Last week in a nutshell

- In the US, the addition of 187K non-farm payrolls confirmed what JOLTS and ADP had hinted at: A slowly cooling job market.

- Manufacturing PMIs stabilised in the US and the euro zone and slightly recovered in China, while activity levels are pointing to ongoing regional divergences.

- The first estimates of August inflation rates in the euro zone showed a sticky 5.3% YoY increase, above the ECB’s goal and market consensus.

- To revive its struggling economy, China continues to intensify its efforts, with further rate cuts, and a reduction in foreign exchange reserve requirements.

What’s next?

- Industrial production and balance of trade for key countries will likely put discrepancies in economic growth and international trade in the spotlight.

- In the US, the Federal reserve system will publish its beige book, a survey of regional business contacts based on anecdotal information from the Fed’s 12 regional banks.

- Japan will release several data to gauge the state of the economy: GDP growth rate, consumer sentiment and outlook for the country.

- In the euro zone, fresh releases on retail sales and ECB’s consumer expectations will tell investors how households are faring at the end of the summer.

Investment convictions

Core scenario

- In the United States, latest data continue to point towards a soft landing. Inflation and wages continue to decelerate while growth remains resilient whereas Chinese growth keeps missing expectations and authorities are gradually announcing measures to shore up the economy.

- In the euro zone, growth is weak and expected to remain lacklustre: Activity is contracting in the manufacturing sector and decelerating in the service sector. Receding inflation should help households to regain some purchasing power in H2.

- Most emerging economies have low inflationary pressures and some central banks have started to cut rates: They are not at the same stage, in the interest-rate cycle as developed markets.

- Central banks in developed markets are nearing their peak rates, but interest rates will likely stay high for an extended period. We expect no rate cuts in developed markets in the second half of 2023.

- We also expect a less supportive market environment during H2 than in H1 which should translate into a broadly lateral move of financial markets.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- After the dramatic drop in growth surprises in all major regions outside of the US, the global outlook could become less supportive.

Cross asset strategy

- We have a more cautious equities allocation than during the first half of the year, considering the limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

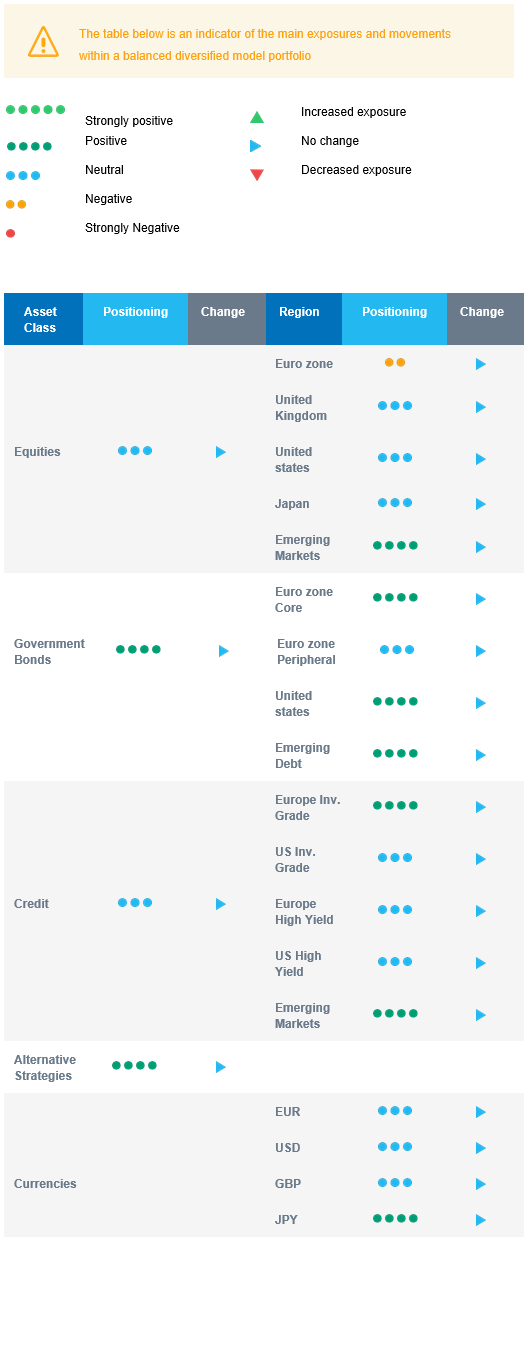

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive and we are underweight euro zone equities as pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery which started in 2022, albeit at a reduced pace compared to the first half of this year.

- In the fixed income allocation, we have a long duration positioning:

- With higher rates and a reasonable level of spreads, we like US and European government bonds and high-quality credit as sources of carry.

- Our overweight stance on investment grade credit is a strong conviction on European issuers since the start of the year as carry-to volatility is attractive.

- We are more prudent on high yield bonds as tightening credit standards should act as headwind and the buffer for rising defaults has decreased in recent months.

- Emerging bonds continue to offer the most attractive carry. The accommodative stance of the central banks is positive for the asset class. Investor positioning is still light and as the USD is not expected to strengthen, this should represent a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into a long duration and a neutral equity stance but with regional nuances. Within fixed income, we are seizing opportunities in the buying levels of European long-term yields amid a hawkish ECB. European Investment Grade bonds also remain attractive. Within equities, we see value in a barbell approach, combining an underweight euro zone and overweight Emerging markets. We are neutral US equity as the momentum is supportive but economic surprises have likely peaked. Markets are increasingly reflecting our soft-landing outlook, limiting the performance potential going forward; therefore, the exposures come with a derivative protective strategy. Our “late cycle” asset allocation strategy is also axed around defensive sectors over cyclicals ones.