Last week in a nutshell

- Global manufacturing output expanded for the first time in eight months, while service sector growth also accelerated at the start of the year.

- The latest Senior Loan Officer Opinion Survey indicates that the worst of the credit tightening may be over, but not for commercial real estate market.

- EU producer prices were down -0.9% MoM, the largest decline since May 2023, but ECB policymakers noted that they “will not get full comfort within a reasonable period”.

- Midway through the earnings season, profits are exceeding expectations due to reduced input costs and better cost controls.

What’s next?

- Large parts of Asia will celebrate the Lunar New Year of the Dragon. In a timely manner, Chinese policymakers rolled out policy easing to defend markets and growth.

- In the US, consumer and producer price inflation reports will be the main focus while retail sales and the preliminary University of Michigan sentiment survey will shed light on the American consumer.

- In Europe, the publication of the preliminary Q4 GDP growth rate and the ZEW survey will be completed by the UK’s inflation and labour market data.

- The earnings seasons continues with releases stemming from Coca-Cola, Kraft Heinz, Cisco and Applied Materials.

Investment convictions

Core scenario

- Inflation gave way and is set to fall rapidly below 3% in both the US and the euro zone, and, barring a new shock, should no longer be a primary concern for investors. The growth / inflation mix is thereby finally returning to “familiar” territory.

- A soft-landing/ongoing disinflation scenario in the United States remains our most likely scenario, implying no rush for central banks to deliver monetary support. We don’t expect the first monetary easing before the end of H1 2024, still leaving room for disappointments compared to current market pricing.

- 2024 should bring better visibility with a narrowing economic growth gap between countries while most central banks have restored room for manoeuvre.

- In China, economic activity has shown some fragile signs of stabilisation (4% GDP growth expected in 2024) while the evolution of prices remain deflationary.

Risks

- While uncertainty remains on the timing and on the conditions of the start of monetary easing, a downside risk would be too prudent of an approach towards monetary easing by central banks and a disappointed market.

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A risk would be a stickier inflation path than expected which could force central banks to reverse dovish rhetoric.

- Beyond commercial real estate exposures, financial stability risks could return as a result of the steepest monetary tightening of the past four decades.

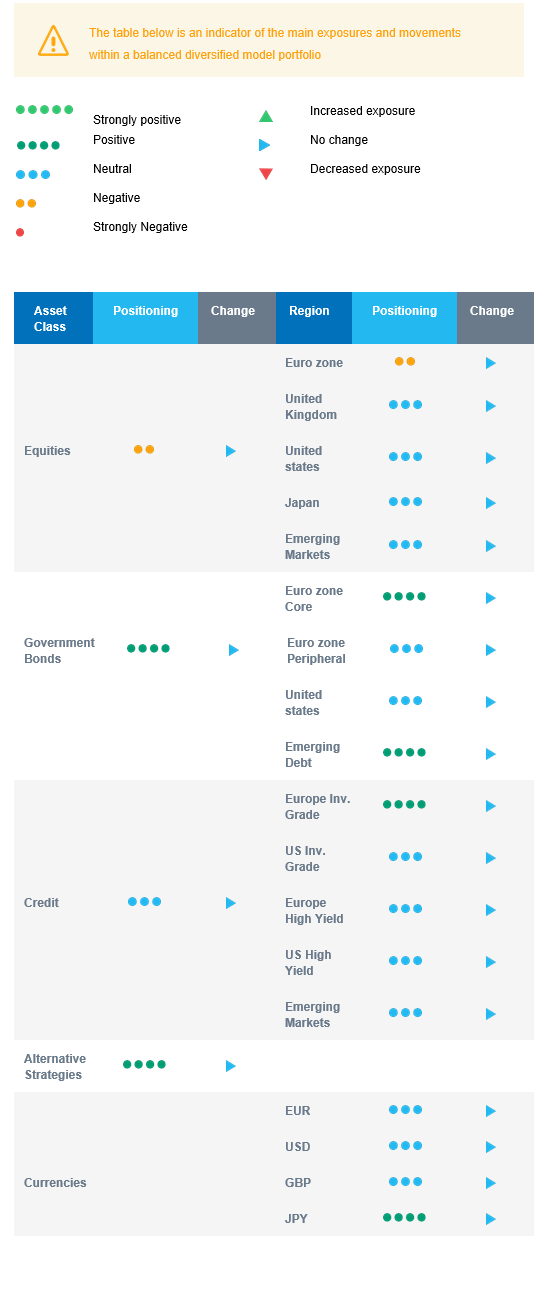

Cross asset strategy

- Our asset allocation shows a relatively balanced approach as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We expect limited equity upside, and are looking for a better risk/reward and clearer signals to start to increase exposure. We keep a neutral allocation towards equity indices outside Europe, having a cautious view on euro zone equities.

- We look for specific themes within Equities. Among them, we like Technology / AI and also remain buyers of late-cycle sectors like Health Care and Consumer Staples. We look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment.

- In the fixed income allocation:

- We focus on high-quality credit as source of a pickup in yields.

- We also buy core European government bonds with the objective to benefit from the carry in a context of cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen albeit after some profit taking and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

Our strategy takes into account the current backdrop, characterised by economic resilience in the US, the EU’s cautious recovery and the prudent approach towards monetary policy in both regions. This backdrop necessitates a patient approach to investment. Overall, we keep a neutral allocation towards equity indices outside Europe, with the latter region appearing bottoming out but still relatively less attractive than the rest of the world. In terms of sectors, we are constructive on the Technology, Health Care and Consumer Staples sectors. Within the fixed income segment, we continue to harvest carry via Investment Grade credit and Emerging Market debt while maintaining a long European bond duration.