Last week in a nutshell

- The Fed kept its funds rate at 5.25-5.50% but Chair Powell’s overall tone sounded rather dovish and came after the US Treasury shifted issuance away from longer-dated bonds, leading bond yields to fall and stocks to rally.

- In the US, October PMIs levels were lower-than-expected, with the manufacturing sector, at 46.7, marking the twelfth consecutive month in contractionary territory and services at 51.8, a low level for an economic expansion.

- In the euro zone, preliminary estimates of October consumer prices showed that inflation fell to a lower-than-expected rate of 2.9% YoY while Q3 GDP shrunk by 0.1% QoQ.

- Among Q3 earnings, Apple and Caterpillar releasing their results. The former underscored challenges in the Chinese market while the latter gave a cautious outlook, feeding concerns about the economic slowdown.

What’s next?

- Markets will continue to digest the slowdown in the US job market, as the unemployment rate continued to creep higher, from 3.4% in April to 3.9%.

- Euro zone Services PMI final readings for October will be released, after preliminary estimates showed a further contraction from the previous month.

- In the US, the University of Michigan Consumer Sentiment survey will provide insights on household expectations for their own financial situation, the general economy, and upcoming inflation.

- China’s consumer and price indexes will be a useful update to evaluate the persistence of deflationary pressures in the world’s second largest economy.

Investment convictions

Core scenario

- In terms of economic growth, we expect the US to avoid a recession providing that long-term rates do not remain too long close to the 5% level. In Europe, growth is likely to remain lacklustre for most of next year, and the likelihood of a recession is increasing in the region. In China, economic activity and the evolution of prices have shown some timid signs of cyclical stabilisation.

- The perception of a softer bias from developed countries’ central banks has finally led to a downward repricing in bond yields. Meanwhile, China’s likelihood to export deflation to the world is fading only slowly.

- The increase in real rates has been a headwind for equity valuations during Q3 and last month while the deceleration of economic growth will weigh on profits. Risks to the outlook for global growth remain tilted to the downside as geopolitical developments unfold.

Risks

- A renewed temporary overshoot in longer-dated bond yields present a risk for fixed income holdings and duration-sensitive equities.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- Besides geopolitical tensions on several fronts, which imply rising uncertainty and vulnerabilities, as well as a potential increase in oil prices, the US elections of November 2024 are looming fast.

Cross asset strategy

- Our asset allocation has turned more cautious as several risks have started to materialise. We expect a deceleration of economic growth which will weigh on corporate profits amid restrictive monetary policies in most of the developed countries.

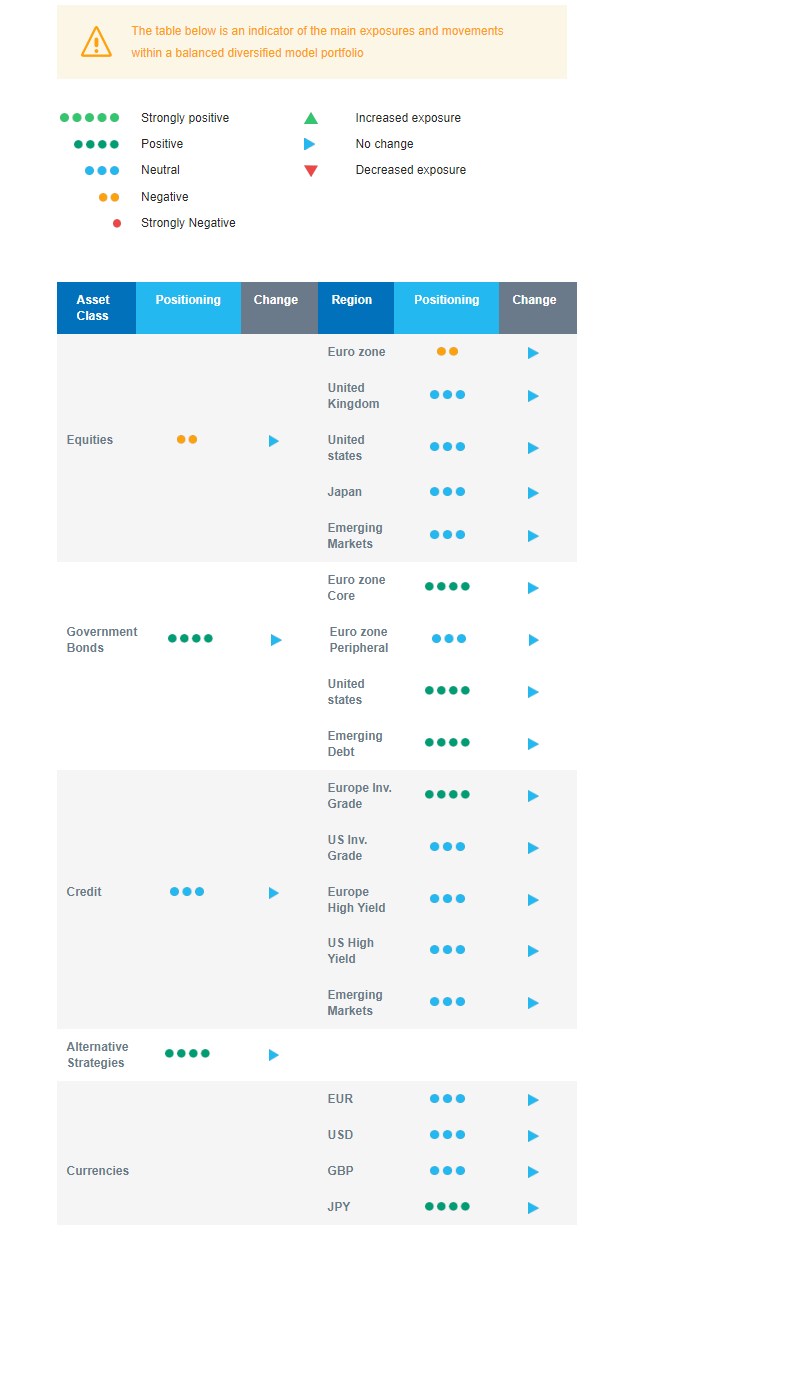

- We have the following investment convictions:

- We are overall slightly underweight equities.

- In terms of regional allocation, we are underweight euro zone equities, as the likelihood of a contraction in activity has increased.

- We are neutral US, Japan and Emerging markets. The latter are vulnerable to the pressure from US rates and the headwind of the USD.

- We keep a preference for defensive, late-cycle, sectors.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European and American government bonds. The commitment on price stability via a hawkish ECB policy has driven long-term yields to attractive buying levels while the growth/inflation couple (i.e. nominal growth) eases.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they have some decorrelation from traditional assets.

Our Positioning

Our positioning has turned more cautious as several risks have started to materialise. The increase in real rates is a headwind for equities while the deceleration of economic growth will weigh on profits, leading us to adopt a defensive allocation, including an underweight positioning on equities and a long bond duration. We are underweight euro zone equity. We are neutral on Japan, Emerging markets, and the US. In terms of sectors, our “late cycle” asset allocation strategy is axed around defensive sectors. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt while being more cautious on high yield. Global growth should remain sluggish in 2024 but the risk appears tilted to the downside as geopolitical developments unfold.