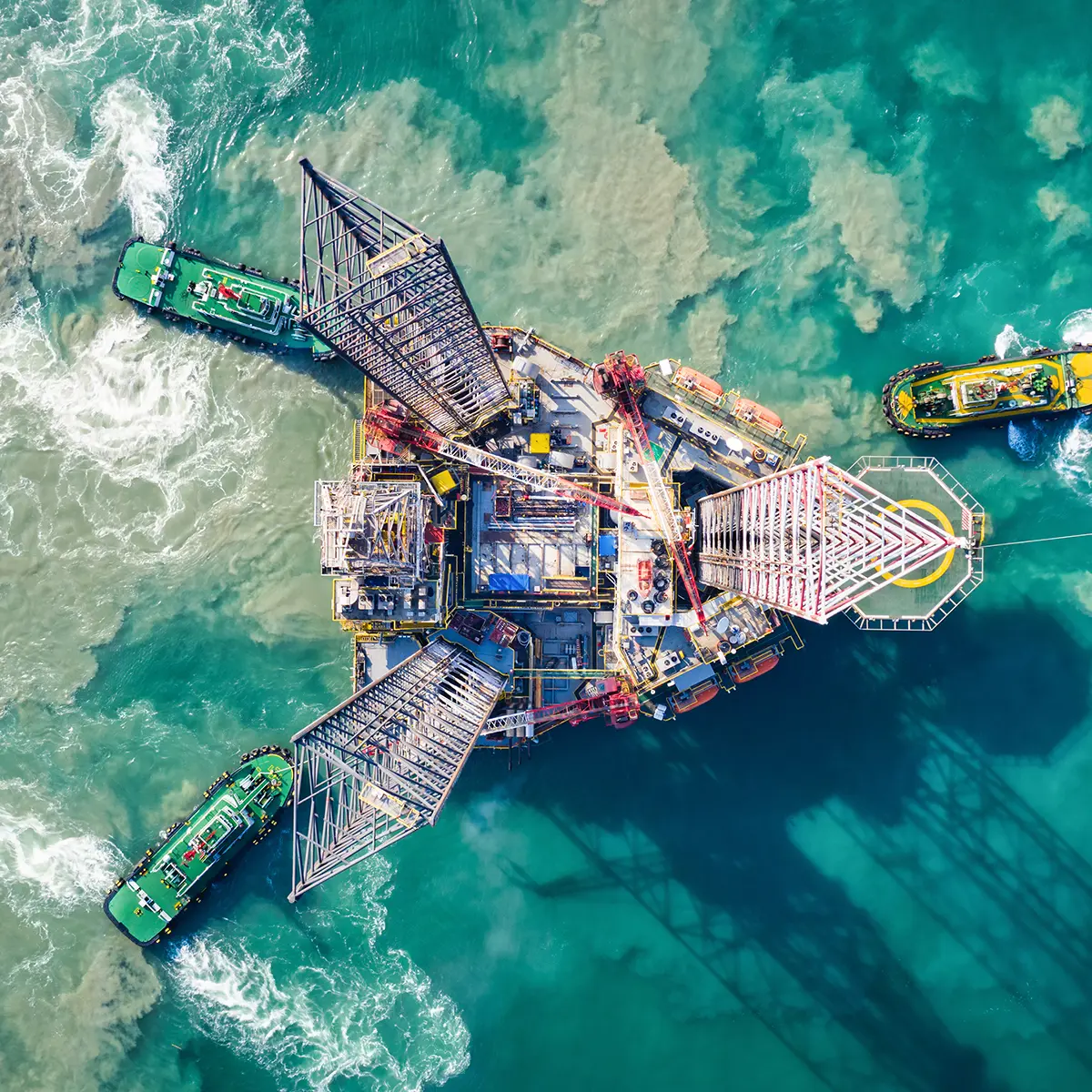

Q&A, ESG, SRI, Kroum Sourov, Christopher Mey, Emerging Markets

Sustainable: an emerging market for emerging debt

Kroum Sourov and Christopher Mey, portfolio managers of the sustainable emerging market debt strategy, describe the significance this type of analysis can have for a bond portfolio. They explain Candriam’s investment process, with our emphasis on relative value and risk management. This approach is intended to allow the strategy to adapt the ever-changing markets over the course of an economic cycle.

Transparency Code

Please find the Transparency Codes on the Fund pages.

Sustainability Overview

Sustainability, and Responsibility, must be part of the personality and culture of the firm. We need Responsibility to be a part of ourselves in order to translate it into your investments.