Last week in a nutshell

- US Treasuries hit a 16-year high, as the 30-year yield reached 5.0%. The sell-off in US bond markets pushed global equities down and the US dollar continued its appreciation against most currencies.

- The US economy added 455K payrolls with revisions, while the labour force increased +90K, leaving the unemployment rate unchanged at 3.8%.

- The US avoided a shutdown, but the vacuum at the US House of Representatives adds uncertainty at a critical time.

- China’s Golden Week ended on a rather positive note after seeing a record travel for the annual holiday. Businesses were left hopeful but wary.

What’s next?

- Inflation data will be in the spotlight with publications from the US, China and the euro zone. The Chinese PPI may confirm the slowing deflationary pressures.

- Minutes from the FOMC and the ECB from the September meetings will be released as investors look for hints on forward guidance and reconcile with the announced high-for-longer rates.

- Preliminary data on the US Consumer sentiment will give us hints on the uncertainty level, which has risen amid labour disputes in the auto industry and the election of a new speaker of the House.

- The Q3 2023 earnings season will kick off, starting with big US banks. The Tech sector, and its Magnificent Seven, will be highly expected as valuations have come down since July.

Investment convictions

Core scenario

- In terms of economic growth, the landing has started in the US while the ongoing dataflow is weak in the euro zone. Chinese economic indicators are improving gradually, but a convincing recovery may take a while.

- The inflation path is on a decelerating trend. In the US, the downward trend is set to resume in Q4 whereas in Europe, the ECB will remain vigilant while core inflation is now at 4.5%. China’s likelihood to export deflation to the world is fading only slowly.

- The persistent hawkish bias by central banks in developed markets and the significant rise in bond yields is impacting financial conditions and assets. The credit channel is restrictive as central banks keep their policy rates high for longer than markets have hoped for.

- In summary, we have a scenario of range bound markets as activity deceleration puts a cap to the upside, whereas the likely end of central banks’ tightening cycle could help building a floor.

Risks

- A temporary overshoot in longer-dated bond yields present a risk for fixed income holdings and duration-sensitive equities.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- While economic policy uncertainty is declining in Europe from last year’s excessive levels, the US elections of November 2024 are looming fast.

Cross asset strategy

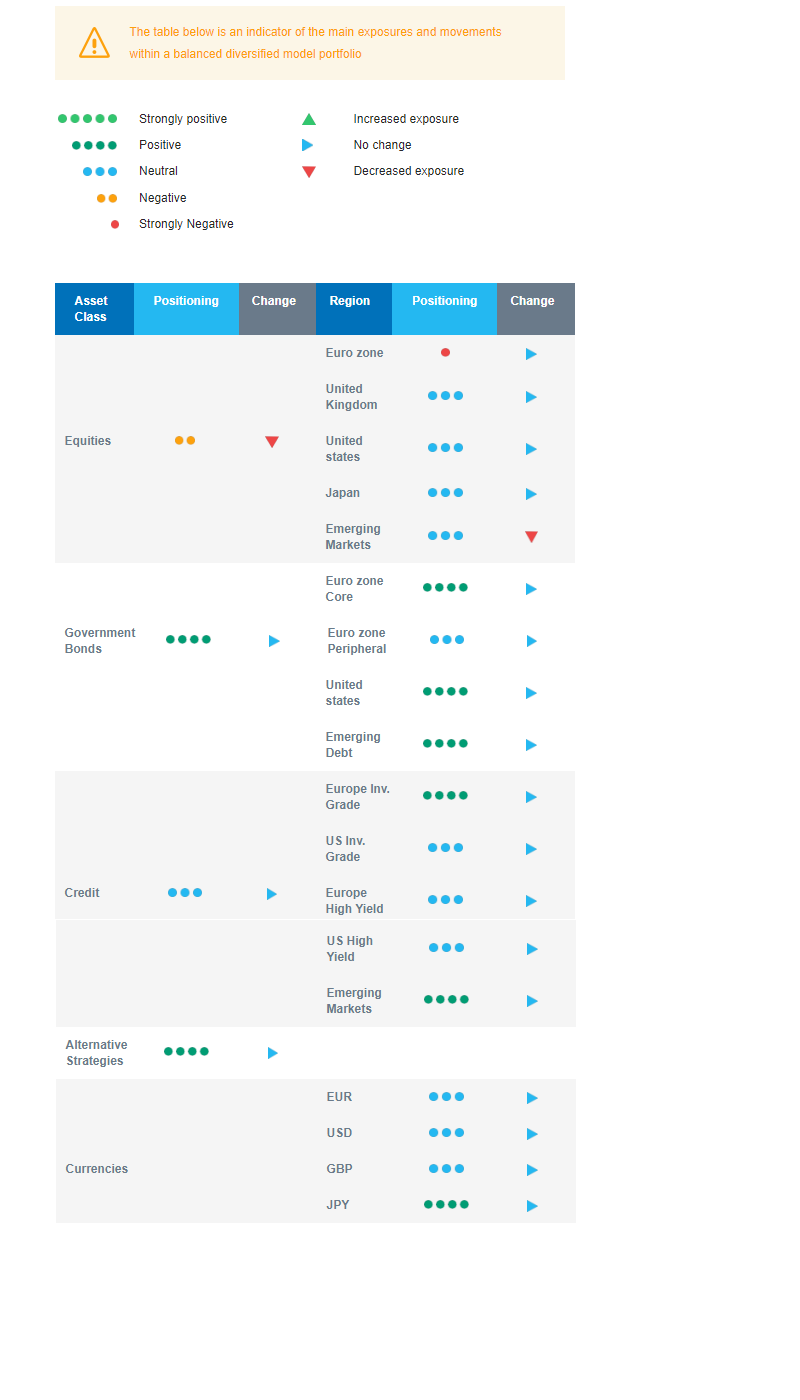

- Our overall equity exposure moved from neutral to underweight as we want to temporarily reduce the risk exposure given the materialisation of some of the risks identified above.

- As a result, our main convictions are a pronounced underweight euro zone equity and a neutral Emerging markets equity. The increasing pressure from US rates and the USD are headwinds for emerging countries.

- We expect a range-bound global market and consider limited upside potential. At current levels, an economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

- We have the following investment convictions:

- Taking into consideration the sustained rise in the US dollar and in US yields, we adopt a more cautious stance: We are strongly underweight euro zone equity and reduced our exposure to Emerging market equity to neutral. We take note that Chinese economic indicators are improving gradually but lack a convincing recovery to regain confidence in this market.

- We are neutral US and Japanese equity.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as Cyclicals are already pricing an improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely at the current stage.

- In the fixed income allocation:

- In government bonds, we remain positive on US and EU duration. While in the US, the landing has started, there is no reason for the Fed to become dovish yet. By the same token, there is less growth in the euro zone, but inflation is still too high for the ECB.

- In credit, we focus on carry and are positive on Investment Grade, especially by European issuers. The conviction has been strong since the start of the year as carry-to-volatility is attractive.

- We are more prudent on high yield bonds: After rallying in 2023, spreads are now close to historical levels. Tightening credit standards should be a headwind.

- We are positive on Emerging debt (hard and local currency) as the bonds continue to offer the most attractive carry. The accommodative stance of the central banks is positive for the asset class. As investor positioning is still light, this should represent a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into a long duration mostly via European and US government bonds, a focus on credit that brings carry, i.e., investment grade and emerging debt while being more cautious on high yield and lastly an underweight equity allocation. We are strongly underweight euro zone equity. We are neutral on Japan, Emerging markets, and the US as the positive US economic scenario seems priced in, capping further upside. In terms of sectors, our “late cycle” asset allocation strategy is axed around defensive sectors over cyclicals ones, which are priced for a recovery.